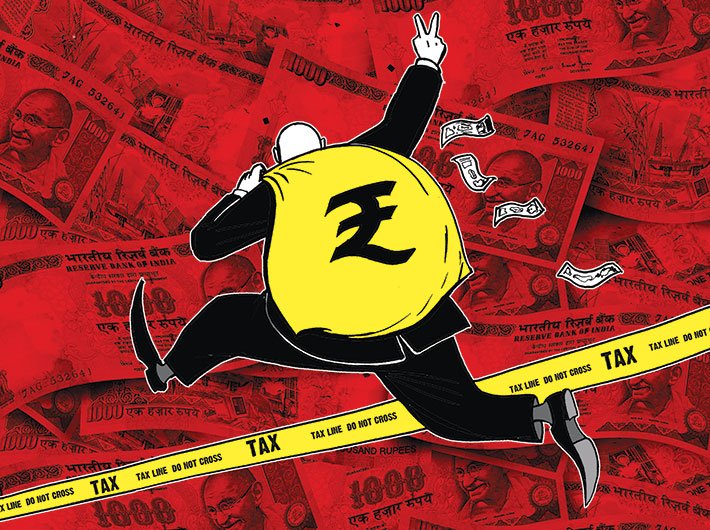

Everyone agrees that black money should be found, taxed, confiscated. We have the mighty governmnet to do it. And yet, very little black money has been uncovered. Why has there been so much talk and so little action?

The nation is in ferment once more. Indignation is overflowing. All good men are frothing at their mouths. The target is old and familiar – black money. The outrage is understandable. For we are the worthy citizens who pay taxes in time, to the last penny. We are the ones who pay for the roads everyone walks on, for the electricity that slummers steal. But there is a dastardly minority – or is it a majority? – that does not pay taxes, or makes a show of paying taxes but shirks them. It parks its ill gotten money in swanky cars, high-rise apartments and showy earrings. It enjoys all the facilities we pay for with our hard-earned money, cocks a snook at us, and shows off the fancy possessions it has acquired by cheating our government. Its money is all black.

It is not just us – common men – who mind this; the government has also from time to time been concerned about being cheated out of tax revenue. It has appointed a succession of committees and commissioned a series of research professionals to tell it what to do. There was the Ayers committee in 1936. Then there was the income tax investigation committee in 1947. Then there was the taxation enquiry committee in 1953. I could save myself the trouble of writing this column by listing all of them – 15 at least at last count.

Everyone agrees that black money should be found, taxed, confiscated. We have the mighty government to do it. And yet, very little black money has been uncovered. Why has there been so much talk and so little action?

The reason is clear in the case of money parked abroad: our government’s diktat does not run there. Vodafone bought two-thirds of the Hutch-Essar telephone business in 2007 in Cayman Islands. Indian tax vultures asked it to pay capital gains tax, since the business it bought was in India (they did not ask Essar, which is in India and made the profit; after all, it is Indian and influential).

Vodafone went to court; the Supreme Court ruled that India had no jurisdiction on a transaction done abroad. The government changed the law to overrule Supreme Court; no wonder Supreme Court is in no hurry to confirm that the government has the power to overrule it. The international law is that income is taxed where it arises, and does not depend on the location of assets or companies. The government is stuck in its own folly.

But what of all the black money in India? Nothing is easier than to undervalue property so that one pays less property tax and capital gains tax on transactions.

It is rampant. Before we get hot behind the ears, however, let us ask ourselves why this is such a hot issue in India and nowhere else. The reason is that other countries have less stupid governments. They understand that it is very easy to understate the value of properties; so they have relatively low taxes on property sales. Where they make money is on property itself: they impose a property tax.

Indian authorities do that as well; but our local authorities, which register properties, are easily bribed, and happily undervalue property. The central government cannot impose a property tax because our Constitution assigned the tax to municipalities long ago. Also, governments abroad do not take the word of property owners on the value of their property; they base property tax on the average value in an area based on all the property transactions over a certain period. So property is where most of India’s black money resides.

I believe that most of the black money is here in India; I am not convinced that Indians park much money abroad. It is perfectly easy to evade taxes within India; one does not have to take the trouble of parking it abroad. But my neighbour, a man of means who spends his day speculating on stocks, disagrees; he thinks that there is a lot of round-tripping. Rich people take their money abroad, and invest it in the Indian stock market through Mauritius, which has a special double taxation agreement with India – that profits made on investment coming into India from Mauritius are taxed in Mauritius, and not in India. And Mauritian tax on such profits is zero; so it is advantageous for all rational people to buy shares through Mauritius – and Indian investors are nothing if not rational. Is my friend right? I do not know; there is no way of ascertaining the nationality of an investor coming through Mauritius. But if the government were serious, it could easily find a solution to the problem. One would be to abrogate the treaty with Mauritius. Indira Gandhi gave Mauritius a special favour three decades ago, when no one wanted to invest in India; this concession has outlived its utility. The other solution is to abolish income tax on capital gains altogether, and replace it with a tax on capital assets.

The story appeared in November 16-30, 2014 issue