Urgent need to reinvigorate private investment, remove infrastructure bottlenecks and provide a major thrust to Pradhan Mantri Awas Yojana, says RBI panel

There is a need for speedier clearance of projects by states, RBI’s monetary policy committee said and added that there is an urgent need to reinvigorate private investment, remove infrastructure bottlenecks and provide a major thrust to the Pradhan Mantri Awas Yojana for housing needs of all.

“On their part, the government and the reserve bank are working in close coordination to resolve large stressed corporate borrowers and recapitalise public sector banks within the fiscal deficit target. These efforts should help restart credit flows to the productive sectors as demand revives,” said the minutes of the monetary policy committee meeting of August 1-2, 2017 that were released on Wednesday.

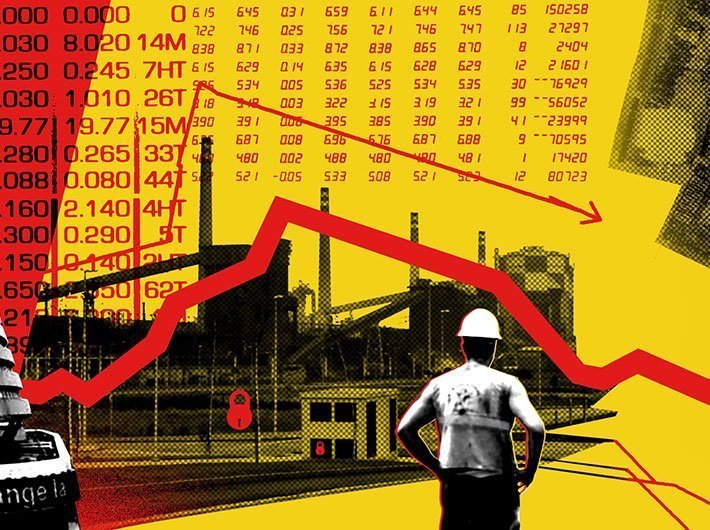

The report said that industrial performance has weakened in April-May 2017.

“This mainly reflected a broad-based loss of speed in manufacturing. Excess inventories of coal and near stagnant output of crude oil and refinery products combined to slow down mining activity. For electricity generation, deficiency of demand seems to remain a binding constraint. In terms of uses, the output of consumer non-durables accelerated and underlined the resilience of rural demand. It was overwhelmed, however, by contraction in consumer durables – indicative of still sluggish urban demand – and in capital goods, which points to continuing retrenchment of capital formation in the economy.

“The weakness in the capex (capital expenditure) cycle was also evident in the number of new investment announcements falling to a 12-year low in Q1, the lack of traction in the implementation of stalled projects, deceleration in the output of infrastructure goods, and the ongoing deleveraging in the corporate sector. The output of core industries was also dragged down by contraction in electricity, coal and fertiliser production in June, owing to excess inventory and tepid demand. On the positive side, natural gas recorded an uptick in production after a prolonged decline and steel output remained strong,” it said.

The second bi-monthly

statement said that there are several factors contributing to uncertainty around the baseline inflation trajectory.

“Implementation of farm loan waivers by states may result in possible fiscal slippages and undermine the quality of public spending, entailing inflationary spillovers. Moreover, the timing of the states’ implementation of the salary and allowances award is critical – it is not factored into the baseline projection in view of lack of information on their plans. If states choose to implement salary and allowance increases similar to the Centre in the current financial year, headline inflation could rise by an additional estimated 100 basis points above the baseline over 18-24 months. Also, high frequency indicators suggest that price pressures are building up in vegetables and animal proteins in the near months. There are, however, some moderating forces at work.”

It went on to say that business sentiment polled in the manufacturing sector reflects expectations of moderation of activity in Q2 of 2017-18 from the preceding quarter.

“Moreover, high levels of stress in twin balance sheets – banks and corporations – are likely to deter new investment. With the real estate sector coming under the regulatory umbrella, new project launches may involve extended gestations and, along with the anticipated consolidation in the sector, may restrain growth, with spillovers to construction and ancillary activities. Also, given the limits on raising market borrowings and taxes by States, farm loan waivers are likely to compel a cutback on capital expenditure, with adverse implications for the already damped capex cycle.

“At the same time, upsides to the baseline projections emanate from the rising probability of another good kharif harvest, the boost to rural demand from the higher budgetary allocation to housing in rural areas, the significant step-up in the budgetary allocation for roads and bridges, and the growth-enhancing effects of the GST, viz., the shifting of trade from unorganised to organised segments; the reduction of tax cascades; cost, efficiency and competitiveness gains; and synergies in domestic supply chains. In turn, these virtuous forces may spur investment.”

The MPC observed that while inflation has fallen to a historic low, a conclusive segregation of transitory and structural factors driving the disinflation is still elusive. In respect of inflation-sensitive vegetables, prices are recording spikes. Excess supply conditions continue to push down prices of pulses and keep those of cereals in check.