For the first time in India, a budget has worked towards bringing 454 million migrant workers within ambit of govt’s labour welfare schemes

The Union Budget 2021 is aimed at restoring growth in the aftermath of heavy economic losses suffered by the country due to Covid-19 pandemic by enhancing the investment ecosystem in the country, secretary (DPIIT) Dr. Guruprasad Mohapatra said on Friday.

Overall, Budget focuses on investment promotion, infrastructure development, leveraging private investments and encouraging social sector; thus creating a promising outlook for the future, he told media.

Mohapatra said the budgetary increase in capital expenditure from Rs 4.12 lakh crore in 2020-21 to Rs 5.54 lakh crore in 2021-22, an increase of 34%, will lead to multiplier effect on investment through various means, for instance by building connectivity infrastructure, spurring the demand for construction inputs and so on. This is expected to give a fillip to investment across related sectors.

He said that feeding into India’s vision of becoming ‘Atmanirbhar’ and a global manufacturing hub for investors, the budget launched PLI schemes for 13 sectors, with an outlay of Rs 1.97 lakh crore, for a period of five years starting from FY 2021-22. The scheme will be implemented by concerned ministries/ departments and will be within the overall financial limits prescribed.

Dr. Mahapatra said through the combination of PLI schemes and the customs duty revision, along with certain sector-specific announcements, the budget will unlock the domestic manufacturing potential across sectors, including renewable energy, heavy industry, agriculture, automotive, textiles and so on.

On the focus given to infrastructure sector in the budget, he said that the national infrastructure pipeline (NIP) covering 217 projects worth Rs 1.1 lakh crore has been expanded to 7,400 projects, which will collectively become a vital lever for economic revival and building long-term competencies. To make the financing of NIP sustainable, funding will be raised by creating the institutional structures; monetizing assets, and by enhancing the share of capital expenditure in central and state budgets. The government will also set up a Development Finance Institution (DFI) with an outlay of Rs 20,000 crore.

He said that there was an increased focus on the public-private partnership (PPP) model to drive efficiency and effectiveness in infrastructure development. Seven major ports projects worth Rs 2,000 crore were announced under the PPP mode, with transfer of operational service of ports to private players. Similarly, for urban transport, the PPP model will enable private players to finance, acquire, maintain, and operate over 20,000 buses. The budget also announced the June 2022 timeline for commissioning the Western Dedicated Freight Corridor (DFC) and the Eastern DFC.

The DPIIT secretary said that the heavy focus on infrastructure development in the budget is geared towards the crucial bottleneck in India’s growth story. It will bring down the logistics costs substantially for the Make-in-India strategy and will have multiplier impact across industries.

While speaking about the financing, he said that strengthening the country’s financial architecture and ensuring stable capital inflow was another dominant theme in this year’s budget. The public sector enterprise (PSE) policy aiming to divest BPCL, CONCOR, SCI, IDBI Bank among other public sector undertakings, aims to create new avenues for private investors. For infrastructure development, some conditions concerning prohibition on private funding, restriction on commercial activities, and direct investment in the infrastructure sector have also been relaxed.

He said that opening sectors to new channels of investments from domestic and international private investors, will resolve financing difficulties for a range of sectors including banking, insurance, infrastructure, aviation etc.

On the Ease of Doing Business, he said that the budget brought in inclusive measures to support small communities, businesses and workers who were specially impacted by the pandemic. The compliance requirement of small companies has been eased through revision of their definition under the Companies Act, 2013 by increasing their thresholds for paid-up capital from “not exceeding Rs 50 Lakh” to “not exceeding Rs 2 crore” and turnover from “not exceeding Rs 2 crore” to “not exceeding Rs 20 crore”.

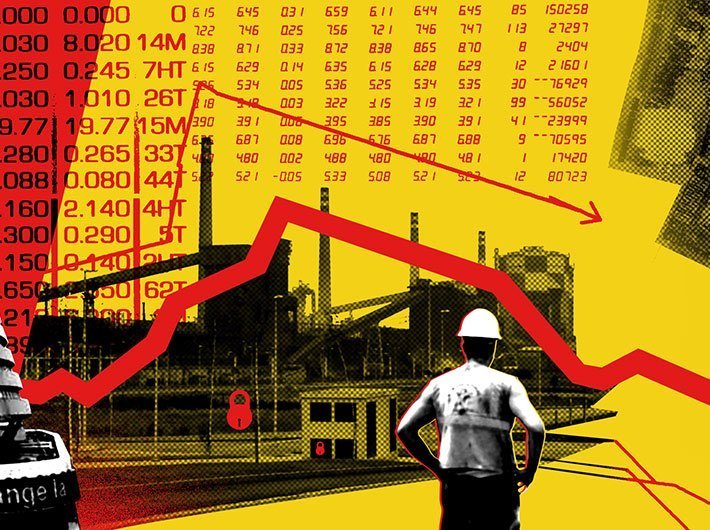

Mentioning about the labour welfare, he said that the budget announced the creation of a portal to collect information on unorganized labour force, migrant workers for better policy planning. Under the One Nation One Ration Card scheme, the beneficiaries would now be able to claim rations anywhere in the country. Additionally, the minimum wages and coverage under the Employees State Insurance Corporation have been extended to all categories of workers and social security benefit has now been made available to gig and platform workers as well.

He said that for the first time in India, a Union Budget has worked towards bringing India’s 454 million migrant workers within the ambit of government’s labour welfare schemes. The government has also recognized the need for safeguarding the interests of increasingly growing number of employees in the country’s gig economy.