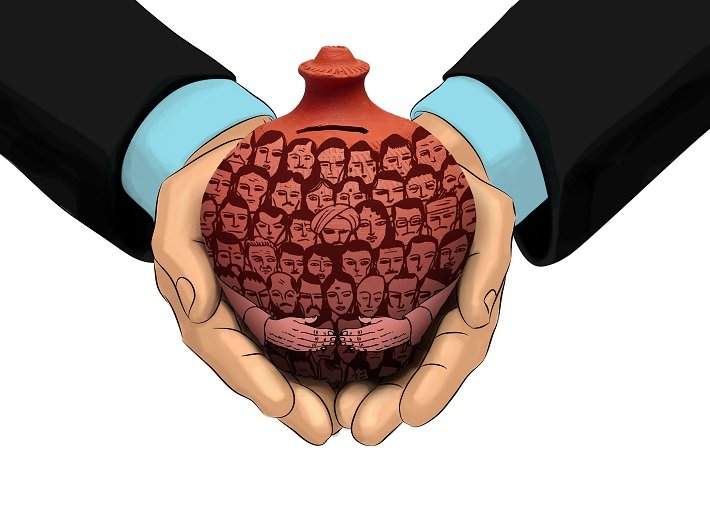

Banks across India are levying inconsistent service charges on basic savings accounts. A study, “Benchmarking Reasonableness of Service Charges by Banks in India”, uncovers and exposes inconsistencies in adherence to RBI mandates by banks. It finds some banks impose charges exceeding reasonable limits.

The study, authored by Dr Ashish Das of the Indian Institute of Technology Bombay (IIT-B), analyses service charge data obtained for a sample of 23 scheduled commercial banks (SCBs) and two cooperative banks. Using a rank aggregation method, 44 service-charge variables were analysed to rank all the banks in the sample. The banks were then grouped into four categories (A-D), with A being the best and D being the worst.

It also sheds light on commendable practices as well as areas of concern in the way Indian banks charge for their services. The study, commissioned by Moneylife Foundation, was released here Wednesday by former RBI deputy governor SS Mundra.

It also sheds light on commendable practices as well as areas of concern in the way Indian banks charge for their services. The study, commissioned by Moneylife Foundation, was released here Wednesday by former RBI deputy governor SS Mundra.

It finds that Canara Bank and Axis Bank charge the highest. Canara Bank ranked lowest in the study for its extremely high service charges for services like 'DD Cancellation', 'Self-Generation of ATM PIN', 'mandatory-SMS alerts' and 'non-maintenance of average balance' in rural areas and ranked the lowest along with Axis Bank that has relatively higher charges, with a few outlier charges for 'non-maintenance of balance' in metro and urban accounts, 'non-financial transactions from own bank ATMs' and 'failed Standing Instruction'. Both Canara Bank and Axis Bank have been categorised the lowest at Category D

Among public sector banks (PSBs), State Bank of India, is rated as the best. It has scrapped the controversial average quarterly balance (AQB) but categorised in Category B.

Among the scheduled commercial banks (SCBs), IDFC First Bank, AU Small Finance Bank and Bandhan Bank are the only three in on top (Category A). IDFC First Bank has 14 services where its charges are exceptionally low or zero. Next in terms of low charges is AU SF Bank, which does not charge for mandatory SMS alerts, charges less for online IMPS compared to at-branch IMPS and has a comparatively lower requirement for average monthly balance. Bandhan Bank is the only bank apart from State Bank of India (SBI) with zero average monthly or quarterly balance requirements.

Saraswat Cooperative Bank and SVC Cooperative Bank performed exceptionally well earning a spot in the top tier (Category A). However being cooperative banks they have different customer segments, business models and regulatory requirements. For the purpose of eliminating any undue effects of these two cooperative banks in the rankings, only a sample set of 22 SCBs was considered when ranking the banks with respect to service charges.

Until 1999, RBI prescribed what banks could charge for various services. Since then, banks have been allowed to set their own service charges, but RBI has emphasised that bank charges should be reasonable and linked to costs. A report by RBI in September 2006 laid the foundation for discussions on ensuring the reasonableness of bank charges identifying certain services as being fundamental to banking operations. However, there has been no detailed research on whether the principle of 'reasonableness' mandated by RBI is being followed by banks.

There was a preliminary investigation by IIT-Bombay (in 2009) and RBI's Department of Banking Supervision conducted a thematic analysis (in 2020-21). As these are unpublished and not in the public domain, no comparison or ranking is available and bank customers remain in the dark about the reasonableness of banking charges, resulting in a lack of transparency and accountability.

Here, Professor Das says that despite these efforts the question of reasonableness of basic banking service charges remains a pressing concern particularly in light of the significant transformations within the banking sector over the past 18 years. "The report emphasises the need for a thorough assessment, justification and adherence to regulatory guidelines in fixing service charges. The report provides three case studies that are eye-openers," he says.

Key findings of the study

General Observations: While private sector banks tend to impose higher average minimum balance requirements, public sector banks (PSBs) exhibit higher average charges across various services. Some banks impose extremely high service charges. These are: YES Bank (for 'Cheque Returned due to technical reasons'), Federal Bank (for 'Doorstep Banking'), Standard Chartered and Indian Overseas Bank (for 'Non-financial Off-Us ATM transactions') and Canara Bank (for 'DD Cancellation' and 'Self-Generation of ATM PIN'). Off-us refers to transactions done at ATMs and POS terminals of other banks.

ATM/NEFT/RTGS/IMPS Related Charges: Wide disparities in ATM withdrawal charges are evident among banks; some banks adhere to the caps set by RBI, while others charge below or above these thresholds. Additionally, inconsistencies persist in charges for services such as NEFT/RTGS. Central Bank of India, Bank of Maharashtra, Bank of India and IDBI Bank, contrary to RBI advice, have failed to pass on branch-based NEFT/RTGS service charge benefits to customers.

Charges for ATM/POS Decline due to Insufficient Balance: Many banks impose penalties for ATM/POS declines due to insufficient balance, with charges reaching as high as Rs 25. Out of the 25 banks in the sample, 11 do not charge for POS declines (but charge for ATM declines) while 5 do not charge for both. The study raises questions about the rationale for such charges particularly since failed transactions do not inflict any cost (the normal interchange charge) on the bank.

Debit Card Annual Fees: Despite the declining significance of debit cards domestically, a majority of banks continue to impose annual fees. Of the 25 banks in the sample, 16 banks do not charge for debit card issuance, while all banks, except IDFC First Bank, impose debit card annual fees. The study advocates a review of the reasonableness of these fees, especially taking into account the large number of instances where cards remain unused.

Charges on Mandatory-SMS Alerts: RBI has mandated SMS alerts for debit transactions done through UPI/NEFT/RTGS/IMPS and ATM cash withdrawals. Such SMS alerts become part of the product features of the withdrawal channels. Yet, some banks levy charges for mandatory SMS alerts. Ten out of the 25 banks do not charge for the mandatory-SMS alerts, and among the 15 banks that impose these charges, five do not have a monthly/quarterly cap on such SMS alert charges.

Penal Charges for Non-maintenance of Minimum Balance: The study reveals inconsistencies in penal charges imposed by banks for non-maintenance of minimum balance with some banks applying disproportionately higher charges. There are 14 banks having a slab structure wherein for each slab the penal charges are constant in rupee terms, i.e., they are not a fixed percentage of the shortfall even within each slab. These banks impose a disproportionately higher penal charge in the lower slab of shortfalls than in the higher slabs.

Category A (Best Performers):

IDFC First Bank

AU SF Bank

Bandhan Bank

Saraswat Cooperative Bank

SVC Cooperative Bank

Category B:

State Bank of India

RBL Bank

Ujjivan SF Bank

HDFC Bank

Bank of Maharashtra

Punjab National Bank

IndusInd Bank

Union Bank of India

Bank of Baroda

Category C:

Central Bank of India

IDBI Bank

Bank of India

Kotak Mahindra Bank

ICICI Bank

Federal Bank

Indian Overseas Bank

Yes Bank

Category D (Worst Performers):

Axis Bank

Canara Bank

Recommendations:

RBI should conduct a thorough review of the issues highlighted in the report, focusing on the reasonableness of service charges imposed by banks.

Regulatory observations made through case studies should be addressed promptly to ensure fairness and transparency in banking practices.

Banks should prioritise customer-centricity, rationality and adherence to regulatory guidelines when fixing service charges.

Greater oversight and accountability mechanisms need to be established to safeguard the interests of bank depositors, particularly marginalised ones.