A new book by Anant Merathia is both a helpful introduction for newcomers and a full-scale reference volume for practitioners

From December 2016, the Indian business community at large, bankers and financial institutions, among other stakeholders, were introduced to a new comprehensive legal and institutional machinery – the Insolvency and Bankruptcy Code, 2016 (“IBC”) – which was set to revolutionize the resolution process of financially distressed companies.

If it is a rather complicated subject for an average reader, here is a book that will be a helpful introduction to it – as well as a full-scale reference volume for practitioners. In other words, here is a valuable resource for both those with legal backgrounds and those who are new to the subject.

‘Defaulter’s Paradise Lost’ by Anant Merathia, published by Thomson Reuters is lucid and understandable, aims to provide a comprehensive and practical understanding of the IBC's impact on the resolution process for financially distressed companies.

Merathia, drawing on his experience in legal practice, aims to present the evolution and dynamics of the IBC in a way that is accessible to a wide range of readers. The book is structured to guide readers through the different aspects of the IBC in a manner that is free from excessive legal jargon, making it easier for professionals, stakeholders, students, and others to comprehend.

In ‘Defaulter’s Paradise Lost’ Merathia meticulously curates the dynamic nature of the IBC while taking inspiration from his experience in legal practice. This book accompanies the reader through the journey and evolution of the IBC in a stakeholder-wise manner touching upon, in the process, its various facets in a lucid and understandable manner, without the flourishes and jargon of a legal text.

This treatise will enable the reader to acquire a sound grasp of the working of the IBC in a simplified way. It is intended for use by members of the bench and the bar, insolvency professionals, finance professionals, chartered accountants, company secretaries, various stakeholders in the IBC, businesses, corporate entities and individuals, students, researchers, academicians, and law professors who wish to understand the nuances of the IBC and garner a practical understanding of the insolvency regime prevailing in India.

The author is a practicing commercial litigation and disputes resolution lawyer and heads Anant Merathia & Associates, a legal practice in Chennai. This is his first book. He has formulated his thoughts and practical knowledge on the Code in the book by accumulating data and resources over a period of three years to provide valuable insights in a simplified manner in this dynamic area of law.

Here is an excerpt from the book:

THE JOURNEY OF THE LAW

The IBC is a law that has possibly seen the maximum number of amendments within a short period of 6 years since its inception. This law has seen both criticism and appreciation from different quarters in equal measure, with the former primarily due to grey areas that emerged with the introduction of this law and which have been and continue to be addressed by the courts at every stage. While most amendments were prospective and not retrospective in nature and stakeholders who had suffered earlier didn’t have any recourse, the workings of the law aren’t to be toyed with either.

In this chapter, I attempt to cover the interesting journey of this law from its inception till date, the various milestones it has seen, where the law stands on different key propositions at present and some analysis of what could be in store in future.

IBC – THE INITIAL BREAKTHROUGH

IBC was first introduced on 28 May 2016 and was notified to come into effect from 1 December 2016. The NCLT Bench at Mumbai was the first to pass a few admission orders in early 2017, and it was soon caught up with by the other prominent benches such as New Delhi, Chennai, Kolkata and Ahmedabad. Given that the law and the subject matter of CIRP was absolutely new, there were gaps and grey areas in various aspects of interpretation and implementation of the law.

The courts starting right from the NCLT, NCLAT to the SC especially have in a noteworthy manner passed various landmark judgments giving a lot of clarity to the stakeholders on various legal issues. One of the initial questions that arose before the SC was with respect to the parameters involved in the admission of a Section 7 application initiated by an FC in the case of Innoventive Industries. It was settled that if the NCLT is convinced that the existence of a ‘debt’ and ‘default’ is established and if a registered IP has consented in writing to take up the assignment in the event it is admitted, then the NCLT shall proceed to admit the CD into CIRP. This set the tone for NCLTs to evaluate all Section 7 applications.

Additionally, in the Vidharba case, the aspect of evaluating the solvency of the CD has also been considered.

A GLANCE AT THE KEY EVOLUTIONS OF THE CODE

Section 29A was one of the most contentious inclusions to the Code via an amendment in 2018. It introduced ineligibilities that prevented defaulting promoters from gaining a back-door entry back into the business at significant discounts. After the report of the Insolvency Law Committee in March 2018 was released, there were several changes to the Code, including further streamlining of Section 29A. Promoters of the MSME category were given some relief with the introduction of Section 240A, which stated that the ineligibility under Section 29A(c) and (h) shall not be applicable to RAs who were MSMEs.

The voting share of CoC required was lowered from 75% to 66% for extending the time period of CIRP for more than 180 days, to appoint IRP as RP or to replace IRP, replace RP, approval of certain actions under Section 28 and for approval of resolution plan. Section 21(8) states that unless otherwise provided, all decisions of the CoC shall require a vote of not less than 51%.

As discussed in detail earlier in the book, another major amendment that has to be mentioned here is the recognition of homebuyers as financial creditors. Amendments to the Code in this regard includes adding the words ‘other financial creditors’ to Section 7, provisions for appointment of authorized representatives by adding subsection 6A to Section 21 and the Supplementary Regulations 16A and 8A. Section 14(2A) was inserted to prevent the termination of essential supplies of goods and services that are critical to protect and preserve the value of the CD and manage the operations of such CDs as going concerns. An order approving a resolution plan by the NCLT was slated to be binding on the Central and State Governments. Section 32A was also added along with the same amendment, which stated that the CD, in case of approval of resolution plan, shall not be prosecuted for an offence committed prior to the commencement of CIRP.

Part III of the Code dealing with the Insolvency and Bankruptcy of Individuals and Partnership Firms insofar as it is applicable to personal guarantors of a CD was brought into effect from 1 December 2019.

These are to be read with Section 60 of the Code. Insertions were made to extend the jurisdiction of the NCLTs to the liquidation or bankruptcy of a corporate guarantor or personal guarantor.

[…]

THE VERDICT ON THE INSOLVENCY AND BANKRUPTCY CODE, 2016

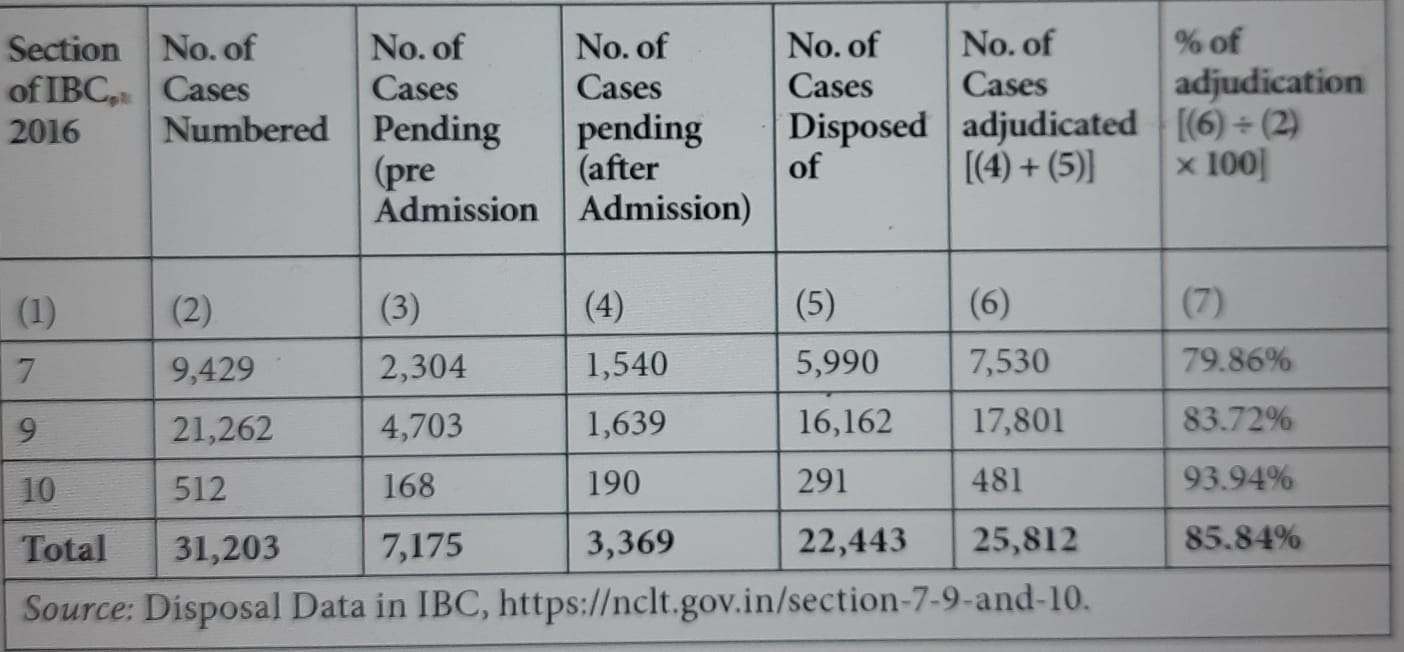

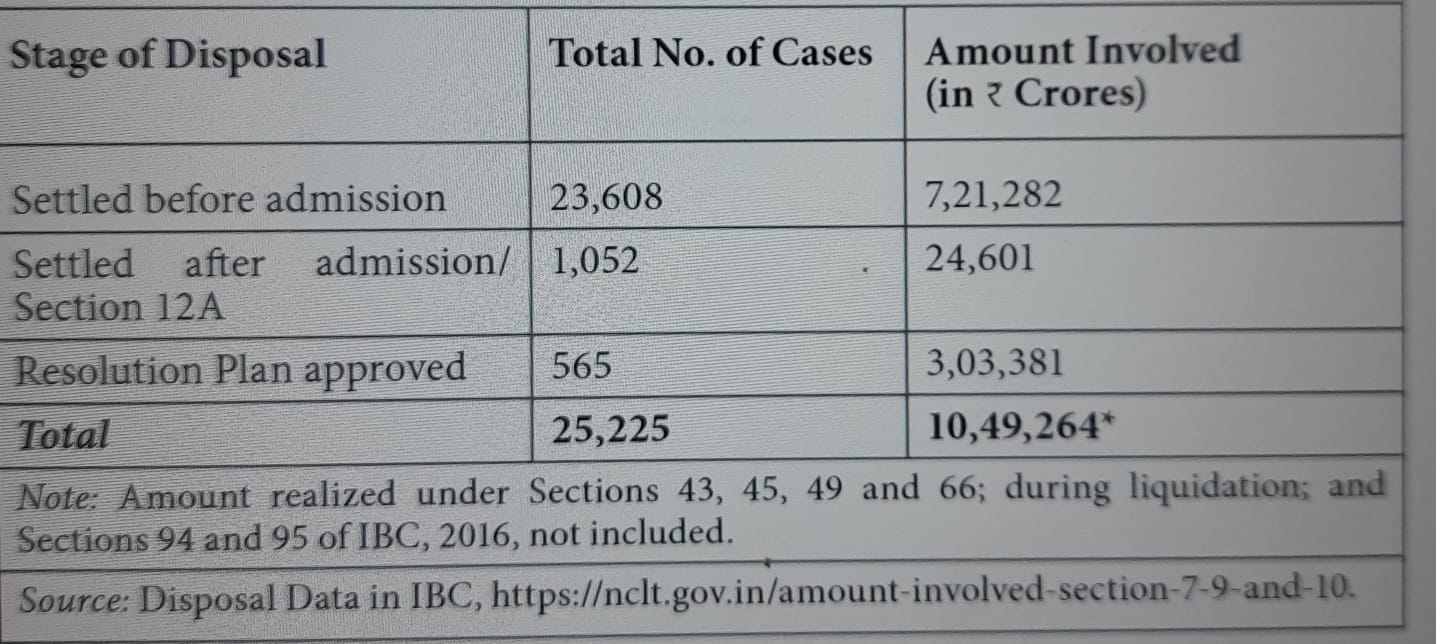

The science of statistics is the chief instrument through which the progress of a civilization is now measured, and by which its development hereafter will be largely controlled. In a similar vein, the measurement of the growth of any new legislation, including the IBC, 2016, can best be gauged from the data and statistics compiled and maintained by the requisite depositories and databanks of the Government of India. The relevant extracts from the website of the NCLT on the data pertaining to disposal of cases under the Code and the quantum involved (as on 31 December 2022) is given in Tables 14.5 and 14.6 for reference.

Table 14.5 Cases Filed, Pending and Disposed under Sections 7, 9 and 10 of the Code from 1 November 2017 to 31 August 2022.

Table 14.6 Total Amount Involved in the Cases Disposed of Under Sections 7, 9 and 10 of the Code

While the IBC, 2016, has garnered mixed reactions from various quarters, I opine that the reader would be the best judge and jury of how this law has impacted the economy of the nation in the context of restructuring and distress management of financially troubled companies and how the various stakeholders have been affected, be it beneficially and/or adversely. Having been a part of the journey of the evolution & performance of the law through this book, the extent of efficacy of the law is for the reader to decipher.

[The excerpt reproduced with the permission of the publishers.]