Vote For Pant: But, Don’t

By Sorabh Pant

Rupa Publications, 200 pages, Rs 295

Do not vote for comedian Sorabh Pant. He is irrelevant, insignificant and has no knowledge or insights about politics and issues that matter. Also, he’s never going to run for elections but, that’s another story. Either way, Sorabh is still going to talk about those issues, or at least the ones he’s allowed to talk about.

Critically acclaimed comedian and writer Sorabh Pant’s new book is a firecracker that talks about everything from politics to economics, a post-mortem of all that common man worries about.

‘Vote For Pant: But, Don’t’ is as witty as his stand-ups. It is engaging, yet not talking down, but talking to his readers. His work has made him a mouthpiece for Indians who have seen it all, heard it all, and yet are coerced into silence.

In this book of toned-down thoughts and toothless opinions, he attempts to answer the important questions: Can motivational speakers solve unemployment? Is politics mainly about not paying tax? Should India give a haircut to Mallya? Can we use our population for direct profit? What is the correct price to buy news? Did ‘someone’ important plagiarize Sorabh’s stand-up set? Should the prime minister personally thank people for paying income tax? What makes China so cute? Is nepotism not really Bollywood’s problem? Should the punishment for fake news be more fake news? And, if Sorabh hosted Mann ki Baat, who would watch that?

Here’s an excerpt that would give you an idea of what Pant is up to in this new work.

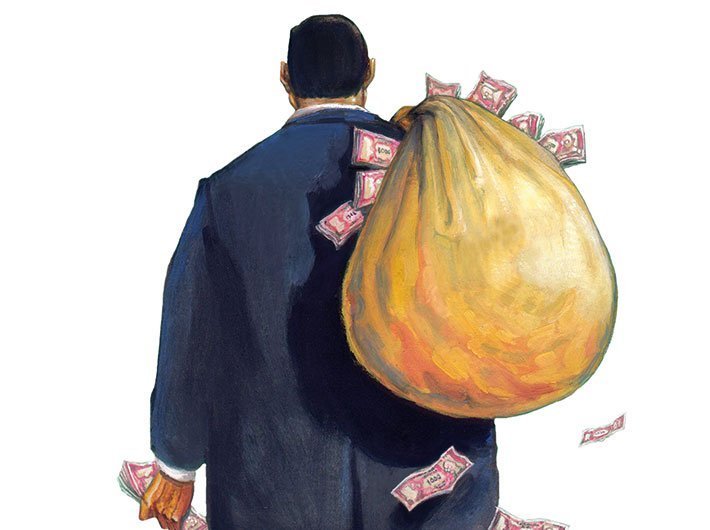

Income Tax: Note of Thanks

Here’s what some people tell you about taxation in India—it is high. It is so high that it should be illegal to do it anywhere except in Amsterdam and certain states in America and Canada.

If you’re earning above Rs 1 crore (not me—this is for my friend Sorabh Putin), then here’s roughly what you’re paying in taxes:

• 25 per cent of income (post expenses),

• 10 per cent surcharge

• 10 per cent TDS,

• 12–18 per cent GST (you don’t even realize when you’re paying this),

• 35 per cent indirect taxes (average tax on any consumer goods is around 25 per cent, on fuel it’s 70 per cent, on flights it’s 50 per cent, even your EMI has a tax component etc.)

Now, obviously I’m not a financial expert or a chartered accountant, which is proven by the fact that the above calculation brings taxes to 117–123 per cent of your income, which seems essentially impossible—you can’t pay more tax than you earn, even though we are close. And while all this is exaggeration, actual resources say that total taxation in India (if you’re paying income tax) is about 55–60 per cent!

Again, since I’m not an editor for a financial newspaper, these figures may not be entirely accurate, but I’m pretty sure they will be. Because I have a calculator. And my forefathers

were ministers.

Minister+calculator=verified facts

The amount of tax that sneaks up on you is absolutely ridiculous. Let’s take fuel as an example. India has the highest tax on fuel in the world! In my last research, the amount was 69 per cent. … So each time any government announces a reduction on fuel prices, I’m not impressed. I’d love to hear them announce a reduction in taxation. If you run an airline in India, congrats. You’re immediately paying 16–50 per cent more than the average global rates for aviation fuel. [https://www.business-standard.com/article/economy-policy/aviation-fuel-

price-50-higher-in-india-111111700039_1.html] It’s possible our aviation fuel comes infused with Red Bull or some special boost (maybe actual Boost is the secret of the plane’s energy?) or it could be that it’s stupidly high.

It goes without saying that Jet Airways may have stayed afloat if their operational expenses were 10 per cent less, but since I’m not Naresh Goyal’s spokesperson (yet), I say ‘no comment’ (for now).

Barely 3 per cent of India pays income tax (source: income tax uncle I met at my parent’s party. He assured me this figure was correct and then proceeded to spend 12 minutes telling me to use onion oil to regrow my hair). This is not unusual— apparently, even developed countries have barely 8–10 per cent people paying income tax. This is because agriculture is mostly exempt and so are children, homemakers, the retired, etc., etc.

But, 2.5 per cent of the country pays income tax (source: Economic Times. Uncle was off by barely 0.5 per cent), of this number 4 per cent pay 60 per cent of the total income tax collected. [https://economictimes.indiatimes.com/wealth/tax/budget-

2020-the-deceptive-rise-in-indias-income-tax-base/articleshow/73868046.

cms?from=mdr] If you have money to buy this book, there’s a high chance you’re one of those Indians.

The government won’t, so I would like to personally thank you for helping build this nation.

And that’s what I would like from the government. A personal thanks.

I’m not complaining (actually I am) about the taxes in India being so ridiculously high. It makes me jealous of those who don’t pay taxes and use bribery and black money to evade taxation. I’m constantly impressed by them as to how they avoided the tax net.

The Panama Papers or housing scams or Swiss banks or flying to London—one part of me is furious and another part is so impressed by them, thinking how they got away. I would neither have the interest, nor the inclination, and specifically not even the methods and definitely not the income to do the same.

What I do know is that paying 55 per cent tax is nuts.

If you want context—taxation of 55 per cent is comparable to ‘rich’ European countries, most of which offer either free education and/or transport and/or food and impeccable infrastructure.

Unlike...

Obviously India is a little bigger than most European countries. In fact, India’s population is almost double of the whole of Europe. One country is double the people of an entire continent! Technically, India has more population than all, but one continent—and that continent happens to be the one where India exists. How are we not a continent ourselves? Or a planet. Forget Pluto, I demand that India be designated as a dwarf planet—at least that way when China tries to claim our land, it’s not only an international, but a universal crime.

Our population is ridiculous and we have many people in abject poverty struggling to make ends meet (I still don’t know what that term means, ‘make ends meet’, it sounds like twerking) and it is only logical that the ones who have the means must help uplift those who do not. That’s the only way a society can function. And your historic privilege and its benefits should come with your responsibility to help others. I completely understand what a great person I am for paying my taxes.

I’ve been paying taxes since I was 18 because that’s when I started working. My parents were with the income tax department, so you’d think that came with some family benefits, but no. My mom once told me, ‘Please pay all appropriate taxes and more. What will the department say if we don’t?’ It was such an annoying attitude. Honestly, why did my parents even sit for the UPSC exams and become civil servants if they didn’t learn how to game the system? This kind of honesty is not what built tycoons.

Paying taxes should not come with an award system, I don’t want a Nobel Prize or a Red and White Bravery Award. But, I do think I deserve some kind of mention.

[The excerpt reproduced with the permission of the publishers.]