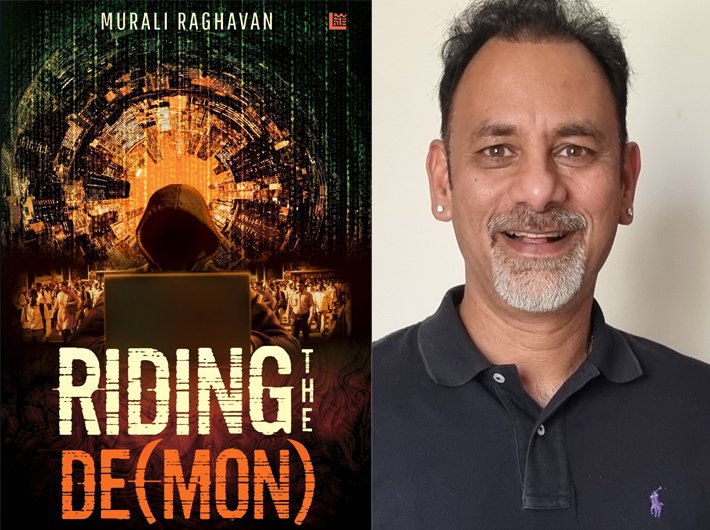

Murali Raghavan, author of ‘Riding the De(Mon)’, talks about demonestiation and his thriller about it

Murali Raghavan’s ‘Riding the De(Mon)’ (Leadstart Publishing) is a financial thriller that dives deep into money laundering in India, particularly the methods used by corrupt businessmen and politicians to funnel their ill-gotten gains into the banking system, post the surprise announcement of demonetisation.

A UAE-based chartered and cost accountant from India, Raghavan weaves a brilliant tale of big money and crime. ‘Riding the De(Mon)’ is a perfect pick for the fans of Paul Erdman and Ravi Subramanian.

The book comes via Script A Hit (www.scriptahit.com), a platform that helps people to turn ideas into books and scripts. “Script A Hit is proud to announce the release of its first book Riding the De(mon), a financial thriller. We plan to release at least five books this year based, selected from hundreds of ideas that we have received,” said Jaishankar Krishnamurthy, founder of Script A Hit, author and a finance professional.

Raghavan said, “Never in my dreams would I have pictured myself as an author. Back in 2016, we spent a lot of time debating the impact of demonetisation on the common man and challenging the hypothesis of the government around this topic. The discussions lingered and in year 2020, I simply decided to take that leap of faith and submitted a synopsis of the idea to www.scriptahit.com.

“The novel has been written after a lot of research about the methods used by people with ill- gotten wealth to deposit their black money with banks and the vulnerabilities around the data of cash deposits that exists even today. It is a must read for finance professionals and curious minds who are interested to understand if the Government made any real substantial gains from the surprise announcement.”

‘Riding the De(Mon)’ is the story of a presumably innocent banker, a religious leader accused of murder, a journalist who is after more than just the next big story and a plan to use demonetization to topple a government.

Young, smart, once with a promising career before him, Vikram is in jail in Chennai. He stands accused of defrauding over ten crore rupees from Bharat Bank, where he worked in the IT department. Though he insists on his innocence, the evidence is stacked against him, and Vikram appears doomed to spend the best years of his life in prison – unless he agrees to a strange request from a lawyer representing an anonymous client.

Trapped in jail with no possibility of release, Vikram agrees, only to fall back into the world of corporate espionage and government corruption and intrigues, a run on a bank, and murder.

Ashwini, an investigative financial reporter, tumbles upon methods used to circumvent the rules imposed by the Reserve Bank of India during India’s demonetization.

Vikram crosses paths with Ashwini in his quest to expose the web of corruption between people with mountains of money to hide and the unethical ways they invent to hide it.

But Ashwini’s true investigation is into the man known as “Guruji” – Vikram’s fellow inmate and possibly his only friend from his time in jail – whom she believes to be the cause of her sister’s death.

Can Vikram swim against these murky tides to secure his freedom – from jail and from his benevolent blackmailer’s clutches? Will Ashwini ever discover what really happened to her sister? And what is Guruji’s dark secret, that seems to hold the key to many mysteries?

Raghavan, who has been based in UAE for 29 years, is the co-founder of the company CFOSME, which enables SMEs to optimise their Cash From Operations with improved financial ecosystems. His experience with multinational companies in retail and wholesale distribution, IT, real estate and hotel development, risk management and insurance (financial advisor) gives him a wide range of skills and experience.

Here are his answers to some questions from Governance Now over email:

Demonitisation continues to be in conversations and arguments, what is your take on it?

The surprise announcement of demonetisation had a major impact on the parallel economy in India, which by some estimates equals the official one. While there was hardship that the country faced post announcement, the ubiquitous use of digital payment industry, which was a necessity at that time, has now become a norm. While initial arguments against the demonetisation that lead to crippling of the real estate sector and led to its contraction were valid, it is now becoming clearer that the benefits of almost universal adaptation of digital payments, which was a necessity, now far outweighs the initial pain the whole country went through. My personal opinion is that while the government did not get the intended benefits, India as a country will see the benefits of digital payments for a long time.

Why did you choose to write a thriller on corruption and demonitisation?

We were all shocked from the surprise announcement of demonetisation in November 2016. I used to debate amongst friends about the benefits to the government from this announcement with strong arguments from both sides. Initially there were estimates that the RBI would have windfall gain of Rs 4 lakh crore, as many corrupt people with a lot of black money in cash would risk losing the money than deposit it in their bank accounts and face the wrath of IT officials. However, when it was announced in late 2017 that over 99.6% of the notes had been deposited, I continued to contemplate about how the corrupt businessmen and politicians had got rid of their ill-gotten wealth. My mind returned to this idea again and again until I started to pen down notes around this topic.

I was looking for answers to two major questions: (1) How did the corrupt businessmen and politicians funnel their ill gotten wealth into the banking system post surprise announcement of demonetisation? (2) Can data of records of deposits made during the demonetisation period be analysed and used for black mail or for bringing down governments. I submitted a brief synopsis to www.scriptahit.com that helped develop the idea into a financial thriller. Most importantly, their research has helped answer major questions about money laundering pre-during and post demonetisation.

How do you perceive the current situation in terms of the effect of demonetisation on digitisation of monetary transactions?

As I mentioned earlier, India is one of the few countries that has become truly cashless and also mobile. As an NRI, I have travelled to several countries and I feel that the ease of transaction through digitalisation in India is spectacular and has reduced transaction costs. More importantly, it has helped the section of people who never had access to credit cards transact without fear.

You weave the story through Vikram, the central character who is a banker trying to expose corruption during demonetisation. How much of it comes from true life incidents and people? What research went into the book?

Once the idea was accepted, Script a Hit worked on the idea for several months and came up with a detailed synopsis. While the basic premise was from my idea, they had added several layers to the story and many new plotlines to create an unputdownable financial thriller. They used their own research team by speaking with CAs on the methods used by persons to route their wealth back into the system. Their team also spoke with IT banking security specialists to come up with a plausible way for the protagonist to hack into the banking system to download records. When I now read the book, it provides me with great insights about money laundering which was unknown to me as a finance professional.

The story is fully fictional and not based on an actual business person or politician.

There is also the involvement of a religious leader, accused of murder and at the centre of the entire inventions to hide heaps of money. What triggered this plot and influenced the character sketching?

The team from Script a Hit decided to add a few layers to the synopsis by introducing the character of a religious leader. I felt that it was quite realistic considering the number of religious leaders in the past and now and the powerful influence and wealth that many have managed to accumulate. Who does not like to read about the complex web of lies between a guru, politicians, women and a corrupt social organisation?