Women self-help groups of Mewat in Haryana open bank accounts under PMJDY, borrow and repay their loans before time

With 42 percent literacy rate and more than 90 percent of its work force engaged in agriculture and living in rural areas, Mewat district in haryana has been grappling with many developmental challenges including proper banking facility in last few years.

A month after the launch of the PMJDY in August 2014, people had little expectations from the scheme as many such drives had failed. Due to the high rate of illiteracy people were totally unaware of the benefits of formal banking.

A visit to some of the villages like Adbar, Salamba, Ranika and Suraka, just to name a few, clearly showed how most people were untouched by the formal banking service. Further, those who had accounts complained of the unresponsive attitude of bankers.

However, in the last eight months things have been changing dramatically for the better. With the push given by the PMJDY people are finding it easy to open accounts and those who already had accounts prior to the launch of the scheme are now using it in much better way than ever.

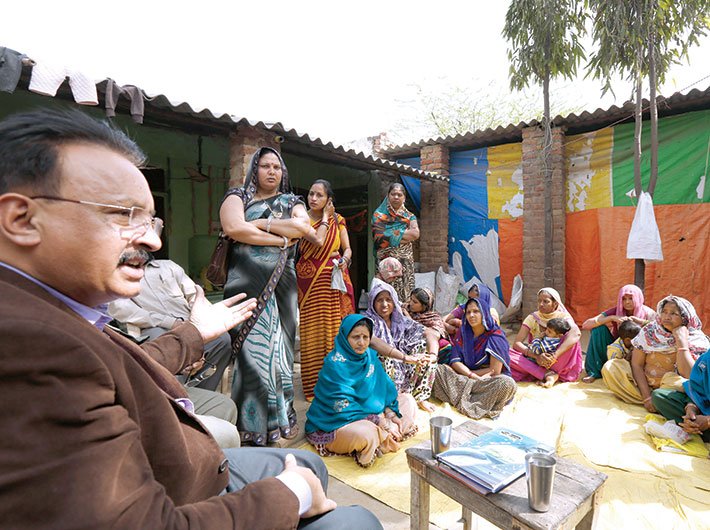

In Tauru block of Mewat, some 40 km away from Gurgaon, Rakhi, who heads a local women’s self-help group (SHG), speaks in a businesslike manner. She has a glint of infectious confidence in her eyes as she starts telling about how Shobha, a member of her SHG, started her own business a year ago and is happy with the outcome.

Shobha, who listens to Rakhi animatedly as she tells about the functioning of the group, is shy but confidence quickly takes over as she starts speaking about her tailoring business. She says, “I buy dress material of which I stitch women’s suits and sell it. But it would not have been possible without the help of the loan I got from the SHG. I earn around '10,000 per month. It takes care of a lot of needs of my family.”

She treated the loan as an instrument for her economic betterment, than just a dole, and repaid it in 10 months – two months before schedule. Now, she has again taken a loan of '1,40,000 to expand her business.

Recounting how the group works ardently, Rakhi talks about an important aspect of the financial inclusion plan; how accounts opened under schemes like the Pradhan Mantri Jan-Dhan Yojana (PMJDY) can be effectively used for economic upliftment of the marginalised classes.

The group decides on an amount to be saved every month and deposited in the group’s bank account. It also discusses how much its members would require to further their business interests. It then applies for the loan. Intra-group borrowing also takes place and is monitored by the SHG as a whole. All transactions, and savings, are recorded in a register managed by the group.

The bank usually lends up to four times the money saved by the group. The group decides to give money to one, or more, member on the basis of her income generation and repayment capacity.

Another SHG group in the same block is almost two years old and took a one-year loan of '50,000. The group of around 15 repaid the entire amount within 10 months. “This time they borrowed '1.5 lakh,” says Anuj Prasher, branch manager, Syndicate Bank, Tauru. “The women groups have better capacity and intent of repayment than individuals. They have peer pressure, which is not seen among individuals. And the role of a bank manager is largely played by the pradhan of the group. They fine those who do not pay the loan instalment in time,” he adds. He says women SHGs are not eligible for the second loan until they clear the previous one.

Stressing on how these groups have used bank accounts as an effective tool to gain financial services, Prasher says 35 SHGs had taken loans of '50,000 each and the first loans had been repaid by all the women SHGs.

Prem, one of the oldest members of the second group, got her account opened under PMJDY. “I don’t have to beg anyone for money. Earlier, I used to tie it in my saree or hide it in the kitchen. But many a time I lost it. But now we just go to the bank and withdraw,” says Prem, who operates the account with the help of her daughter-in-law. (Prem is illiterate and her daughter-in-law has studied till BA second year, though she could not complete her graduation.)

Prem has now decided to take a loan next year to help her daughter-in-law complete her education. The changes in the lives of these women might be small but are significant. “We don’t have to beg anyone [family members] for money. It is easier to take a loan from here and repay,” adds Prem.

Women use the borrowed money to either run their businesses, to pay their children’s school fees, or even to build or renovate homes. “The stress should not be on whether the loan we are giving them is being invested in a productive work or not. Our basis of identifying a beneficiary should be to see who has the motivation and intention to repay the loan,” says Tribhuvan Singh, district manager, Syndicate Bank.

Savita is yet another example of how banking facilities are helping them change their lives. Savita sells earthen pots. She buys earthen pots from the potters at wholesale prices and then sells them in the local market. She took a loan of '20,000 to expand her business. “Whenever and however I feel like I spend the money. I never ask my husband for it.” In the 16 years of her marriage, Savita always had to depend on her husband to fulfil her financial needs. “Now, I use money for my child’s education and sometimes I spend it on myself as well. My husband is also very happy because I am able to share the financial burden of the family.”

jasleen@governancenow.com

(The article appears in the June 1-15, 2015 issue)