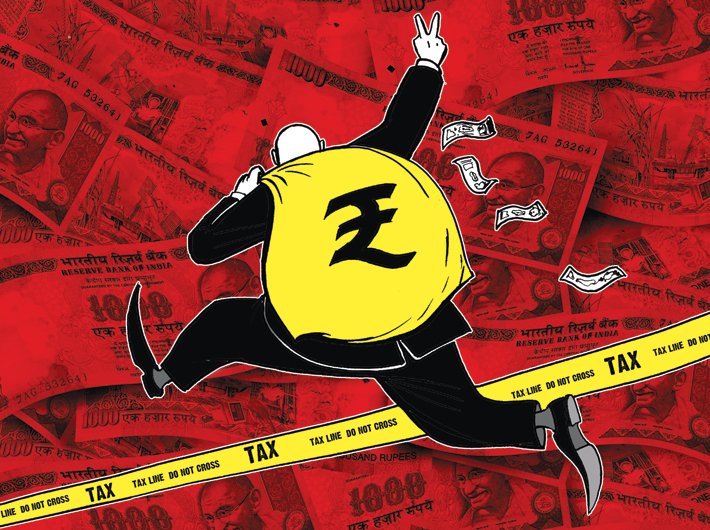

A report by Ambit Capital estimates India’s black economy to be around 20 percent of India’s GDP

GN Bureau | June 6, 2016

Fit In, Stand Out, Walk: Stories from a Pushed Away Hill By Shailini Sheth Amin Notion Press, Rs 399

The recent European Union (EU) policy on artificial intelligence (AI) will be a game-changer and likely to become the de-facto standard not only for the conduct of businesses but also for the way consumers think about AI tools. Governments across the globe have been grappling with the rapid rise of AI tool

The Indian Railways is celebrating 171 glorious years of its existence. Going back in time, the first train in India (and Asia) ran between Mumbai and Thane on April 16, 1853. It was flagged off from Boribunder (where CSMT stands today). As the years passed, the Great Indian Peninsula Railway which ran the

7 Chakras of Management: Wisdom from Indic Scriptures By Ashutosh Garg Rupa Publications, 282 pages, Rs 595

In a path-breaking initiative, the Election Commission of India (ECI), for the first time in a Lok Sabha Election, has provided the facility of home voting for the elderly and Persons with Disabilities in the 2024 Lok Sabha elections. Voters above 85 years of age and Persons with Disabilities (PwDs) with 4

Reason to Be Happy: Why logical thinking is the key to a better life By Kaushik Basu Torva/Transworld, 224 pages