Not all government banks are inefficient, not all private ones are role models. Size is what matters in customer care

Outside it’s a nice, pre-winter morning. Inside incense sticks fill the air with sweet, sticky, holy smoke as the faint light from incandescent bulbs fights its way to the dark cemented floor of a south Delhi branch of State Bank of India (SBI). Two middle-age women employees on the sofa facing the enquiry counter chat with the morning’s first masala chai cups sitting on the sofa handles. A man enters. He stops a while, letting his eyes adjust to the low light before walking up to a counter. He wants to open a bank account. He asks the woman behind the counter about the procedure. Clearly irritated at the interruption in her early morning ritual, she almost throws the 10-page form at him, instructs him to fill it up and submit it with required documents, at the adjoining counter.

The man, puzzled, flips through the pages and tells her he only has an Aadhaar card, and that he had been told it was good enough to open a bank account. “That is under the jan dhan yojna, and we have stopped opening accounts under that scheme,” the woman replies curtly. She continues to trace the sequined flower pattern on her sari.

“But, weren’t they mandated by the government to open an account, even irrespective of residence proof?” he says.

“Yes, but we have run out of forms. Why don’t you go to the nearby branch, they are opening accounts under jan dhan,” she answers, now turning to her computer.

The employee at the SBI branch was passively rude to a prospective customer.

Switch to HDFC Bank in the same locality.

The contrast is stark and stretches from the sun-kissed marble floor to the ‘white-collared’ staff wearing neck ties. Most of those sitting on the other side of the table are young men and women, ready to serve new-age customers with new-age services. They look relaxed and sport a restrained enthusiasm and polite smiles.

Praval Chaudhry, the student, arrives at the branch to open an account. He informs the executive behind the ‘May I Help’ placard that he does not have an address proof of Delhi. Yet, would it be possible for him to open a bank account? “No problem,” says the beaming executive. He is then suggested to get a rent agreement made, which will act as an address proof for the account to be opened. Chaudhry, new to the city, looks uncertain. The executive then calls over a colleague and apprises her of the case in a soft voice while instructing her to take Chaudhry aside and tell him how to get a rent agreement made.

The private bank staff is clearly courteous and visibly happy to help a customer.

The above two instances make for a stereotypical portrayal of Indian banks – that the public sector charges less but provides poor quality of service while the private sector charges more but ensures client satisfaction. These instances, however, do not tell the full story. Stereotypes are being broken piece by piece, and from one part of banking to another. Almost 20 years after private banks made a comeback in independent India, the difference in the work cultures and service quality is blurring. Now, the scale of operation determines the overall performance of both public sector and private banks.

Professor Santosh Dev of the Jaypee Institute of Information Technology, Noida, wrote a doctoral thesis titled ‘Client satisfaction and impact of work culture on employee satisfaction in banks’. “One major finding was that the mean values of all the dimensions of client satisfaction, except interest rates and other charges and accessibility, were higher as perceived by the clients of private sector than the clients of public sector banks,” she says.

But perceptions are not foolproof.

At the AD tower branch of ICICI Bank in Gorakhpur, Uttar Pradesh, Ambrish stands in a long queue to deposit '15,000. He has had to take half a day off work from the coaching institute where he is employed. He reaches the counter half an hour later, only to be told that cash below '50,000 can only be deposited through the cash deposit machine. The machine, however, is not functioning. He is told to come the following day.

Sumit, assistant manager at the branch, says, “Usually, we ensure that third-party customers (who do not have an account in that branch) deposit the amount through the machines. The facility was launched a few months ago and we are educating the customers so that they can deposit the cash even when the branch is not open.”

Ambrish, however, is dissatisfied. “There is no guarantee the machine will function tomorrow. I will lose one day of work for this small task.”

A visit to a branch of Syndicate Bank in Nuh, Haryana, evokes a different picture. Mohammad Nasir of Adbar village, who has come to deposit his weekly savings, says most of the people he knows have an account in Syndicate Bank. “We are very happy with the bank’s services and the staff is quite courteous,” he says. Others customers talk well about the bank. A sense of satisfaction is apparent.

But then, Syndicate Bank belongs to the public sector. Isn’t it supposed to be inefficient?

One similarity among banks when it comes to customer service – not that difficult to observe – is the scale of the customer base. Those with numerous customers show a visible lack of concern for services, as in the case with SBI and ICICI Bank. Are their employees overburdened due to the large number of customers?

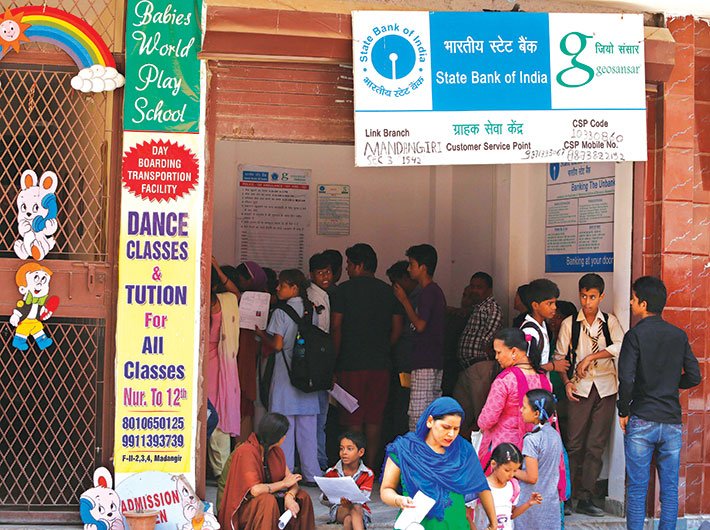

For the last two months, with the launch of the pradhan mantri jan dhan yojna (PMJDY), banks are brimming with people lining up to get their accounts opened. For a majority of them – usually from lower income groups – opening a bank account is a major achievement. They don’t care about the level of services they get; they are generally positive because they get to avail an overdraft facility of Rs5,000.

But it is a very different story among those for whom banking is a necessity; with more frequent operations, whether it is cash deposition or withdrawal, banking is not a luxury born of some welfare scheme for them. Their expectations are much higher.

For Anita Mertia, who owns a jewellery shop and a petrol pump in an eastern UP town, good banking service is very important for smooth functioning of her business. Mertia has accounts in both private and public sector banks. Government banks, she says, are more transparent in their transactions and have improved the staff quality over the years. “What is good about these banks is that they are very clear about the amount they charge on the various services you avail, which is lacking in the private bank,” says Mertia.

However, Mertia complains of lack of concern for the customer in government banks. “We have been trying to get real-time gross settlement (RTGS) facility for the past two years, but the bank has provided no suitable reason for the delay on its part.” For the same reason, Mertia also maintains an account with a private bank. She says private banks lack transparency; but when it comes to new-age services such as online transfer of funds, private banks score over government-owned banks.

Visits to different branches of private and public sector banks blurred any well-settled differences between them. In many cases private sectors banks were found on the same footing as government banks when it came to customer care, and in some instances public sector banks belied common perceptions.

Case in point

HDFC Bank, Green Park, south Delhi: An elderly man waits on the sofa opposite the cash counter. He is waiting for some details regarding his fixed deposit account. He is approached by a bank employee, who gives him the required detail and the old man walks out of the bank after thanking him.

Sanchit, who works at this branch, says, “All the banks have products but we believe in giving the best service to the customers. In order to maintain a good customer base and ensure full customer satisfaction we make the best possible efforts.”

Switch to State Bank of India in Mewat. Vinod Kumar Gupta, manager at the local government-run school and one of the customers of the branch, points out that most of the government schemes and benefits are linked to bank accounts in his state. Banking services are critical here. But the scholarships that students get through their bank accounts never reach them on time due to lethargy and the casual attitude of banks, Gupta says.

In his defence, SA Khan, manager of the same branch, says, “We are doing enough work to ensure the best possible banking facility to our customers.”

The first case lives up to its image; a private bank, providing good and personalised service to its customers. The second case also affirms the stereotype – a typical government bank marked with inefficiency and unaccountability, not caring about its customers.

Yet, as in the Gorakhpur case, the biggest private sector bank – supposed to be customer friendly – fails on that very account. Perhaps, it is the size of these two banks. SBI and ICICI Bank are the biggest banks in their respective sectors and customers of both the banks face similar problems. Similarly, those dealing with HDFC Bank and Syndicate Bank experience the same level of satisfaction, in most of the cases.

Relationship between employee satisfaction and customer service

A probationary officer posted in SBI in Ranchi, Jharkhand, told Governance Now: “When I joined this sector some four years ago, I never expected there will be so much work. People think only private sector employees have long working hours. But you spend a day here and you will realise the amount of work we have to do. I never leave the office before 7 pm.”

Dev, in her thesis, observes: “The level of employee satisfaction decides the quality of service the customer receives. One cannot expect excellent result/service from an unsatisfied employee. An employee’s frustration with his work will obviously get reflected in the way he treats the customer.”

The Annual Report on Banking Ombudsman Scheme, 2012-13, says 23,134 of the 70,541 complaints received were against SBI and its associate banks. With the biggest customer base the number of complaints is expected to be higher. But when India’s largest bank contributes heavily to the number of complaints, it reflects deep dissatisfaction among people with its services.

Infrastructure and tangibles

According to Dev’s thesis, ‘tangibles’ include infrastructure and other facilities for the comfort of customers. “For the younger customers it matters a lot whether the infrastructure is good or not. Things like being offered water and coffee on visiting the branch matters to them; however, it matters less to the elderly customers,” says Dev.

Vibhav Prakash, an advocate at the Allahabad high court, says, “I have an account with IDBI and with more than '1 lakh in my account I am a preferred customer. I am personally attended to by the manager. However, in SBI no matter how much business you are giving to them, they do not care.”

What accounts for the popularity of public sector banks?

Experiences of people to a greater extent corroborate Dev’s findings. According to Dev, interest rates and other charges and accessibility were perceived better by the clients of public sector banks than the clients of private sector banks.

“Public sector banks should equip themselves with the latest technology; change the general image of being more of a government office and foster a customer-friendly environment in the branches. The private sector banks need to go beyond their elite image and become mass banks instead of class banks by increasing their accessibility and lowering their charges.”

Preferred customers

According to Dev’s findings, “Out of all the three – highest, middle and low-income groups – the highest income group was more satisfied than the other two groups.” While the field survey to an extent supports Dev’s conclusion in case of private banks, it wasn’t the same with public sector banks.

Mertia says, “More than the business you give to them, it is the personal equation with the managers that helps you get your work done smoothly.”

Positive trait: gender neutrality

Much of what can be observed at the banks also confirms to another finding of Dev’s research. According to Dev, “There was no significant difference in most of the dimensions of client satisfaction on the basis of gender.” Going by one of the most important conclusions of Dev’s research, banks still need to do much to become more customer-orientated.

Private banks have, earlier, come under scrutiny for their aggressive, and sometimes even violent, methods to recover loan amounts. There have even been reports of defaulters committing suicide.

Dev concludes, “Customer orientation is one area where both types of banks are lacking the most. It appears that in the new scenario, where ‘perform or perish’ has become the order of the day, banks have been forced to focus more on profit and capital augmentation to remain self-sustained, even by losing sight of customer orientation.

Banks need to take note of this situation and take care of customer orientation by planning and releasing customer-oriented schemes and policies.”

The story appeared in December 1-15, 2014, issue