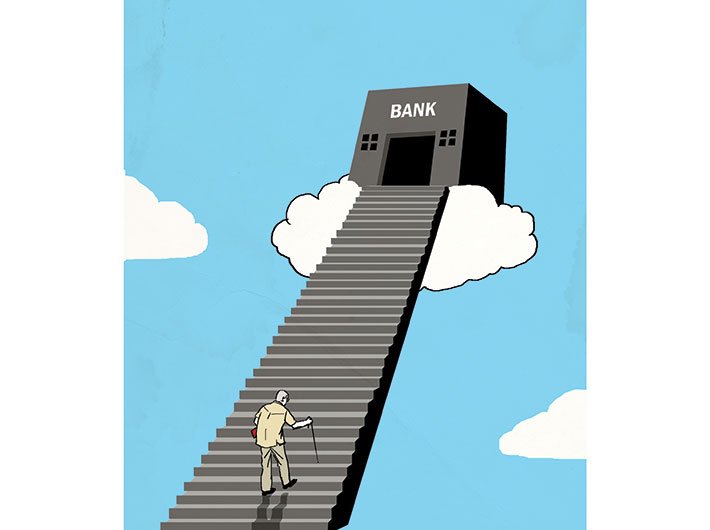

Personalised banking, relationship managers, courteous but insistent calls to sell cards, insurance and other services – these are the positives one has come to associate with private and multinational banks. Equally, they have become notorious for making hidden charges, not warning customers about ruthless penalties, and dealing with complaints opaquely. What is worse, if one were to go by complaints received by the Reserve Bank of India (RBI), they don’t give due benefits to senior citizens and the differently abled.

In October last year, an RBI statement laid out services and banking facilities to be provided to senior citizens. In November, the RBI listed out facilities for the differently abled. But a series of complaints received since then accuse banks – particularly private and multinational banks – of not heeding these directives.

Banks are required to have dedicated counters for senior citizens and the disabled, to simplify submission of life certificates and collection of cheque books, to convert without ado fully KYC-compliant accounts to senior citizen accounts when holders turn 60. Also, they must provide additional services to the visually impaired. A December 31, 2017 deadline was set for banks to start providing doorstep services to senior citizens and those who need them.

Overall, banks are pushing for digital transactions and the use of ATMs. But the regulators – the RBI and the government – want them to be sensitive to the needs of those who cannot go digital. Ombudsmen have been told to take complaints on these counts seriously.

But private and multinational banks are sticking neither to the spirit nor the letter of these directives. For example, KYC-compliant accounts of people turning 60 aren’t immediately treated as senior citizen accounts. A branch manager of a private bank in Colaba, Mumbai, says, “A customer’s account cannot be automatically converted into a senior citizen account on his/her turning 60 years unless he or she personally makes a request. As for doorstep facilities, the customer will have to make a request and it will be provided conditionally.” A leading private bank stonewalled this correspondent’s queries about the number of accounts automatically converted to senior citizen accounts and the number of senior citizens being offered doorstep services. Reminders on phone and email went unanswered. Senior citizens are thus deprived of due benefits despite the RBI guidelines.

Given the competition for getting and keeping customers, one would have expected private and multinational banks to score with better services. In fact, it is public sector banks that are endearing themselves. Their offices may not be as swank as that of private sector banks, but public sector bank staff are acting from the heart. There is an air of friendly neighbourliness in the branches and managers try to build on the rapport they have established with customers.

Says Mohanlal Solanki, a businessman, “We have been banking with Dena Bank for years and are very happy with the services.” His son Vinod, who runs Kismat Arts, concurs, saying that many private and multinational banks loot customers with extra and hidden charges. He says, “Forget senior citizens, even when one of us is busy or simply unable to reach the bank, a staffer drops by and provides us doorstep banking – without a charge too. And this when we don’t even qualify for a senior citizen account.”

Small and mid-level business persons like the Solankis have found great allies in public sector banks, with staff taking extra steps to help. “Today, even if a cheque I have drawn is deposited into my bank at a time when there are less funds, the bank manager calls up and I rush to deposit the amount to ensure the cheque is cleared,” says Suresh Kanojia, a resident of Colaba. “How many private banks will offer this sort of service? They earn mostly from such lapses and oversights by customers who don’t even realise how they are being charged.”

Public sector banks list all the services, charged and free, as laid down in RBI guidelines. It takes just an RTI application to obtain details. Private or multinational banks, on the other hand, put such queries through a maze of internal procedures. The customer often gives up. It’s this attitude that makes many wary of private banks. There’s also a well-orchestrated silence over hidden charges and internal procedures meant to maximise profits and further managers’ careers. This often translates into deficiencies in service, which customers are forced to take up with consumer fora and courts. In many cases, consumer courts have awarded both redress and compensation. In 2016, the National Consumer Disputes Redressal Commission even censured one private bank, saying it had “no love and respect for India”.

Against that high-handedness, public sector banks are steadily acquiring a reputation for being amiable. Here’s what senior manager Sanjay Gondhalekar of the public sector Dena Bank says: “We’ve been offering doorstep banking facility not just for senior citizens, but also those who are unable to visit the bank for some reason. We’ve been doing this for years, even before the RBI notification. We offer personalised services to all customers who have been banking with us for over generations. It’s trust and goodwill that we value more than sheer profit.”

Generally, the private sector responds better to competition. In banking and finance – unlike say, in the hospitality industry – the response has focused on innovation and profitability. Surprisingly, public sector banks, in their drab yet genial way, have one-upped the private sector with good service.

feedback@governancenow.com

(The article appears in the September 15, 2018 issue)