Regulated utilities: Steady operations; higher receivables, rebate affect cash flows

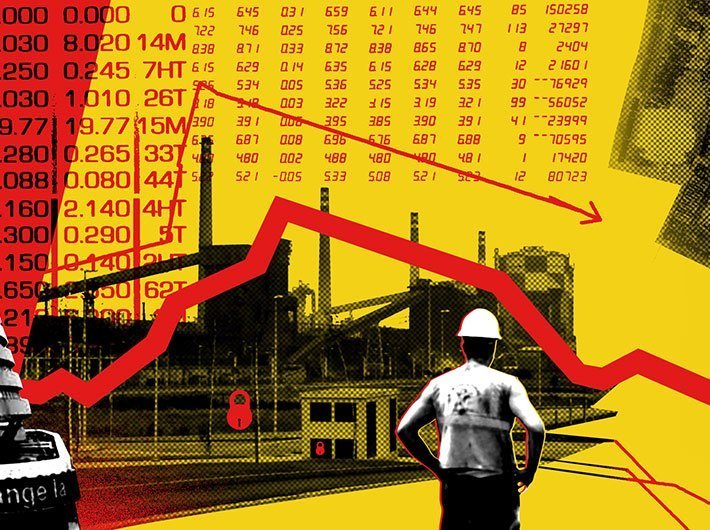

As the lockdown and movement restrictions in the aftermath of the Covid-19 pandemic come to hurt economic activities, India’s electricity demand is set to drop by 4% during the financial year ending March 2021, Fitch Ratings said in a statement.

The fall in demand is likely to result in lower load factors, mainly for coal-based power plants. The weak demand, along with higher coal inventory, led to India’s coal imports falling by 22% y-o-y in 1H20.

“We expect the credit profiles of state-owned distribution companies (discoms) to worsen further against weak demand from high-paying industrial customers, due to the economic slowdown. The central government's recent Rs 900 billion liquidity facility for discoms should help them pay the huge outstanding amount owed to generation and transmission companies, the statement said.

Fitch expects the pandemic-related supply chain and labour disruption to result in slower renewable-energy capacity additions during 2020. Hybrid projects (a combination of renewable and storage facilities) are gaining traction in India to address the intermittent nature of renewable power and streamline integration with the grid, while solar continues to lead capacity additions.

For more, read Fitch’s Special Report, ‘India Power Watch 1H20’, which is available at www.fitchratings.com.

Regulated utilities: Steady operations; higher receivables, rebate affect cash flows

Indian regulated power utilities – NTPC Limited and Power Grid Corporation of India Ltd – maintained largely stable operating profits amid the lockdown, supported by availability-based payments under a favourable regulatory framework, says Fitch Ratings. However, cash flows were affected by higher receivables and a one-time rebate to state-owned power-distribution utilities.

Both utilities reported an increase in EBITDA in the first quarter of the financial year ending March 2021, supported by new assets commencing commercial operations. This highlighted their cost-plus tariff framework based on system availability, which is not exposed to volume risk.

These regulated utilities, however, face higher receivables risks as most of their customers are state-owned power-distribution utilities (discoms), whose operational and financial profiles have weakened from the pandemic-related drop in electricity demand and payment concessions to end customers, Fitch Ratings said in a statement.

“However, we believe the receivable days for these utilities have already peaked, barring any second wave of large-scale lockdowns in the country. Our expectation is driven by improved collections in July, post the removal of lockdowns, largely assisted by payment settlements from discoms under the central government's Atmanirbhar scheme, whereby discoms are being provided with liquidity support to clear outstanding dues.”

Automakers’ demand outlook cloudy despite some respite in July

Demand for automobiles in India continues to be uncertain even though the sharp slide in sales in April-June 2020 slowed in July, which could reflect the release of pent-up demand following the gradual easing of restrictions to contain the coronavirus pandemic, Fitch Ratings has said.

India’s auto demand continues to face several challenges and Fitch forecasts overall industry volume to decline by more than 20% in the financial year to June 2021 (FY21). This forecast could be revised down if the extent and magnitude of the pandemic are worse than we expect.

The economic fallout from the pandemic exacerbated the weak consumer sentiment that was dampened by the higher cost of ownership under BS6 – a more stringent emission framework adopted from April 2020. This is likely to constrain demand from first-time car buyers as well as upgraders, despite their preference for private transportation due to hygiene reasons.

Likely curtailment in private and public investments will weigh on demand for commercial vehicles (CVs), particularly medium and heavy commercial vehicles (MHCV), which are used in more cyclical end-markets. The pandemic has also reduced the availability of financing as lenders exercise caution, particularly to weaker borrowers that form a significant customer base for CVs.