The companies under reconstruction require working capital and often the non-fund based requirements are high.

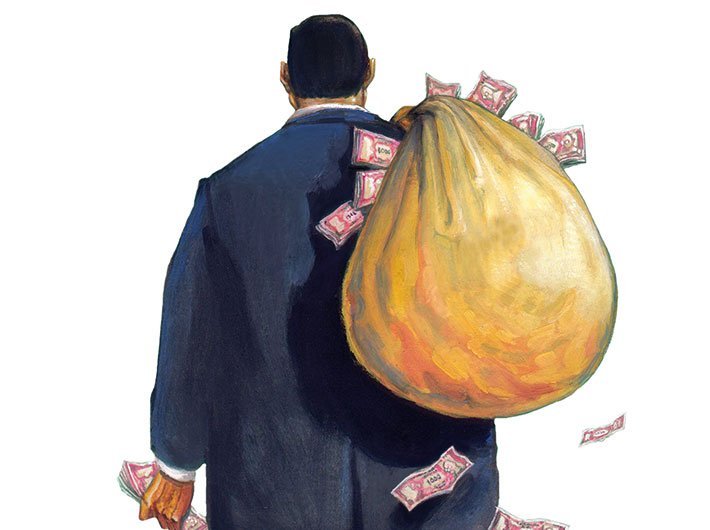

The Asset Reconstruction Companies (ARCs) have been sold Rs 2.44 lakh crore worth of gross non-performing assets (NPAs) even as the current stock of stress in the Indian banking system is estimated at Rs. 11.80 lakh crore, according to an ASSOCHAM-SIPI-Edelweiss study.

Seeking a level playing field with the banks in terms of conversion of loans into equity, the paper said that though a huge level of stressed assets, as much as 15 percent of advances (9.84 percent NPAs and 4.2 percent restructured assets), is a matter of concern for the economy, it offers a huge opportunity for the ARCs, adds the joint study.

As many as seven ARCs have largely been promoted by banks even as foreign direct investment has also been permitted into the asset reconstruction, which the paper said should be treated as a resolution and not a recovery business.

The paper said there must be a level playing field along with more teeth to ARCs for dealing with the promoters of companies owing to a high level of bank debt which has decayed into NPAs. At least 51 percent conversion should be allowed to ARCs while reconstructing an asset.

The ARCs are not on par with banking system when it comes to equity conversion. While RBI has given sweeping powers to bank in form of Strategic Debt Restructuring (SDR) and even in case of normal debt conversion, ARCs are restricted to maximum 26 percent of equity share in a particular company.

The paper stressed that incentive structure has to be introduced for banks where 100 percent debt is sold to ARCs. The banks are not following a consortium approach which is a major issue that leads to delay of 12-18 months for debt aggregation. ARCs have to resort to a time- consuming process of dealing with each bank separately, often at different commercial terms.

The companies under reconstruction require working capital and often the non-fund based requirements are high. The banks selling NPAs to ARCs, cannot lend, while non-bank entities, such as private equity /NBFC, demand very high interest along with priority in repayment over existing debt.

Further the banking system is completely against any new exposure including non-fund based to these companies, even if they have come out of their structural issues. “This leaves the responsibility of providing working capital finance on the ARCs and even non-fund based limits have to be raised against 100 per cent cash margins thus putting more pressure on the resources of stressed asset and impacting the viability,” the ASSOCHAM- SIPI-Edelweiss said.

Besides, while there have been changes in the SARFAESI Act exempting applicability of stamp duty, states have yet to pass necessary legislations to give effect to the same. Further, the registration fee for such transaction documents is very high in many states, increasing the cost for the ARCs and finally the borrower.

Decline in NPA sales is on account of two main reasons; first because of price mismatch between the expectations of ARC and the banks two, due to resource constraints.

However, post March 2016, amendments and relaxation of shareholding limits in ARCs as well as increase in permitted FDI investment limit in ARCs has provided a fillip to sourcing capital. The number of ARCs having been granted certificate by RBI stands at 23 in March 2017.

Significant capital has been raised and is ready for deployment by existing players while several new high profile players are expected to commerce business in FY 2018.

“While ARCs are an important means to help banks manage NPAs, at its heart, ARC business is a resolution business and not a recovery business. ARCs do not have any magic spell for reviving a non-performing asset. Process of resolving a stressed asset requires aggregation of debt outstanding to various banks, arrangement of capital, right sizing the business and bringing in a strategic partner. This requires a period of 3-5 years,” said ASSOCHAM secretary general D S Rawat.