After the Jan-Dhan Yojana, Mudra Yojana is projected to be a major step in ensuring financial inclusion. Will it keep its promise and spur in growth of small businesses?

As he launched the Pradhan Mantri Mudra Yojana (PMMY) – where Mudra stands for ‘Micro Units Development and Refinance Agency’ on April 8, prime minister Narendra Modi made an important observation. He noted that in our country one often experiences that things revolve around mere perceptions, while the details often paint a different picture. He was making a case in point about how the perception has been built that large industries create more employment, though the truth is that “only 1.25 crore people find employment in large industries, whereas small enterprises employ 12 crore people”.

In the last one year, the success of social welfare schemes seem to be more based on perception – built on hyperbolic rhetoric than on details. Launch of the PM Jan-Dhan Yojana (PMJDY) undoubtedly ushered in a new era of financial inclusion but not without valid limitations. The fact remains that even after a year of its launch and with direct benefit transfer (DBT) being implemented, more than 40 percent of accounts still have zero balance which when translated into numbers runs into around 6.5 crore accounts. However, such concerns were ignored in the euphoria created on meeting the target of opening 7.5 crore accounts much before the deadline, and by the end of this financial year more than 10 crore accounts were opened.

Now, the Mudra scheme seems to be following suit. The Micro Units Development Refinance Agency (MUDRA) Bank has been set up as a subsidiary of Small Industries Development Bank of India (SIDBI). It aims essentially to provide funding to the non-corporate small business sector. It has a corpus of Rs 20,000 crore, and credit guarantee corpus of Rs 3,000 crore. MUDRA Bank will refinance micro-finance institutions (MFIs) through the PMMY. The roles envisaged for MUDRA include laying down policy guidelines for micro enterprise financing business and registration of MFI entities as well as their accreditation and rating.

The headline target of granting loans for starting and expanding small businesses is big, no less ambitious than Jan-Dhan. The budget has given the banking sector an overall disbursement target of Rs 1,22,188 crore during 2015-16 for MUDRA loans.

After the Jan-Dhan Yojana, PMMY is projected to be a major step in ensuring financial inclusion. MUDRA on its website states that, “PMMY will be extended by all banks such as PSU banks, regional rural banks and cooperative banks, private sector banks, foreign banks, microfinance institutions and non-banking finance companies. All loans up to Rs 10 lakh provided for non-farm sector income-generating activities since April 8, 2015 is treated as PMMY.”

The reason for creating MUDRA, as stated on its website, is “the biggest bottleneck to the growth of entrepreneurship in the non-corporate small business sector (NCSBS) is lack of financial support to this sector. Majority of this sector does not have access to formal sources of finance. GoI is setting up MUDRA Bank through a statutory enactment for catering to the needs of the NCSBS segment or the informal sector for bringing them in the mainstream.”

The perception and the detail

According to the NSSO Survey 2013, there are 5.77 crore small business units, mostly in individual proprietorship. Majority of these small business units are owned by people belonging to the scheduled castes, scheduled tribes and other backward classes. PMMY would have served the twin purpose of promoting self-employment/entrepreneurship and uplifting the marginalised class by helping them start their own ventures, and in many cases expanding the existing one. However, in case of MUDRA Yojana detail seems to be less inspiring than the perception.

Vinay Kumar, a meat seller, is sitting with an application form that runs into 21 pages at a State Bank of India (SBI) branch in Noida. He is there for a loan as he is looking forward to rent a shop and expand his business. A friend had told him about the MUDRA scheme and the fact that banks are giving money to people to start their businesses. Vinay came to the bank to apply for the loan. After filling up the form and submitting all required documents, the bank agreed to grant him the loan. But to his surprise, the amount offered was Rs 5,000 when his requirement was Rs 25,000. “What will I do with Rs 5,000? It can hardly help me in any way. They are raising the hope and then dashing it. This seems to be some kind of a joke,” laments Vinay.

MUDRA story so far: lending to small business

He then adds, “Also, my friend told me that there will be no hassle as very few documents are required. But here I have been given this long form and I had to submit my address proof, identity proof and income proof. I know these documents are important. But then I cannot understand in what way this scheme has made it easier for people like us to avail a loan.”

The branch manager, speaking on condition of anonymity, admitted, “I don’t understand why the government is projecting it as a dole. We have been given instructions and guidelines not to do anything in haste. We need to look into viability of the business for which the person is taking the loan. We have to also ascertain other factors like the applicant’s credit-worthiness and past record.”

Ziyaul Haq, who owns a paan shop in Sector 20 in Noida, has a similar story to tell. He says, “I really expected that I would get the loan and will be able to get a bigger shop. But then the bank told me that they can give me only Rs 5,000. I refused as that much money I can even borrow from my friends. Why should I get into the hassle of taking a bank loan for that amount?”

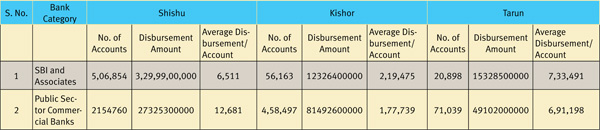

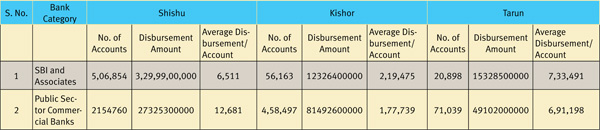

Under PMMY, loans can be availed under three categories, ‘Shishu’, ‘Kishor’ and ‘Tarun’, named so “to signify the stage of growth/development and funding needs of the beneficiary micro unit/entrepreneur as also provide a reference point for the next phase of graduation/growth for the entrepreneur to aspire for”. Shishu will cover loans up to Rs 50,000, Kishor between Rs 50,000 and Rs 5 lakh and Tarun between Rs 5 lakh and Rs 10 lakh.

While MUDRA was launched to structure microfinance, currently it seems it has little impact in the way banks are lending to small businesses. In an email response to a question regarding the concerns, Jiji Mammen, chief executive officer, MUDRA Bank, told Governance Now, “Generally the banks sanction the loan based on the funding needs of the project. The borrower will have to give the details of his investment needs, the working capital requirements etc. and based on that banks have to sanction the loan so as to ensure the unit is properly established and made operational.”

“Regarding the documentation part, the banks have adopted a minimum documentation requirement. This includes KYC compliance for which an identity proof and a residential proof is necessary,” Mammen added.

Aakash Gupta, along with his brother Amar, runs a customer service centre authorised by SBI. Recently, one of the companies involved in issuing the Aadhaar card outsourced some work to Gupta. “I got the work of printing Aadhaar cards. For that I needed around Rs 50,000 to buy a computer, a fingerprint scanner and other equipment. In spite of the fact that I own a customer care service of SBI, I was offered only Rs 5,000.”

He adds, “The bank said that any loan above Rs 5,000 can only be given as term loan and not under the MUDRA scheme, and for that I had to accept extra conditionalities.” When contacted, the branch manager refuted Gupta’s claims and said they had offered him a loan of Rs 5,000, based on his requirements.

Commenting on this issue raised by Gupta, Mammen says, “Sanctioning term loan or working capital loan depends on the need of the project. If it is to establish a new project which involves investments, the loan would be in the nature of term loan. If it is for running a unit, the loan will be in the form of a working capital loan. So, the bank will sanction the loan according to your need. As far as Mudra loan is concerned it could be either working capital loan or term loan depending on the nature of the loan requirement.”

Still, the fact remains that people have only a vague idea of the scheme and they are rushing to banks thinking it to be more as a dole-out rather than a scheme that is trying to institutionalise microfinance.

S Srinivasan, deputy general manager, MUDRA Bank, clarified, that his agency’s role is limited only to refinancing the loan for the banks that operate PMMY.

While several banks have organised camps to grant loans under PMMY, the question remains if MUDRA and PMMY have made it easier for small businesses to avail loan. If the decision regarding the beneficiary and the amount is left totally to the discretion of the banks, then MUDRA serves little purpose. The problem lies somewhere in the fact that PMMY, like PMJDY, is perceived as cash doles, raising wrong expectations among people. An objective promotion of the scheme without any populist signals will only help the government to ensure that the benefits reach the right people and serve the basic purpose of the scheme.

Self-help group (SHG) has been a successful model in capability building and employment generation. Women SHGs across the country have shown immense potential in generating income through micro enterprises. It has been observed and acknowledged by bankers that repayment records of the small businesses, especially SHGs, have been much better than that of big debtors. Field studies in places like Tripura and Haryana have shown that with proper identification of beneficiaries and their financial needs, coupled with appropriate mechanism in place to ensure repayment, micro enterprises can be a big leap in employment generation.

MUDRA disbursement so far

In Tripura, it was observed how with financial assistance provided by the government under different self-employment generation schemes, many women entrepreneurs were earning well to support their families. Suku, who owns a tailoring shop, earned around Rs 2 lakh in June-July last year, as she got a big contract for stitching uniforms for schools. She started her business with Rs 80,000 that she took as loan from a bank. Apart from supporting herself, she also employs six other persons.

The prime minister at the launch of PMMY observed that while there are a number of facilities provided for the large industries in India, there is a need to focus on these 5.75 crore self-employed people who use funds of Rs 11 lakh crore, with an average per unit debt of merely Rs 17,000 to employ 12 crore Indians. He said that these facts, when brought to light, led to the vision of MUDRA Bank.

What can help in actualising the vision behind the creation of MUDRA is to identify the real beneficiaries and fund their ventures appropriately. Large figures indicating numbers of accounts opened under the scheme can help in building a perception of success, but a little number-crunching can belie the most positive claims.

shishir@governancenow.com

(The story appears in the October 16-31, 2015 issue)