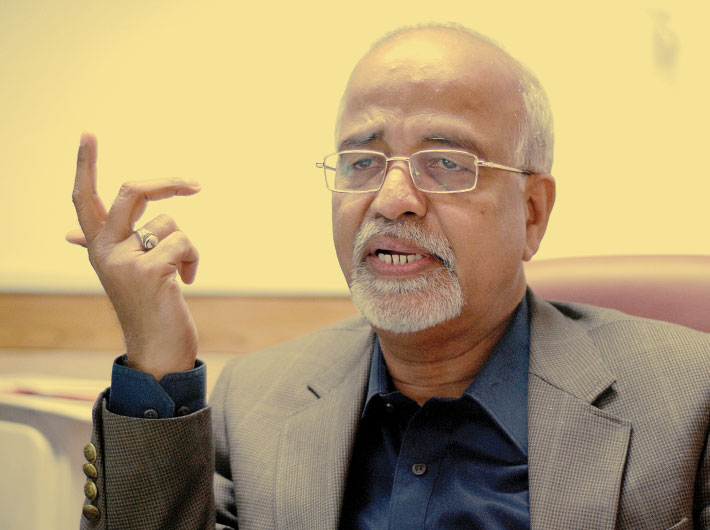

Within hours of demitting office, additional solicitor-general Bishwajit Bhattacharyya alleges in a book how the government expected him to lose cases!

Bishwajit Bhattacharyya retired as India’s additional solicitor-general on Friday, November 9. Hired specifically to fight on behalf of the government on all indirect taxation cases involving thousands of crores, Bhattacharyya says he spent most of his time watching his client (the government) enfeebling him and handing things on a platter to the lawyers of the corporate houses.

In a damning book released a day after his retirement titled "My Experience with the Office of Additional Solicitor General" (Universal Law Publishing, 2012), Bhattacharyya recounts how the Union of India (UOI) is deliberately squandering its tax cases, involving claims of thousands of crores of rupees.

Without naming either Attorney-General GE Vahanvati and or finance minister P Chidambaram, Bhattacharyya makes thinly-veiled references to both of them while making the shocking revelation that “the government expected me to lose!”

The book tells a sordid and untold story of how India is being sold to the saints in our corporate sector. It details how some good samaritans sneaked him into the role of ASG (Indirect Taxation) after many hiccups and how some persons, batting for India Inc., tried to scuttle his efforts to squeeze out lakhs of crores trapped in government’s legal duels with corporate godzillas, when they realised the full import of their choice!

Of course, there will be the other side to what Bhattacharyya has written, but few can fault the meticulous detailing and an unprecedented narrative of what every government counsel, slaving for a fraction of the payment for the other side, tells you in private, yet doesn’t pen down for fear of burning their boat.

Bhattacharyya describes just who ensures self goals and how the UOI aligns to ensure that cases are handed over on a platter to beneficiaries (needless to say, these beneficiaries aren’t ordinary citizens like us, they are large corporates who have the stakes and the deep pockets to persist to the level of supreme court).

Bhattacharyya book details how some five years back, the UOI decided to have an ASG each to plug in the horrendous fiscal deficit that we have. The idea was pious. If the government had specialised law officers for direct (income tax) and indirect taxes (customs, central excise and service tax) they would assist the apex court reach satisfactory conclusions to benefit the country and the exchequer.

But what happened? The first ASG-Indirect Taxes resigned within a few months. Bhattacharyya, the next one, was selected after months of hiccups, his name rejected within FinMin without the knowledge of Pranab Mukherjee, the finance minister, because of his willingness to tear Union budgets and finance ministers to shreds in his avatar as columnist for The Economic Times and budget analyst on Zee News. He had to escalate the matter up to Mukherjee, meeting him for the first time in his life.

But his ordeals did not end. For someone finally hired because of his expertise in indirect taxes, Bhattacharyya was dumped only with cases on income tax, somewhat like Sehwag being told to play hockey instead! That too with briefs that would land in the middle of the night, peons who expected to be bribed, no office or staff, and crucial pages torn and missing! For want of an office, the ASG-Indirect Taxes claims he stored and carried around for several months crucial files in the boot/seats of his car!

When after a few months of swimming against the tide, Bhattacharyya developed some standing with the bench on direct taxes, the “Central Law Agency,” which decides which law officer fights which case, started dumping mountains of briefs on indirect taxes too. The documents were seldom complete, and they invariably were sent at the last moment, and all but tied one hand of the government’s swordsman out there in battle with truly focused and the best-paid lawyers on the other side. Some briefs apparently came at 10.29 am, when the case was coming at 10.30! Even Special Leave Petitions (SLPs) were filed by the government deliberately late, so that the courts would throw them out on grounds of limitation. It's another matter that the courts played spoil sports and stopped throwing out such SLPs!

At times, the opposite strategy was used: Cases on which he had prepared for over 50 hours would be taken away at the eleventh hour and assigned to someone else, like in the case of a senior I-T official who had flown in especially to brief Bhattacharyya, only to be told that he was taken off the case.

Something happened in our ASG-Indirect Taxation’s cursed life after Mukherjee’s candidature was announced as President of India. Sushil Shinde was told to start preparing to be home minister and Chidambaram became for all practical purposes the shadow finance minister. Mysteriously, briefs and files to him dried up completely. So, July 4, 2012, with four full months before end of term, Bhattacharyya started writing the book, which is why it was ready to be released a day after demitting office.

An important swipe in the process is on the supreme court registry, which decides which cases would get heard. Here our protagonist waits for days for his listed matter, but the Vodafone case breaks the queue because of Harish Salve’s “mention.” Here, $11 billion (over Rs 55,000 crore) had been transferred from Cayman Island to Hong Kong for a telecom infrastructure that existed in India, but the court decides that the Indian taxman (CBDT) isn’t within her jurisdiction**. Bishwajit devotes an entire chapter on how he, as an ASG, sat awaiting his own matter, only to see the three-judge SC court overlook that the same investment on that very telecom infrastructure was considered to be within the jurisdiction of the Foreign Investment Promotion Board (FIPB) just a few rooms away from CBDT in North Block itself, and without adequately hearing Mohan Parasan appearing on behalf of UOI!

Today, Monday, November 12, 2012 is the first day in three years that the former ASG-Indirect Tax will take private briefs, his boat burnt with the UOI.

NB: **The widely-respected Justice JS Verma has on November 10, 2012, endorsed in my presence this criticism of the Vodafone judgement as “among the three worst decisions that the SC will have to live down” (the other two, as per Verma, being the Habeas Corpus case and the JMM Bribery Case). Among the former chief justice of India’s audience was a sitting judge of the Supreme Court!