A little modification in the system will ensure that the facility is availed by maximum number of people

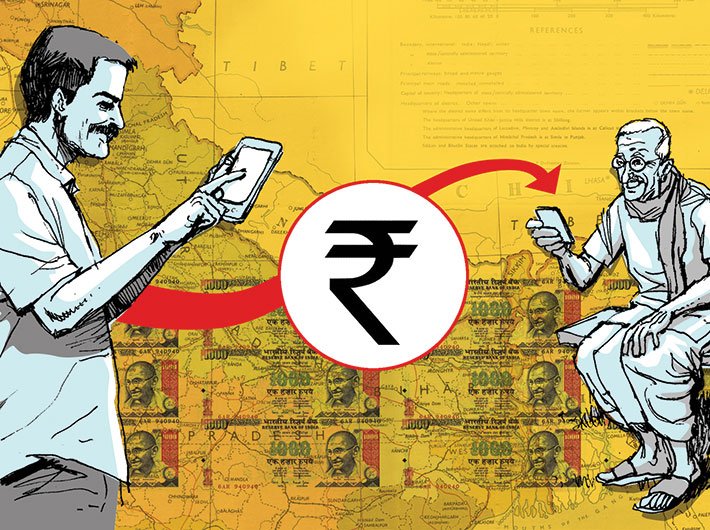

India has evolved many ways of money transfers, informal and formal. For Jeetandra Kumar, a cook at Mukherjee Nagar in north Delhi, sending money to his family in Katihar, Bihar was difficult but ‘secure’ in desi environment. His earning would reach his family through a friend working in the pantry of a train running till his hometown.

But now he no longer needs that favour. His younger brother, who lives with him and studies in Delhi University, transfers money back home through online payment. No hassles, no human intervention and no waiting.

Banking experience has changed for Jeetandra. But for a larger part of the population it still remains the same. There are over 900 million mobile users in the country. However, less than 5% or about 36 million are mobile banking customers. This clearly shows that mere presence of a facility does not ensure its usage. One of the reasons for this low level of mobile banking user base is because only 162 million use smartphones, which is required for mobile banking.

Smartphones and internet will need some time to reach the bigger chunk of the population.

However, a little modification in the system will ensure that the facility is availed by the maximum number of people. In this respect the concept of payments bank is a major step.

Mobile-wallet or m-wallet, a facility introduced in 2011, allows people to make banking transactions without using the internet. Applicants for payments banks include m-wallet service providers along with telecommunications companies and big business conglomerates.

Payments banks will allow people to avail same facilities as provided by the m-wallet system with some added benefits (see table for comparison). It will be ‘neighbourhood banks’ like neighbourhood kirana stores.

Financial inclusion was the main idea behind the pradhan mantri jan dhan yojana (PMJDY) launched in August last year. With more than 12 crore accounts and with almost 100 percent household coverage, PMJDY has made a major headway in eradicating financial untouchability.

Now with the guidelines for payments banks decided and application process concluded, financial inclusion might get a major fillip in the coming months.

The final guidelines on payments banks and small finance banks were announced on November 27, 2014. Following that, applications were invited, with February 2 being the last date. According to the Reserve Bank of India (RBI), 41 applications for payments banks have been received.

Two external advisory committees (EACs) will evaluate these applications, following which recommendations will be made to RBI. The EAC

for payments banks will be chaired by former RBI deputy governor Nachiket Mor.

Backdrop to payment banks

In the union budget 2014-15 presented on July 10, 2014, the finance minister stated that, “after making suitable changes to the current framework, a structure will be put in place for continuous authorisation of universal banks in the private sector in the current financial year”.

He added that RBI will create a framework for licensing small banks and other differentiated banks.

According to the finance minister, “differentiated banks serving niche interests, local area banks, payments banks, etc., are contemplated to meet credit and remittance needs of small businesses, unorganised sector, low income households, farmers and migrant work force.”

Further, a committee on comprehensive financial services for small businesses and low income households, under the chairmanship of Mor, examined the requirements of a payments bank. In its report released in January 2014, the committee stated, “given the difficulties faced by the pre-paid payment instruments (PPI) issuers and the underlying prudential concerns associated with this model, the existing and new PPI issuer applicants should instead be required to apply for a payments bank licence or become business correspondents (BCs).”

Following the finance minister’s assurance and the expert committee report and taking into account that there was a need for niche banking in India, and differentiated licensing could be a desirable step in this direction, RBI in November last year issued guidelines for payments banks, defining the nature and scope of these banks.

Role of the new entity

With more than 12 crore accounts opened under PMJDY and claims of 100 percent household coverage through public sector banks (PSBs), private banks, cooperative banks, and regional rural banks (RRBs), what will be the role of the newly conceptualised payments banks?

RBI states, “The objectives of setting up of payments banks will be to further financial inclusion by providing (i) small savings accounts and (ii) payments/remittance services to migrant labour workforce, low income households, small businesses, other unorganised sector entities and other users.”

Commenting on the role of the payments banks, a recent CRISIL report states, “We believe there is a strong business case for such banks in India because a sizeable portion of the country’s population remains outside the ambit of formal banking. Potential licensees would hope to capitalise on the synergies the payments bank business is likely to have with their existing businesses (exploiting already existing distribution network, providing a wider suite of services to customers, enhancing customer stickiness and brand recall, etc.).”

What differentiates payments banks from regular banks?

One feature of the payments banks that clearly differentiates them from commercial banks will be that the former will initially be restricted to maintaining a maximum balance of '1 lakh per individual customer. The other major difference would be that the payments banks would not undertake lending activities.

Similarities between payments banks and commercial banks

Payments banks, like other commercial banks involved in core banking function, will be allowed to issue ATM/debit cards. However, they will not be allowed to issue credit cards.

Big players to enter the business

Some of the biggest players from the corporate world are likely to enter the business. Reliance Industries, Aditya Birla Group, Future Group and Bharti Airtel are some of the big names that have applied for the licence to run payments banks. Microfinance giant SKS Microfinance and Vikram Akula-promoted Vaya Finserv are the other business entities that are vouching for the new business model.

India’s largest corporate house Reliance Industries and the country’s largest lender State Bank of India have also come together to establish a payments bank.

Safety valves

There are some legitimate concerns on the sustainability of payments banks, as they will not be allowed to issue credit which would earn them revenue through interest charged. But to ensure customers’ interest, RBI has ruled that apart from amounts maintained as cash reserve ratio (CRR) with the central bank on its outside demand and time liabilities, it will be required to invest minimum 75 percent of its “demand deposit balances” in statutory liquidity ratio (SLR), eligible government securities/treasury bills with a maturity up to one year and hold maximum 25 percent in current and time/fixed deposits with other scheduled commercial banks for operational purposes and liquidity management.

Payments banks and telecommunication

With phone banking getting a major thrust from the government, experts believe that the structure of payments banks will give a major boost to this sector.

A CRISIL report states, “We believe telecom operators are the ideal candidates to set these up, given their significant customer bases in rural areas and well-entrenched distribution networks. Moreover, they are already offering m-wallet services for remittances. The value of transactions through m-wallet has more than tripled in the last two years to over '27 billion in the last fiscal, indicating the huge business potential.

Setting up a payments bank also makes strategic sense for telecom operators as it would help them improve the ‘connect’ with customers, and also, over a period of time, obtain a greater share of their wallet.”

Together with mobile banking, payments banks could be a great source of real financial inclusion where people will be able to use facilities with minimum infrastructural support.

shishir@governancenow.com

(The article appears in the March 16-31, 2015, issue)