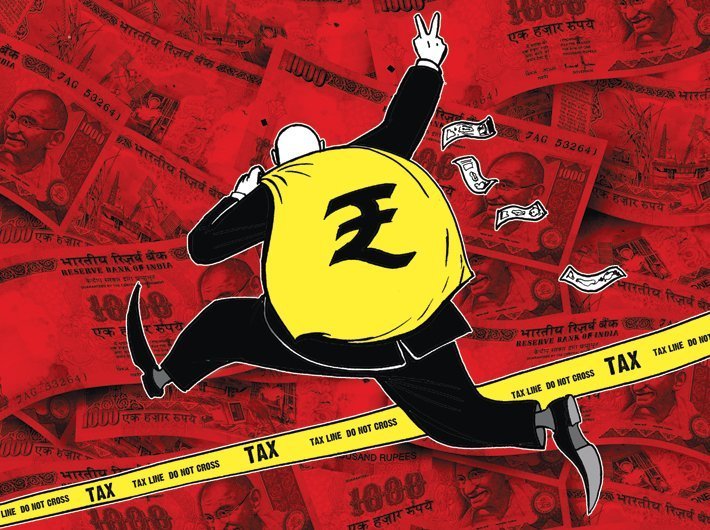

Total illicit financial flows likely grew at an average rate of between 8.5 percent and 10.1 percent a year over 10-year period in developing countries, says GFI report

Illicit financial flows represent a challenge to economic and social progress in the developing world, said a comprehensive report that pegs trade misinvoicing range in India between 5 percent and 13 percent in inflows.

The Global Financial Integrity (GFI) report highlights estimated illicit inflows to developing countries. It has become increasingly evident that both types of illicit flows represent a challenge to economic and social progress in the developing world.

Read: Don’t think black money can be completely stopped: Former top IT official

GFI finds that IFFs remain persistently high. The study finds that over the period between 2005 and 2014, IFFs likely accounted for between about 14.1 percent and 24.0 percent of total developing country trade, on average, with outflows estimated at 4.6 percent to 7.2 percent of total trade and inflows between 9.5 percent and 16.8 percent.

Total IFFs likely grew at an average rate of between 8.5 percent and 10.1 percent a year over the ten-year period. Outflows are estimated to have grown at an average annual rate between 7.2 percent and 8.1 percent and inflows at a slightly faster pace, between 9.2 and 11.4 percent per year. Those growth rates translate to an estimated range for total IFFs of $2 trillion to $3.5 trillion in 2014; outflows are estimated to have ranged between $620 billion and $970 billion in that year, while inflows ranged between $1.4 trillion and $2.5 trillion (in 2014), said the GFI report.

GFI’s measures of illicit financial flows stem from two sources: (1) deliberate misinvoicing in merchandise trade (the source of GFI’s low and high estimates), and (2) leakages in the balance of payments (also known as “hot money flows”). Of those two sources, trade misinvoicing is the primary measurable means for shifting funds in and out of developing countries illicitly. Even using the lower of GFI’s two estimates for trade misinvoicing, GFI finds that an average of 87 percent of illicit financial outflows were due to the fraudulent misinvoicing of trade.

The estimates presented in the report underscore the severity of the problem illicit financial lows present to the developing world. Illicit flows in and out of the developing world amounted to at least 13.8 percent of total trade (or $2 trillion) in 2014. The significant estimated propensities for illicit flows in the developing world have not declined appreciably over the 2005-2014 period.

Propensities for nations to experience illicit financial outflows have been highest in Sub-Saharan Africa, while propensities for illicit inflows have been highest in Eastern Europe and Asia.

GFI has recommended a number of policy measures to curtail illicit flows. Broadly, they are related to increasing transparency in the global financial system. Measures related to tax haven secrecy, anonymous companies, and money laundering techniques are of particular importance.

Specifically, GFI’s major policy recommendations include:

1. Beneficial Ownership. Governments should establish public registries of beneficial ownership information on all legal entities, and all gatekeepers to the financial system should know the true beneficial owner(s) of any account or client relationship they open.

2. Anti-Money Laundering. Government authorities should adopt and fully implement all of the Financial Action Task Force’s (FATF) anti-money laundering recommendations; laws already in place should be strongly enforced.

3. Country-by-Country Reporting. Policymakers should require multinational companies to publicly disclose their revenues, profits, losses, sales, taxes paid, subsidiaries, and staff levels on a country-by-country basis.

4. Tax Information Exchange. All countries should actively participate in the worldwide movement towards the automatic exchange of tax information as endorsed by the OECD and the G20.

5. Trade Misinvoicing. Customs agencies should treat trade transactions involving a tax haven with the highest level of scrutiny. Moreover, governments should significantly boost their customs enforcement by equipping and training officers to better detect intentional misinvoicing of trade transactions, particularly through access to the most recently available world market pricing information at a detailed commodity level.

6. Addis Tax Initiative. Governments should sign on to the Addis Tax Initiative to further support efforts to curb illicit financial flows as a key component of the global development agenda.

More than 30 countries and international organizations have launched the Addis Tax Initiative aimed at promoting a strong domestic tax system, including stronger tax institutions and the stemming of cross-border and domestic tax evasion.