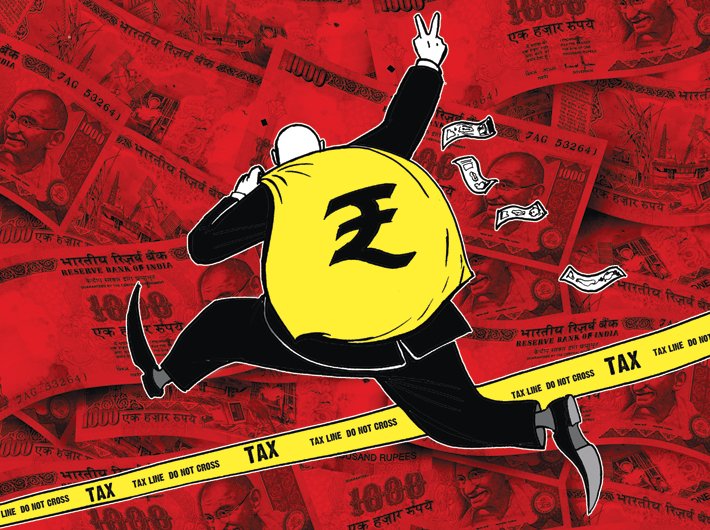

The Modi government’s latest move to ban Rs 500, 1,000 notes may help in eliminating black money. But a lot more needs to be done

Although I am not an expert on economy, I do understand that the latest step taken by the Narendra Modi-led NDA government has created a lot of noise and will play a significant role in combating black economy. This move, however, will alone not be enough.

The demonetisation of Rs 500 and Rs 1,000 currency notes can certainly prove to be a game-changer and can affect the Indian economy. But will it actually prove to be a big blow to the black economy, only time will tell. Let us first understand what black economy is, how it affects our economy and what really can be done about it.

Recalling a meeting with Arun Kumar, retired economics professor, JNU, who discussed at length about public consciousness and pressure that could create a political will to take stringent steps to destroy the black economy.

Kumar said that we have been losing 5 percent rate of growth since the mid-1970s. And had the black economy not grown, each one of us would have been seven times richer; our per capita income would have been higher. “We are missing out $13 trillion of development every year. The negative effect of black economy is huge. We have shortage of resources for education. We have never been able to spend more than 3 percent of GDP on education. On public health we spend less than 1 percent. All the social sectors and infrastructure are being affected.”

Kumar said that, unlike the West, the black economy in India is not parallel but is intertwined with the white economy. This is majorly because it is used for a lot of activities like buying a house, in the political process, and weddings which are dependent largely on unaccounted wealth.

This could probably be another surgical strike by the government on the black economy but if banning high denomination currency notes could curb black economy, we would not have been facing the problem in 2016. The Morarji Desai government did it in 1978.

A few months ago the government attempted to combat the underground economy with the Income Declaration Scheme (IDS), which ended on September 30. It was not an amnesty scheme but the central board of direct taxes (CBDT) put a total tax of 45 percent including 30 percent tax, 7.5 percent penalty fee and 7.5 percent surcharge. Prof Kumar said that the income generation schemes were unfair for an honest person.

Although, he estimated, all the sectors are generating black income. The bulk of it is coming from the service sector, which is 62 percent of the GDP. It includes all kinds of services like transportation, hotels, restaurants, finance, entertainment business and other business services, and professionals like lawyers, doctors, CAs. “People do not disclose their actual income; even teachers who take tuitions are not showing that as their income. We do not talk about judicial corruption, but there is massive corruption there. At 60 percent of the GDP, the black economy is systematic and systemic. So therefore it is a political matter rather than a technical one.”

The move by the government will certainly have some impact on the black economy but a lot still needs to be done. Over the years, tax rates and controls have come down but the black income generation has only increased.

“Lakhs of Indians have money abroad and hardly Rs 4,000 crore has been declared, which is peanuts. The important point is not the scheme but its implementation. If I have my money abroad and I know that the government cannot tackle me, then why would I bring it back? Unless you ensure people are caught hold of, it does not matter how many schemes you announce. Politicians are a party to the whole system and even their own money is involved. And to do this they involve the bureaucracy.”

But Prof Arun Kumar had told me that without the political will, which also means that the public has to be conscious, not much can be achieved. For example, he had said, if people do not put pressure on the government, nothing will be done. During Anna Hazare’s movement a lot of public pressure was generated. That forced the government to bring in the Lokpal bill. He said, “Honesty is not personal but social and collective.”

He further talked about how, in history, pressure generated through public movements has created huge impact on political will. And that the government needs to start nabbing wrongdoers at the very beginning but it does not want to affect the business environment. Thus, he added, the government is confused by its own rhetoric. That philosophy has to be changed and the environment should be made easy for the honest and very difficult for the dishonest, he said.

While Prof Kumar agreed that something is being done by the government like the Income Declaration Scheme, but a law is a law on paper, in letter and spirit.

In a country with a population of over 125 crore, only 1.5 lakh people have taxable income of over Rs 50 lakh. While people are dissatisfied and there is a sense of social injustice, situation can be changed, says Kumar.