Under an MSIPS scheme Friday, foreign godzillas like Samsung and Bosch got a green light for massive investment subsidies. Two top experts worry that the electronics minister has laid an open invitation to tax dodges and over invoicing, ringing a death knell for small home-grown firms

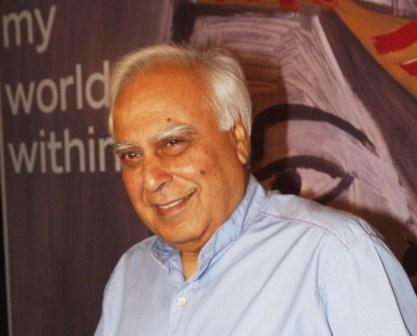

Even if you were a fan of Kapil Sibal or his poetry, it was a curious way for the electronics minister to be breaking a mega "investment" story.

A half-page (paid!) advert on Page 17 of The Economic Times (Delhi) platform Friday became the first medium for the world to know that India has approved the first round of sops under a modified special incentive package scheme (MSIPS) encompassing Rs 5,000 crore of investment.

Samsung, Robert Bosch GmbH, and a third company, Sahasra Electronics, the ET advert informed, would be the first three beneficiaries.

Only later in the day, electronics and telecommunication minister Kapil Sibal found time to brief newswire PTI, where he said more clearances will be announced in the coming days and that investments from Bosch and Samsung were only among the first set of Rs 3,300 crore proposals under National Policy on Electronics approved by him.

Rs 544 crore, PTI reported, is expected to come from Bosch Electronics in the automotive electronics segment, Rs 406 crore from Samsung Electronics for manufacturing of mobile phones in the country and Rs 11.1 crore from Indian firm Sahasra Electronics for manufacturing LED lights in Noida.

The agency also said investment proposals amounting to Rs 2,327 crore for setting three new electronics clusters-specific zone which will house entire eco-system required to develop electronic products, have also been approved.

Now, MSIPS implies 25 per cent capital subsidy and reimbursement of customs and excise from taxpayer money.

Over invoice the plant 4x (remember there’s no customs duty to worry about on a higher base) and Samsung or Bosch could be recovering 100 per cent of the actual cost from Sibal!

In a strong pushback, Steve Rogerson, CEO of the $9-billion Cheekotel Venture Fund cheekotel.com, the largest in South Asia, saw utter discrimination in Sibal (unwittingly?) killing competition between a local Joe and a Samsung operation in India, bankrolled by the war chest of the Head Office in Korea.

"Discretionary tax exemptions are a disaster for India,” Rogerson said via a blunt email.

“If the government wants to incentivize local production, taxation should be waived for everyone who manufactures locally,"

Added another glaring gap, Dr Rohinton Dehmubed, board member of Indian Institute of Technology (IIT) Angel Fund and an IIT Powai alumnus, "the country desperately needs key technologies. For that the government has to ensure high level of import substitution and local production of key components like semiconductors and displays,” none of which was seemingly evident in the first raft of proposals green lighted.

“All government resources should be used for import substitution or in key areas. Else the total dollar outflow on capital goods and components will far exceed the outflow on efficient imports of finished goods," Dehmubed said via email.

Sibal announced a National Policy on Electronics in October 2012 with a promise to create jobs and reduce trade gap by encouraging local manufacturing. He projects electronics imports will reach $400 billion a year by 2020, surpassing oil as India's costliest import.

Under the garb of good intent, his MSIPS thus offered several incentives, including returning up to a quarter of the money companies invest in building manufacturing facilities and reimburse federal taxes paid by them for 10 years.

Friday is just the beginning of the Santa’s largesse. “The Department of Electronics and Information Technology, which approves projects under the electronics-manufacturing policy, is expected to clear another 14 proposals in a month's time, “ the Wall Street Journal (WSJ) noted in a follow up story to the ET advert.

“India has already received proposals from global companies for investing about 41 billion rupees and the department expects at least $100 billion in foreign investments in electronics manufacturing by July 2016, the minister said. In the current fiscal year through March, it expects to clear proposals for 250 billion rupees,” WSJ reported.

That’s serious tax payer money up for grabs. But is it too much expecting ET to be saying that first?