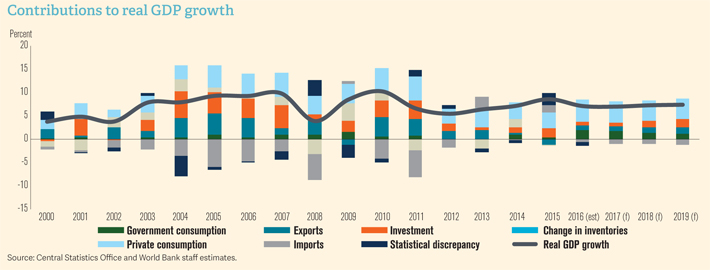

Return to business as usual and subsequent rebalancing of growth drivers towards investment could support acceleration of GDP growth to 7.4 percent by FY2019

Disruptions from demonetisation and events surrounding the implementation of GST led to a setback in economic activity and a potentially larger negative effect on the poor and vulnerable, said a World Bank report.

The International Monetary Fund’s World Economic Outlook too cited lingering impact of demonetisation and the Goods and Services Tax (GST) for the expected slow down in the economy. It said that India’s economic growth for 2017 and 2018 will be slower than earlier projections.

World Bank South Asia Economic Focus said: “Looking ahead, return to business as usual and subsequent rebalancing of growth drivers towards investment could support acceleration of GDP growth to 7.4 percent by FY2019. As in the past, sustained growth is expected to translate to continued poverty reduction, albeit with heightened uncertainty because of the effects on the informal economy.”

The report said that one-time policy events – disruptions from demonetization and uncertainty surrounding GST – slowed India’s economic momentum in FY2016.

“Real GDP growth slowed to 7.1 percent in FY2016, from 8 percent in FY15/16, and further to 5.7 percent in Q1 FY2017. On the one hand, public and private consumption gained pace: (i) after implementation of the 7th central pay commission recommendations; and (ii) due to the revival in rural demand after normal monsoon and agricultural impetus. On the other hand, overall demand slowed as public investments started to wane.

“Excluding agriculture, output growth experienced a slowdown decelerating to 6.9 percent in FY2016, from 9.4 percent in the previous year. Construction, real estate and manufacturing activity were particularly affected by both policy events. Manufacturing production decelerated sharply pre-GST as producers ran down inventories. Inflation remained in check and in alignment with weak global prices, slowing demand and moderate revisions in administered food prices,” the report said.

The South Asia Economic Focus went on to say that inflation has since moderated to an average 4.1 percent. External accounts remain robust. Export growth turned positive in FY2016, due to a reversal in commodity prices and improvements in global trade. Imports recovered and the merchandise trade deficit rose. Remittances have declined for two successive years due to unfavorable external factors.

The South Asia Economic Focus went on to say that inflation has since moderated to an average 4.1 percent. External accounts remain robust. Export growth turned positive in FY2016, due to a reversal in commodity prices and improvements in global trade. Imports recovered and the merchandise trade deficit rose. Remittances have declined for two successive years due to unfavorable external factors.

However, overall capital flows gained momentum, partly due an easing of FDI policies and increasing global investor’s appetite, and foreign reserves rose to USD 386 billion or 8.6 months of imports. The currency appreciated by 5 percent in 2017, also due to a weakening of the US dollar. Public finances remained stable, but contingent liabilities rose. The Centre stuck to its fiscal targets in FY2016, at 3.5 percent of GDP, reaffirming credibility.

“GST is expected to disrupt economic activity in early FY2018, but momentum to pick-up. Evidence suggests that post-GST manufacturing and services contracted sharply. However, activity is expected to stabilize within a quarter – maintaining the annual GDP growth at 7.0 percent in FY2018. Growth is projected to increase gradually to 7.4 percent by FY2020, underpinned by a recovery in private investments, which are expected to be crowded-in by the recent increase in public capex and an improvement in the investment climate (partly due to the passage of GST and Bankruptcy Code, and measures to attract FDI).”

The report said that inflation and external conditions are expected to remain stable. Two consecutive years of normal monsoon are expected to further stabilize prices and offset the increase in global oil prices. The rupee appreciated vis-à-vis the US Dollar and is expected to remain resilient. The current account deficit is expected to remain below 2 percent of GDP and fully financed by FDI inflows. Fiscal consolidation is expected to continue, driven more by the Centre.

The union government adopted a neutral fiscal policy stance in FY2017, where most of the consolidation is predicated on privatization receipts. The implementation of GST may provide an additional impetus to revenue collections in the medium term. States’ fiscal deficit could rise in the near-term due to increasing pressures from contingent liabilities.

The most substantial medium-term risks are associated with private investment recovery, which continues to face several domestic impediments such as corporate debt overhang, regulatory and policy challenges, along with the risk of an imminent increase in US interest rates.

The report warned that if the internal bottlenecks are not alleviated, subdued private investment would put downside pressures on India’s potential growth.