Urban local bodies need to improve the collection efficiencies of their own revenues like property tax, says Janaagraha

We now know why people are not getting a good quality of life in cities. Janaagraha Centre for Citizenship and Democracy analysed the financial management of urban local bodies (ULB) and presented key insights on the state of municipal finances based on the audit reports of the CAG on their audits of ULBs in 21 states.

The brief is a precursor to the Annual Survey of India’s City-Systems (ASICS) that evaluates the quality of city systems in India across 18 states and analyses the financial management of Urban Local Bodies.

Urban planning & design, urban capacities & resources, empowered political leadership and transparency, accountability & public participation are the four city-system components covered under ASICS. The ability of Urban Local Bodies (ULBs) to invest adequately in providing infrastructure and services to its citizens is one of the key diagnostic parameters assessed by ASICS, said

Janaagraha

Here are the highlights:

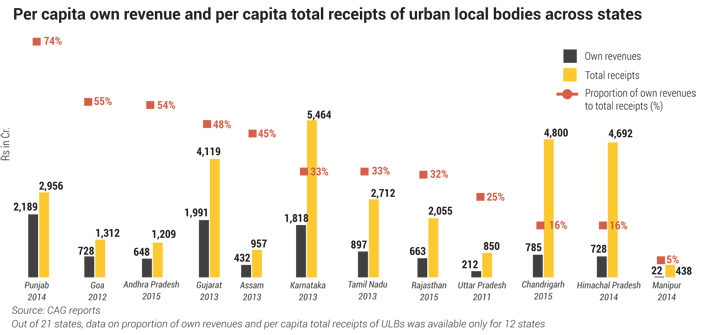

Insight 1: Own revenues on average contribute to less than 37% of the total receipts of ULBs, ranging from a low of 5% in Manipur to a high of 74% in Punjab; only 3 states record > 50% share of own revenues.

Impact: Total receipts Proportion of own revenues to total receipts (%) ULBs depend on State and Central grants to a significant extent, constraining their ability to make capital investments to improve infrastructure services and other investments to improve their functioning.

Recommendation: • ULBs need to improve collection efficiencies of own revenues, mainly, property tax, advertising tax and parking fees. • Buoyant sources of revenues such as stamp duties and entertainment taxes should be devolved to ULBs. • States needs to embark on systematic fiscal decentralization

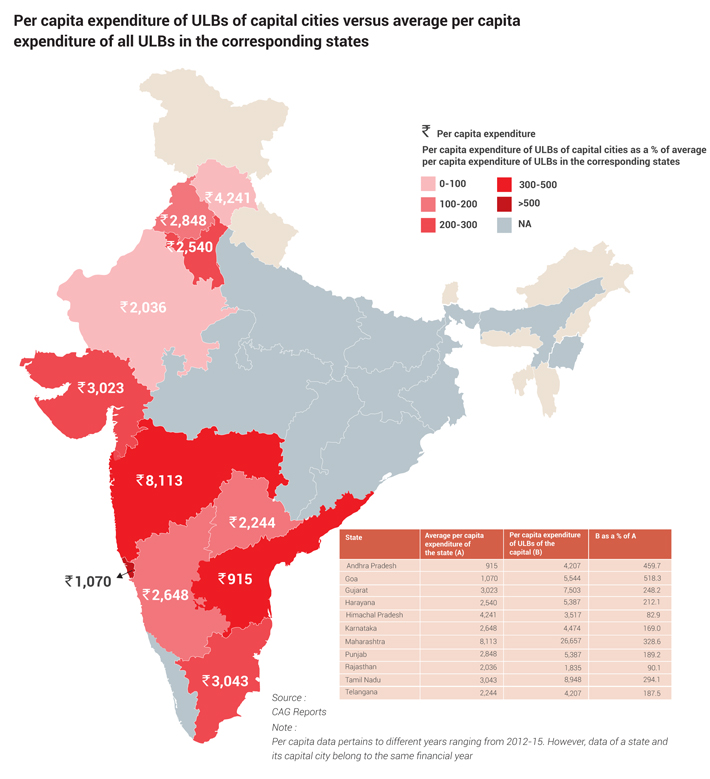

Insight 2: On average (across 12 states), ULBs of capital cities spend 253% higher per capita, on infrastructure and services, as compared to average per capita spend by all ULBs in the corresponding states

Impact: This indicates lower per capita spend across smaller cities, resulting in poorer quality of life in such cities

Recommendation: The focus, currently concentrated only to large cities, must also shift to the smaller cities and towns in order to bridge the gap in per capita spend, by - • improving collections of own revenues of the ULBs in smaller cities and towns • devolving buoyant sources of revenue such as stamp duties and entertainment taxes should be devolved to ULBs, and • increasing grants devolved to smaller cities and towns to meet the infrastructure needs.

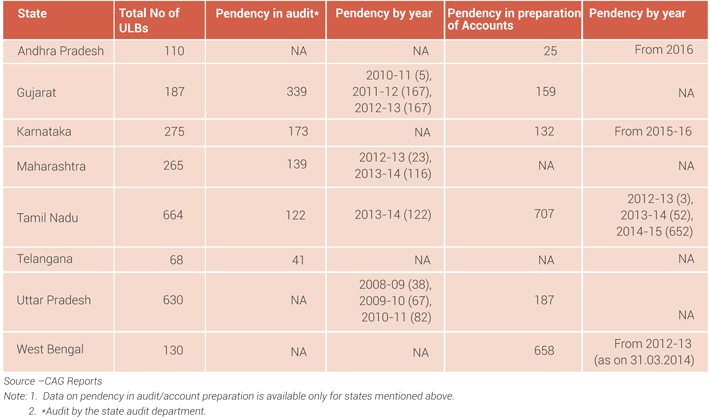

Insight 3 Significant delay in preparation of Accounts and Audit of ULBs across states, inability to ascertain accurate financial position and performance of ULBs

Impact: Constraining the ability of state governments to hold ULBs accountable and of ULBs themselves to take informed decisions or raise funds from the capital markets.

Recommendation: To clear the pendency in accounts and audit, States should actively consider empanelling Chartered Accountants. Karnataka, Bihar, Chhattisgarh, Gujarat, Odisha and Rajasthan are among the states that have empanelled Chartered Accountants to clear the backlog in audit and accounts.

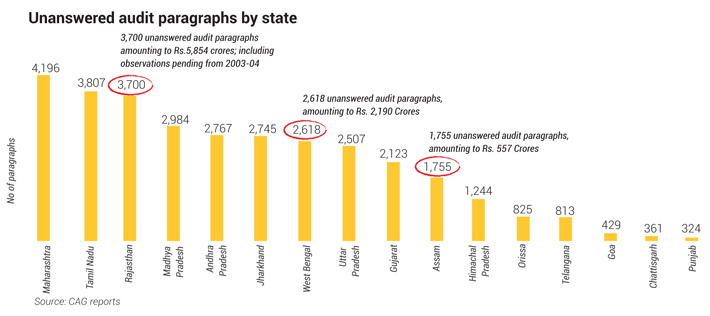

Insight 4: Over 33,198 unanswered audit observations from CAG Audits across 16 states, relating to several thousand crores in financial terms; no implications for open audit observations.

Impact: Open audit observations are a sign of weak internal controls and poor financial hygiene in ULBs, exposing them frauds and losses.

Recommendation: Time-bound, transparent responses to CAG audit observations to be mandated in Municipal Corporation Acts, central and state grants to be tied to performance in audits and responses to audit observations.

Insight 5: Significant backlog in CAG audits of local bodies undermining quality of TG&S by CAG

Impact: CAG audits are the last line of defence around internal controls in ULBs. Delays in CAG audit reflects lackadaisical approach to the audit process.

Recommendation: Fix accountability for submission of financial records of ULBs on time to CAG; make transparent time table of CAG audits and reasons for delays in CAG audits.