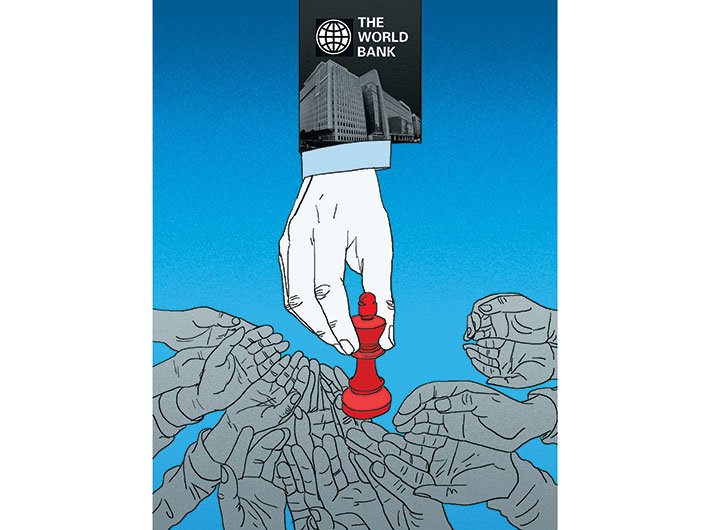

Why multilateral banks, which are full of benign intentions, must demand more from countries they help

End poverty – that’s the mission of the World Bank. Sounds noble. And poverty is indeed ending. Thanks to global and local efforts, poverty (individuals living at $1.9, or about '135, a day or less) as a percentage of the world population fell from 35.5% in 1990 to 10.9% in 2013, despite rising population. Today, so many multilateral banks are working hard to fast-track development, be it the old ones such as the World Bank and Asian Development Bank or the relatively new ones such as the New Development Bank and Asian Infrastructure Investment Bank. While the goals and efforts of all these multilateral banks are laudable, the question is, are they selling themselves short? I am not talking about the interest rates at which they offer loans for various projects in developing countries, but perhaps an underutilisation of the bargaining power they possess.

The benign approach

Before moving on to bargaining power, it is important to note that, as the World Bank says, “[It] works to end poverty in a number of ways – from funding projects that can have transformational impacts on communities, to collecting and analysing the critical data and evidence needed to target these programs to reach the poorest and most vulnerable, to helping governments create more inclusive, effective policies that can benefit entire populations and lay the groundwork for prosperity for future generations.” The focus here is on providing three things: a) finance or credit b) technical expertise and c) policy advice.

Other development banks have their missions and approaches on similar lines. For instance, the African Development Bank aims to achieve its objective of poverty reduction by “mobilizing and allocating resources for investment”, and “providing policy advice and technical assistance”. The common approach evident in almost all multilateral development finance institutions makes them appear more like normal banks with a good heart, or to frame it in another way, benign banks.

The boldness factor

Is a good heart and a pocket full of money enough to end poverty? Maybe, but I would argue that these two valuable assets can buy you a lot more than just economic wellbeing. As of today, multilateral development banks appear almost agnostic to the need for broader institution building in countries they operate in. Why not ask for more? I am talking about strengthening the rule of law and democratic values in institutions beyond the purview of projects funded by multilateral banks. Most projects that are funded through international development finance cover infrastructure, energy, education, etc.

However, rarely do multilateral banks ask recipient governments to improve governance in non-project related institutions such as police and municipalities that are critical to deliver good governance and maintain rule of law. After all, how good will the impact of a road project be if the municipalities are unable to provide high quality peripheral infrastructure in the long term? Whether power distribution is managed by private or public sector, why would people not engage in electricity theft if a corrupt police system doesn’t enforce the law?

Rule of law and good governance will not only improve the overall capacity of public institutions in recipient countries but reduce poverty as well. The UN declaration of the high-level meeting on rule of law clearly points out that poverty reduction and maintaining rule of law are directly proportional to each other. It states that, “Rule of law and development are strongly interrelated and mutually reinforcing, that the advancement of the rule of law at the national and international levels is essential for sustained and inclusive economic growth, sustainable development, the eradication of poverty and hunger and the full realization of all human rights and fundamental freedoms, including the right to development, all of which in turn reinforce the rule of law.”

Some critics of this tougher approach may point out a few potentially adverse consequences. a) Multilateral banks are supposed to provide credit for development projects, why should they worry about aspects beyond their projects? Well, the answer is simple. A project can’t deliver its full value until it gets an enabling environment. Better public institutions will not only create that environment but will also aid the banks to accomplish their mission faster. b) Many countries may consider it an attack on their sovereign right to govern and may end up boycotting multilateral banks, ultimately harming innocent citizens. Here too, the answer isn’t difficult. If multilateral banks clearly state the model institutional reforms that apply to all countries, I don’t see why a citizen-friendly government would not want them. For instance, if freedom of press (based on globally defined and accepted measurable metrics) is one institutional reform that banks put in their covenants, I wonder what will stop recipient countries from accepting it? Only dictatorial and authoritarian regimes would not accept such a condition. And that’s fine. In fact, diverting attention from such fundamental values is nothing short of feeding the monsters in countries with such regimes. If development projects gradually end poverty, as they have done in the past, then the outcome will be economically well-off and institutionally fragile countries. They may not be economically poor but may well be socially poor. And countries that are economically better-off and socially worse-off do not need financial credit, thereby diluting the leverage that multilateral banks possess now.

The ‘Now’ factor

Not only the time is right, I would extend this argument to suggest that multilateral banks are best suited to drive institution building in weaker countries. They don’t represent one country, or ideology. They have no national interests or non-global agendas and hence, can be more transparent. Indeed, the very fact that they are multilateral adds to their capability to influence countries to reform respective institutions. Here’s an example from the past. In 1991, when India embraced economic liberalisation, one of the triggers was IMF’s push for India to do so or be declared a defaulter. Now replace IMF with the US or Russia or China. I don’t think India would have been comfortable with one or two nations cajoling it to implement ‘so called’ neoliberal policies. That would have been an infringement of sovereignty. But India trusted the IMF’s intentions because it had advocated certain economic policies from the very beginning and because it did not run on the whims of select countries. While IMF has been doing a commendable job at guiding countries to frame sound macroeconomic policies, not much attention has been paid on governance of public institutions. The prime reason that such institutions aren’t directly targeted is because they don’t appear to have a direct and immediate consequences. If a country can’t pay back its loans, it runs the risk of being declared a defaulter and thus reciprocates to IMF’s help through tough but effective measures. But there is no immediate consequence if a country ignores corruption in appointments for key government positions. Thus, it is to incentivise countries to carry out important, but perhaps not too urgent, reforms that multilateral banks can and must use their financial power.

It is also interesting to note that multilateral banks do little or no business with bad countries. The World Bank’s website shows zero loans or credits to countries such as Libya, Iraq and North Korea. Now boycotting them may not be the best strategy. Engaging with them and slowly nudging them in the right direction may be far better an approach. Such an approach will not only help the unlucky citizens born in these countries but is also better suited to influence their leaders to move in the morally right direction.

We often underestimate our powers and overestimate our passions. Benign multilateral banks have adequately expressed their passion to make this world a better place, but rarely have they fully utilised the powers they possess to achieve that. There are huge moral, financial and opportunity costs if they don’t start now. Enough of being benign, multilateral banks need to start acting bold.

The writer is a Young Professional with the economic advisory council to the PM. The views expressed here are personal.

(The article appears in October 15, 2018 edition)