Indian e-Retail looks more promising which is up from $3.59 billion in 2013 to $5.30 billion in 2014. By the end of 2018, it is expected to touch $17.52 billion

In 2016, about 69 million consumers purchased online and the number is expected to cross 100 million by 2017 with the rise of digital natives, better infrastructure in terms of logistics, broadband and Internet-ready devices to fuel the demand in e-Commerce, according to an ASSOCHAM-Resurgent India study.

The joint study comes close on the heels of the November 8 demonetisation move that practically forced people to go cashless. Due to lack of cash, consumers were pushed to go online to make purchases.

As per the findings of the joint study, Bangalore has left behind all other cities in India shopping online in the year 2016. While Mumbai ranks second, Delhi ranks third in their preference for online shopping.

In other cities like Bangalore, 69% of its population chose to buy daily routine products through e-shopping in 2015-16, which will go to 75% this year for apparel, gift articles, magazines, home tools, toys, jewellery, beauty products and sporting goods categories.

Likewise, Mumbai share was 65% in the last year, which might go up another 70% in this year for electronic gadgets, accessories, apparel, gifts, computer peripherals, movies, hotel booking, home appliances, movie tickets, health & fitness products and apparel gift certificates etc whereas, Delhi, 61% of its population chose to buy daily routine products through e-shopping in 2015-16, which will go to 65-68% by the year end.

The ASSOCHAM-Resurgent India joint study reveals, Indian e-Retail looks even more promising which is Up from $3.59 billion in 2013 to $5.30 billion in 2014 (a phenomenal increase of 48%), by the end of 2018, it is expected to touch $17.52 billion (with growth of 65%). The e-retail sale continues to register an unprecedented growth and increase by leaps and bounds over the 2013-2018.

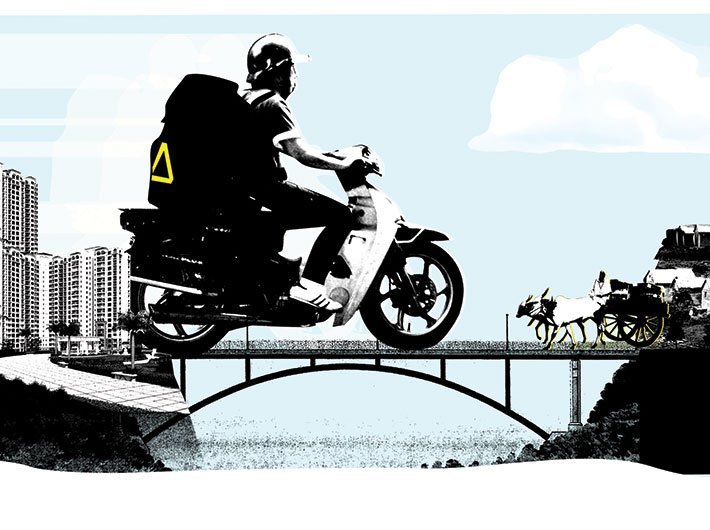

In 2017, mobile commerce will become more important as most of the companies are shifting to m-commerce. Mobile already accounts for 30-35% of e-commerce sales, and its share will jump to 45-50% by 2017, adds the report.

E-commerce is big business and getting bigger every day. Online shopping has been embraced by Indians with close to 25-30 million adults making a purchase via the internet in the last year. A press communiqué said online shoppers and buyers starting with a base age of 18 are become more involved with ecommerce in their early teens.

In 2016, it showed that a higher amount was being spent on average for popular categories such as apparel by 85 percent, mobile phones by 68 percent and cosmetics by 25 percent, when it comes to online shopping. There was also a significant increase in spending on categories such as watches by 75 percent and artificial jewellery by 65 percent. Computer and consumer electronics, along with apparel and accessories, account for the bulk of India's retail e-commerce sales.

There is a surge in the number of people shopping on mobile across India with tier II and III cities displaying increased dominance. In fact, 50% of our traffic is coming from mobile and a majority of them are first time customers, adds the study.

The year 2017 will see large scale growth in the Indian e-commerce sector with increased participation from people across the country. This industry will continue to drive more employment opportunities and contribute towards creating more entrepreneurs through the e-commerce marketplace model.

As per the joint study, the total retail sales in India will likely to increase from the $717.73 billion during CY 2014 to touch $1,244.58 billion by 2018. The total retail sales is growing at an impressive rate of 15%, registering a double digit growth figure year after year.

Challenges for the e-Commerce:

Absence of e-Commerce laws

Low entry barriers leading to reduced competitive advantages

Rapidly changing business models

Urban phenomenon

Shortage of manpower

Customer loyalty

Opportunities for the e-commerce:

Reduction of money transactions in all sectors.

Improvement of Net banking facilities across the country.

Implementation of demonetization policy.

Government policies on banking and financial sectors.

Read: Making financial inclusion mobile