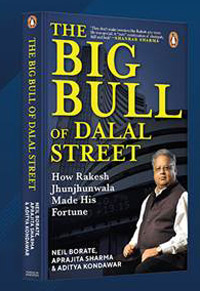

The Big Bull of Dalal Street: How Rakesh Jhunjhunwala Made His Fortune

By Neil Borate, Aprajita Sharma, Aditya Kondawar

Penguin Business, 256 pages, Rs 399

“Respect the market. Have an open mind. Know what to stake. Know when to take a loss. Be responsible.” That is what Rakesh Jhunjhunwala, India’s iconic stock market investor, often used to say.

“Respect the market. Have an open mind. Know what to stake. Know when to take a loss. Be responsible.” That is what Rakesh Jhunjhunwala, India’s iconic stock market investor, often used to say.

This book looks at the life of India’s big bull, as he was famously known, both as a person and as a professional. Providing a fascinating account of his journey, it analyses the records of Jhunjhunwala’s investments and interviews he has given over the years. More than just a biography, a large section of the book is devoted to understanding the stocks that made him rich and the mistakes he made. Looking at the journey of the legendary investor, the book offers retail investors some useful insights—-benefits of long-term investing, mistakes one should avoid in the stock market, risk associated with leveraged trades, among others.

Here is an excerpt from the last section of the book, ‘What You Can Learn From Rakesh Jhunjhunwala’:

Chapter 12

Inherent Optimism about India

Rakesh truly believed in the potential of India since theday he set foot in the stock market. He had all the money in the world to go global, that is, to look for investmentopportunities beyond India. But forever an India bull, hebelieved more in the Indian story than any global story. In fact, he was averse to buying MNC stocks in his initialdays. ‘He would get miffed at us as to why we were buyingMNC stocks. “Tum log MNC stock kyon kharidta hai? Indiancompanies khatm ho gayi hai kya? (Why do you people buyMNC stocks? Are there no Indian companies?)” he wouldtell us often,’ recalls one of his old friends.

In an interview, he himself mentioned that Radhakishan Damani and he differed on many investment ideas, including MNCs. ‘R.K. Damani would buy MNCstocks but I was averse to it. I don’t want to be a husband of an unwilling wife. Let’s face it. The fact is, MNCs don’t want more shareholders,’ Rakesh said in a 2015 lecture at FLAME University. Later, he did invest in a few MNC stocks such as HUL, GlaxoSmithKline and Nestlé.

His inherent optimism about India is what earned himthe title ‘the Big Bull of India’. You just have to recall a difficult phase in the stock market and watch his interviews from those days. He had been a buyer in all of the bea rphases that the stock market has seen, be it the dotcom bubble burst of 2000, the global financial crisis of 2008,the recent Covid-19 crash in March 2020 or the Russia–Ukraine war in 2022. ‘In 2000, the dotcom bust had hurtJhunjhunwala and Damani in a big way. Damani had had enough. He went on to launch the one-stop supermarket chain D-Mart while Jhunjhunwala invested back in the stock market whatever he was left with. Hardly any investor dared to take positions in the market during those days but he believed in India’s growth story and potentialin the stock market,’ recalls his old friend.

His optimism paid him well. His wealth multipliedby many times during the bull market that had started after 2002. All the portfolio stocks that he had bought in the 1990s, especially Titan, turned multi-baggers during this phase. This is the phase that marked his shift from being a trader to a smart investor. ‘In 2001–02, I realized India is on the threshold of a secular growth story and wrote so in the Economic Times in June 2001,’ he said in the FLAME lecture.

When the 2009 crisis hit the stock markets, Rakesh kept his nerve. ‘Now is the time to buy the riskiest assets.Risk is a word with many dimensions. But the way I seeit—say I buy something for Rs 100. It could be that it becomes Rs 60 or Rs 70 or Rs 40. But the way I envisage things—can it be Rs 1200, can it be Rs 1300, can it be Rs 500 or Rs 400? What is the probability of the asset reaching those prices? I think the riskiest assets bought now can give you the greatest return provided youhave the risk appetite, patience and it’s your own, notborrowed, capital,’ he told Sanjay Pugalia in an interview on CNBC Awaaz. Rakesh’s bullishness on India rested on India’s young population (favourable demographics) compared to other markets like the US, Europe and Japanand on India’s low per capita income, which providedmuch scope for catching up to advanced economies. It was a difficult time to be bullish in 2002. The bull market didn’t really gather steam till 2004. An investor looking back even in January 2005 would have seen a decade ofjust 5 per cent returns on the Sensex. ‘The past decade has not been good,’ Rakesh noted in an interview with NDTV in January 2005. ‘Over the next five–ten years, the best investable asset would be equity. The thing that candisrupt this is the world economy such as the US or a hardlanding in China,’ he told the interviewer.

‘The growth we’ve had in the NIFTY in the last ten years will be far exceeded in the next ten years. Most of us are attuned to the thought that this country cannot improve. We cannot grow at 10 per cent. We can’t have a responsive administration. I think that will change. When I was doing my CA, we had a 95 per cent rate of income tax. Nobody thought income tax rates would go below 75 per cent. Now we have a 30 per cent rate of income tax,’ hetold Shereen Bhan of CNBC-TV18 in 2014 after the Modi election victory. ‘India will see growth greater than China. We all will be surprised by the kind of growth that will come, Mr Modi will be the instrument of change but the change will be incremental,’ he added. According to ShankarSharma, an investment guru and broker, some of Rakesh Jhunjhunwala’s enthusiasm was simply a result of not having seen the world. Rakesh rarely travelled outside India or even outside the city of Mumbai. This insularity, somewhat counterintuitively, actually burnished his confidence in the country, according to Sharma.

Rakesh’s optimism about India’s growth was paired with his optimism about the returns on Indian stocks in the long run. There were moments of doubt, but these were quickly reversed. When the Covid-19 pandemic hit India, Rakesh became bearish for a while. ‘I sold 2 percent of my portfolio in March 2020 but in April–May, I changed my view and I took on the highest leverage of my life. The biggest bull market lies ahead of us,’ he told Shekhar Gupta of ThePrint in a 2021 interview. Rakesh’s optimism also transcended his political sympathies. ‘I’m a patriotic Indian but I don’t mix business with patriotism orbusiness with pleasure,’ he added in the same conversation with Shekhar. In various public pronouncements, Rakesh spoke approvingly of the Modi government. ‘Mr Modi should lead this country for the next ten years,’ he told Shereen Bhan in an interview with CNBC-TV18 in 2014. However, he continued to maintain that his confidence was not related to any particular government being in power. While speaking to the authors of this book, Shankar Sharma reiterated that this was Rakesh’s best quality. ‘Rakesh was extremely bullish on India but not bullish on any particular political dispensation taking India somewhere. In the last few years, it’s all become mixed up, politics and investing, which I think is absolutely dangerous. Every pursuit is a completely independent pursuit, and you don’t get involved in analysing a country necessarily through its politics. I say this goes for Harshad Mehta and Rakesh. They remained bullish on the whole India story itself. In Harshad’s time we had Congress,then we had the United Front and then we had the NDA.I find that is a big lesson to all investors that don’t get mixed up with your political inclination,’ he said.

[The excerpt reproduced with the permission of the publishers.]