Can the national policy push electronics manufacturing in India? No, says the industry which is trying to cope with anomalies that are pulling investments down

Pratap Vikram Singh | January 10, 2014

To attract investments in hilly states of Uttarakhand and Himachal Pradesh, the central government announced a package in 2003 with 100 percent exemption for 10 years in excise and income tax. The package also included subsidy for 15 percent of the capital investment in setting up plant and procurement of machines. The government requested a few corporate groups such as Hewlett Packard (HP) and Tata Motors to set up their manufacturing plants promising lucrative incentives.

Industry demands

HP, which came to India in 2004, was already running two plants at that time in Hyderabad and in Bangalore. The US-based IT major merged the plants and relocated them to Uttarakhand in 2007. The new plant, set up in Pantnagar, has a capacity of producing three lakh laptops a month. HP claims it is the largest of its kind in Asia. Compared to plants which manufacture a maximum of 30,000 machines a month, it indeed is.

However, there was an erosion of benefits within three years of setting up the plant. First, since the hilly state doesn’t have a good network of roads, the company faced a two percent logistical disadvantage. Secondly, in the 2010 union budget the government raised import duty on seven components, taking away the much touted competitive advantage. This created an inversion in the manufacturing sector—increasing the production cost vis-à-vis to the price of the imported finished product.

“The more we manufacture the more we suffer,” a senior official with HP told Governance Now. The company soon wrote to the ministries of communications and IT, commerce and industries and finance and to the prime minister’s office (PMO), apprising them of its plan to shut down and pull out of India in case the issues are not resolved.

FAQs: Electronics system design and manufacturing

What is wrong with electronics manufacturing and why do we import over 70 percent of IT and electronics products?

There are very few domestic players in electronics sector. Most of the raw materials and components are imported from China and Taiwan. After the economy was opened in 1991 and duties on wide range of IT products were made zero as India became a signatory to the IT Agreement (ITA) in 1997, several local manufacturers closed down their plants in lack of supportive tax and duty structure and infrastructural facilities. The manufacturers have become traders.

What is wrong in importing?

A committee headed by HCL co-founder Ajay Chaudhary came up with alarming figures. By 2020 the domestic demand would be $300 billion. If this demand is not met by local manufacturing, a substantial part of this will have to be imported, resulting in huge current account deficit. Besides, if India doesn’t catch up, electronics will be a lost opportunity in terms of providing a thrust to economy, generation of employment and IPR.

What is information technology agreement (ITA) – list 1?

According to WTO, the ITA is solely a tariff cutting mechanism. There are three basic principles that one must abide by to become an ITA participant: (i) all products listed in the Declaration must be covered, (ii) all must be reduced to a zero tariff level, and (iii) all other duties and charges (ODCs) must be bound at zero.

What is the impact of free trade agreements (FTA) on local manufacturing?

While an FTA is signed, the countries import (selected items) on zero duty. If a country doesn’t have a friendly environment for manufacturing, zero duty makes things worse and kills the industry.

What is the policy on electronics?

National Policy on Electronics (NPE) 2012 promises sops to new investments. It envisions creation of a globally competitive electronics system design and manufacturing to meet the country’s need and serve international market.

What do industry associations say about NPE?

They say existing investment too needs to be supported by the government.

What are NPE goals for 2020?

• Attract investment of $100 billion

• Reach a turnover of $400 billion

• Create 28 million jobs

• Enhance exports from $8 billion to $80 billion

• Grow chip design/embedded software industry to $ 55billion

• 2,500 PhDs annually

What is a preferential market access (PMA)?

The PMA provision under NPE ensures that in all government procurement of IT and electronics, a certain percentage of the needs have to be procured from the domestic manufacturer.

What is Modified Special Incentive Package (M-SIPS)?

Under M-SIPS government will take care of the 25 percent of the total capital expenditure incurred by new investors.

What is national electronics mission?

National electronics mission will be set up by the government with industry participation to create institutional mechanism to advance the implementation of various programmes aimed at achieving objectives enumerated in the policy and promote India as hardware manufacturing hub. This is yet to be set up by the government.

What is the electronic development fund?

It is the '10,000 crore fund structured to promote innovation, IP, R&D, and commercialisation of products etc in the ESDM, nano-electronics and IT sectors, including mobile applications by providing appropriate funding/incentives to industry, academic and R&D institutions. The funding will be provided to daughter funds for various innovation and manufacturing stages. This is yet to materialise.

Fearing that the decision of HP to pull out might tarnish India’s image as an investment destination, the PMO pursued the case with the company’s top brass. In February 2011, HP’s CEO Leo Apotheker, who was clear that things were not working out in India, visited the PMO. The prime minister, says a highly placed source in the industry aware of the discussion at the meeting, assured Apotheker that the “duty structure will be reversed”. In fact, according to sources, the PMO gave the assurance in writing to the company. (However, the document couldn’t be accessed by Governance Now.)

Unkept promises

Two years have passed, however, nothing has moved forward, says the source. HP, through its six sister concerns acquired in Uttrakhand, employs over 76,000 people in India—the highest anywhere outside the US.

Dell, another US-based IT major, has a plant in Tamil Nadu with an annual capacity of four million desktops and laptops. However, the actual production at the plant is 1.6 million. While signing the MoU (in 2007), the state government had promised relaxation in VAT, which is five percent, and it honoured the same for initial three years. Nevertheless, in the last three years, the government is yet to reimburse the VAT.

As VAT was initially relaxed, Dell had a competitive advantage. It opted for lower pricing. However, since there have been no reimbursements, the company has been forced to increasing the prices of its computers and laptops.

HP and Dell are not aberrations. The two are global IT majors which have investments to the tune of hundreds of crore in electronics manufacturing. One can well imagine the plight of small- and medium-size electronics manufacturers in the country. The policies and tax and duty structures are such that it is cheaper to import and trade than to manufacture and sell in domestic market [see interview with Ajay Kumar, joint secretary (electronics), DeitY].

As per estimates, by 2020 the domestic demand for electronics products in India will be $300 billion, exceeding the oil imports bill and increasing the current account deficit. Chips and sensors have made inroads into several sectors whether it is consumer electronics, home appliances, automotive and health or industrial plants for remote access and management. Moreover, electronics sector not only has a direct impact on the country’s trade deficit but also on security, as it plays a major role in critical sectors like defence, avionics and telecom.

Electronic hardware imports can hurt current account deficit badly

A few decades ago, India and China were on par in electronics manufacturing. “We started much before China. In the late 1950s and early 1960s, India decided to go for large scale industrialisation. Developing electronics was an urgent requirement from strategic, space research and industrial perspectives. The development, though, was government-led, driven by Bharat Electronics Ltd,” says V Niju, director (automation & electronics), Frost & Sullivan.

Around the 1980s, like Semiconductors Complex Ltd, several states set up their own electronics development corporations. However, as economy opened in 1991, and imports became relatively cost effective, most of these agencies became hardware procurement agencies. They shifted their focus to software and system integration.

The Indian manufacturing industry, which already lacked in components manufacturing, was thrown open to competition from East Asian countries with much more advanced manufacturing sector with the signing of ITA-1. The subsequent changes made in the duty structure not only made the whole process complex but also tilted it in the favour of imports. There is a two percent inversion in most of the components. “This has killed the local manufacturing industry,” a senior official with DeitY says.

The interest was renewed after the (HCL co-founder) Ajai Chowdhry led committee on electronics estimated the size of the domestic market by 2020 $300 billion. This created a sensation in policy circles, anticipating a steep rise in current account deficit.

Local disabilities

At present the local IT hardware manufacturing industry is in a dilapidated state, says JV Ramamurthy, COO and president, HCL Infosystems. “Many units have closed down or scaled down their operations despite the surge in demand for IT hardware in India. Electronics imports have emerged to be the third highest imports and IT hardware constitute substantial portion of it,” says Ramamurthy.

Unfortunately, the existing tax regime is trading (hence, import) friendly, leading to immense disabilities for the Indian manufacturer. In fact, many manufacturers have resorted to trading in order to survive, he says.

In November HCL Infosystems closed down its major manufacturing facility, though Ramamurthy clarifies that this is in accordance to the gradual shift in products manufacturing moving to original design manufacturers (ODM) who do the job on behalf of the original equipment manufacturers (OEM, for example HCL) globally. In several industry conferences in the past, however, Ramamurthy has been vocal about the losses incurred by company’s manufacturing plants due to the logistical and other disabilities.

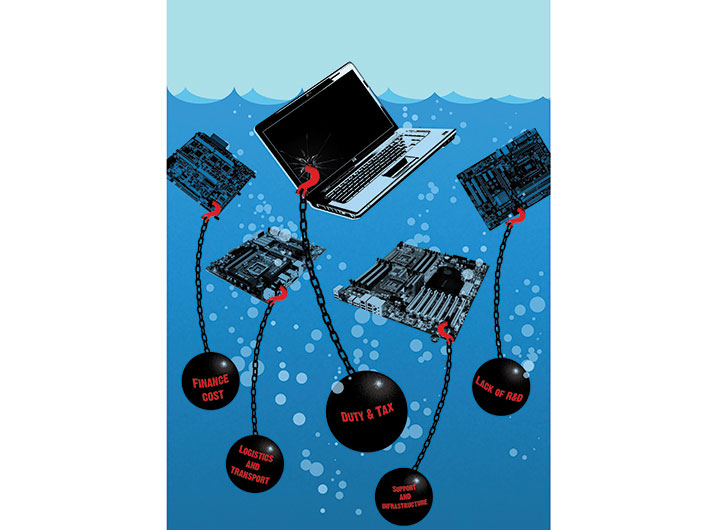

According to a Confederation of Indian Industry (CII) study on local electronics manufacturing, the sector faces eight to 10 percent of disability, vis-à-vis East Asian countries like China, Taiwan and South Korea. The eight percent disability in domestic manufacturing of goods for meeting domestic consumption—unlike export units wherein the plants are located in SEZ or other manufacturing zones and enjoy better facilities and zero duties—has been calculated keeping in mind three factors.

“First is cost of finance. The second major disability is the supply of continuous power and last is the logistics which includes transportation and time taken in the clearance at the ports,” a CII official told Governance Now.

While one can borrow capital overseas at essentially London Interbank Offered Rate (Libor) plus/minus one to two percent, cost of capital in India is between 14 to 16 percent, says PVG Menon, president of Indian Electronics and Semiconductor Association (IESA). “Many financial institutions are also reluctant to give capital to the electronics sector, especially to the SME sector. Finally the risk or venture capital is almost non-existent for this sector, and this is seriously hampering the growth of start-ups in the ESDM sector,” he added.

Logistics in India is anyway a major challenge for businesses. The time taken for ferrying goods from a port in southern India, for example Chennai, to a western or northern part of the country is much higher than the time taken to ferry the same from Taiwan to the port, says an industry expert.

Tax tyranny

Complex tax and inverted duty structure, in addition, has killed the will for local manufacturing, say government and industry personnel. As a highly placed source in the department of electronics and IT (DeitY) says, “They ask which industry has a problem with the tax structure? True, there is no industry complaining because there is no industry. Everything is dead. They have killed them all.”

A trader has to pay countervailing duty (CVD, in lieu of excise duty paid by manufacturers) on the imported price not the price he sells in the market. In contrast when a manufacturer pays excise duty he pays it on the final sale price that includes the value addition and profit margin, says Nitin Kunkolienkar, the legal head of Manufacturers’ Association of Information Technology (MAIT). The manufacturers also pay a cess of 0.36 percent on excise duty. Traders, however, are exempted.

CASE STUDY

Taxing the light out of solar lanterns

Tax structure for electronics manufacturing sector disincentivises indigenous R&D and production

Shivangi Narayan

Solar lamps are costlier to manufacture in India than in China due to a duty structure that, ironically, encourages India to import such lamps. “I manufacture a finished ECCO lamp for '620. However, I am able to import the same for as low as '550 from China,” said ECCO Chairman, Satish Jha. “As a manufacturer, I am paying '70 as penalty for producing the lantern in India.”

ECCO solar lantern also works as a mobile charger and has been specifically designed keeping in mind the conditions of electricity supply prevalent in India.

“The lantern can be charged with a supply voltage of 90 V to 220 V owing to the fluctuating voltage supply in India,” said Jha. “At its lowest setting, it can be run for 250 hours on a single charge and can be used in five different ways, including as a flashlight, cycle-light and table lamp.”

All the components are Indian, except for some, such as solar cells, which have been imported from China. All these components are assembled in India and manufactured into a single lamp. No import duty is levied on the imported products. However, a whole list of taxes including VAT, GST is levied on the finished lamp. Many of these taxes are transferred to the consumer, making their product expensive and uncompetitive in the market.

For imported products, apart from the import duty, which is zero, a service added duty (SAD) is paid by the importer, which is offset with VAT, which is paid by the consumer.

Thus, the resulting product is either cheaper or of the same price as the domestically manufactured or assembled product. The situation does not give any incentive for the domestic electronics manufacturing sector.

Then there is a four percent special additional duty, SAD (literally, it is!) which manufacturers pay on components that are used for manufacturing IT products, which when imported will come at zero duty. “This is a tax and duty regime which benefits China,” says Kunkolienkar.

The zero-duty regime was introduced in 1997 when India became signatory to Information Technology Agreement (ITA) list 1 which covers most of the products in IT. “With the signing of ITA-1 agreement customs duty on 217 items were brought to zero over a seven year time frame of 1998-2005,” said the CII official.

While ITA is appreciated for increasing the accessibility of computing devices, the agreement, along with the inverted duty structure, caused an irreparable damage to India’s local manufacturing industry.

Entertainment blues

It is not just the IT sector that has suffered because of the inverted tax structure. Hardware manufacturers in the broadcast sector too had to pay a heavy price. A case in the point is that of the set-top boxes (STBs), where the disadvantage is too high in manufacturing it locally. The digitisation drive in the broadcast sector created a requirement for 110 million STBs by 2014-15 and 200 million if one also counts the DTH STBs. However, most boxes will have to be imported, fear industry experts, as a locally manufactured STB is at a 14 percent disadvantage against the imported boxes.

“STB is a unique situation where there is a huge disadvantage of 12 to 15 percent alone because of VAT. The higher the VAT the more is the disadvantage,” says Ajay Kumar, joint secretary (electronics), DeitY. That is why none of the service providers sell STB to customers. Instead they give it on lease, thereby escaping the VAT. “Most service providers are not selling STBs. They provide you STB and charge you as a fee (monthly) on which service tax is paid that comes out to be much lesser,” he added.

A similar situation prevailed in late 1990s in respect to telecom equipment. The equipment manufacturers faced a similar inverted duty structure. On industry request, the government brought about an amendment through which telecom equipments were exempted from the net of form C.

“The government has indicated that it wants to do something similar to exempt STBs from the high duty structure, but nothing substantial has been done so far,” says Atul Lall, CEO, Dixon, the company that manufactures STBs. Another major disability is the cost of finance. As of now the STBs are mostly being imported from South Korea and China, where the EXIM banks are providing long term loans on Libor rates.

There is still more to it. The suppliers in East Asian countries also offer financing—an aggressive approach to lure buyers. This enables the buyers to pick up an order by paying only 20 percent down payment while the rest can be paid over a period of time.

Out of 110 million STBs that the country needs, industry experts say, some 30 to 40 million STBs have been imported. The remaining, 70 million boxes, valuing '12,000 crore, will have to be imported, if corrective steps are not taken on time. “In the electronics and hardware industry the margins are going down. The scenario doesn’t allow companies to be competitive with the existing 8 to 14 percent disability,” said Lall.

Given that 2014 is going to be an election year and assuming that STB will be a non-issue for the new government for the initial quarter, local manufacturing of STB seems to be a lost opportunity.

According to a CII study on local electronics manufacturing, the sector faces eight to 10 percent of disability, vis-à-vis East Asian countries like China, Taiwan and South Korea. The disabilities include

cost of finance, supply of continuous power and logistics.

Industry experts also point out that even those items which were not part of ITA-1 were made zero duty when the overzealous commerce ministry signed free trade agreements with several countries. “It’s like shooting first at one foot and then at another,” quipped a senior DeitY official on condition of anonymity.

Manufacturers Association for Information Technology and CII are demanding physical export status and extending all benefits of export schemes to domestic tariff area (DTA) sales of ITA list 1 products (zero duty), as stated under para 2.1(b) of the NPE 2012.

Industry experts also point out that even those items which were not part of ITA-1 were made zero duty when the overzealous commerce ministry signed free trade agreements with several countries. “The products which were not covered under ITA—especially consumer and medical electronics—were also brought under zero duty structure under FTAs (free trade agreements). It’s like shooting first at one foot and then at another,” quipped a senior DeitY official on condition of anonymity.

In consumer electronics, the situation is no different. India doesn’t have a single player which manufactures LCD screens, which requires investments of billions of dollars. According to industry experts, even bigger corporate houses like Reliance Industries initially thought of putting money into making the flat panels. However, they soon cancelled their plans, knowing the risks involved in manufacturing.

Component makers such as Samtel, which was into manufacturing tube display and enjoyed a market share of 60 percent, stopped its manufacturing a few years back. The company had invested in setting up a plasma manufacturing facility but couldn’t go long. Now Samtel has moved from display, which is high-volume low-value business, to defence and avionics which is a high value and knowledge intensive sector.

At present almost two-thirds of electronic hardware are being imported, said the CII official. The increasing dependence on imports—mainly from East Asian countries like China and Taiwan—has set the government in motion.

NPE 2012: A panacea?

The National Policy on Electronics, NPE 2012, which for the first time defines the vision of the government for building local manufacturing capability, was a result of the renewed interest in the sector. Nevertheless, the policy doesn’t strengthen the existing investments in the sector, though it provides for incentivising new investments.

The new policy provides for modified special incentive package scheme (M-SIPS) wherein the government will take care of the 25 percent of the total capital expenditure incurred by new investors.

Nevertheless, to increase the local value addition, which is at present between five to 10 percent as stated in the NEP preamble, it is equally important to compensate the existing manufacturers for the 10 percent disability and the inverted duty structure.

The industry associations such as MAIT and CII, through several presentations to the government, have been demanding the following things from the government to strengthen the existing investments and create a positive environment for the future investments.

Both are demanding for giving physical export status and extending all benefits of export schemes to domestic tariff area (DTA) sales of ITA–1 products (zero duty), as stated under para 2.1(b) of NPE 2012. Under the zero-duty regime, if this is done, the manufacturers will be able take benefit of duty drawback enabling them to avail the exemption of duty on components that are imported for making products.

It will also enable them to avail the duty credit scripts—the 2 to 5 percent of credit which the manufacturer gets after selling the goods into the market as in the case of exports. The duty drawback and duty credit scripts combined will compensate for six percent of disability, the CII official said.

The incentive, under para 2.1(b) of NPE 2012, could be extended, in two ways, says a CII communication sent to the government. Either it could be done by establishing parity with trans-border exports or it could be through providing incentive based on payment of excise duty—and in turn promoting local value addition.

“The existing tax regime is trading (hence, import) friendly, leading to immense disabilities to the Indian manufacturer. In fact, many manufacturers have resorted to trading, to survive.”

“The existing tax regime is trading (hence, import) friendly, leading to immense disabilities to the Indian manufacturer. In fact, many manufacturers have resorted to trading, to survive.”

JV Ramamurthy

COO and president, HCL Infosystems

“STB is a unique situation where there is a huge disadvantage of 12 to 15 percent alone because of VAT. The higher the VAT the more is the disadvantage.”

“STB is a unique situation where there is a huge disadvantage of 12 to 15 percent alone because of VAT. The higher the VAT the more is the disadvantage.”

Ajay Kumar

Joint secretary (electronics), DeitY

![]() “Many financial institutions are reluctant to give capital to the electronics sector, especially to the SMEs. The risk or venture capital is almost non-existent, and this is seriously hampering the growth of start-ups.”

“Many financial institutions are reluctant to give capital to the electronics sector, especially to the SMEs. The risk or venture capital is almost non-existent, and this is seriously hampering the growth of start-ups.”

PVG Menon, president, IESA

“The raw materials required for manufacturing of finished IT product should be kept at the zero-duty level to make locally manufactured IT products more competitive.”

“The raw materials required for manufacturing of finished IT product should be kept at the zero-duty level to make locally manufactured IT products more competitive.”

Nitin Kunkolienkar, legal head, MAIT

The ‘physical export status’ is yet to be notified by the government and is at present under the consideration of the finance ministry. Industry associations CII and MAIT are also demanding that the SAD should be either removed from import of components or it should be cut down to half.

“The raw materials required for manufacturing of finished IT product should be kept at the zero-duty level to encourage local manufacturing and also for making locally manufactured IT products more competitive,” says Kunkolienkar of MAIT. The trade body has also demanded that government should levy basic customs duty of 10 percent on all IT products which don’t feature under the ITA–I list.

The government should also remove the negativity around manufacturing of emerging products like STBs, tablets and LED lightings, said the CII official.

Associations are also demanding for implementation of the Preferential Market Access (PMA) policy, under which all central government bodies will procure IT products having at least 30 percent value addition in the country, across states and union territories. According to Kumar of DeitY, the department will soon take up the issue with states. In a recent CII meet on ICT & electronics (ICTE) in the capital, a senior official from Samsung told the industry gathering that his company doesn’t even do the packaging of S3 and S4 mobile handsets in India!

R&D and fabs

While everyone agrees that for a strong electronic manufacturing base the country needs to strengthen its R&D infrastructure, experts suggest that the time has come for the government to incentivise local research and development and innovations in product development. No wonder the government decided to set up a '10,000 crore electronic development fund, proposed under NEP 2012, aimed at promoting creation of intellectual property in electronics. Unfortunately, the same is at present stuck at the level of the planning commission and is yet to see the light of the day.

In the past, R&D in electronics and semiconductors was hardly a priority for the government, also because the per capita electronics consumption itself was not considerable, says Dr MJ Zarabi, member of the Empowered Committee for setting up Semiconductor Wafer Fabs, approved by the cabinet in 2011.

In the late 1970s the government mooted the idea of setting up a plant for chip-making to cater to the critical needs of the strategic sector including defence and space. The government set up Semiconductor Complex Limited (SCL), as a public sector undertaking, in Mohali in 1983. Dr Zarabi has headed SCL in the past.

SCL was registered into a society—Semi-Conductor Laboratory—in 2005 and is now under the department of space. “The main objective of SCL is to undertake, aid, promote, guide and co-ordinate research and development in the field of semiconductor technology, micro electro mechanical systems and process technologies relating to semiconductor processing,” says SCL’s website.

In 2007 the government did come up with a special incentive package which offered 25 percent subsidy to chip manufacturers. The government pursued Intel Corporation, but the chip giant eventually set up a plant in China, owing to better infrastructure and investor-friendly policies there.

After NPE 2012, the government is now offering 40 percent of capital expenditure in setting up of fabs. The government has given in-principle approval to two fabs being set up by consortiums led by Jaypee Associates and Hindustan Semiconductors. DeitY also received two more applications recently, after it extended the initial deadline to November 25. However, the department officials are not sure whether the proposals would qualify. A final announcement on fabs is expected in the coming days.

The chips that will be manufactured out of these fabs will be 90nm node—a technology which came in 2004-05. By the time manufacturing begins in these two fabs, the technology would have advanced to 14nm and 10nm nodes, and hence, say critics, fabs will not make a big difference.

But then let fabs come first, says V Niju, director (automation and electronics), Frost & Sullivan, a consultancy firm. “Either for 90nm, 45nm, 30nm or 22nm, I am sure people who are investing should have thought about the technology change in the next five years,” says Niju. Jaypee Associates and Hindustan Semiconductors Limited were not available for comments.

Unlike the software sector, which requires highly-skilled manpower, the electronics system design and manufacturing requires a mix of semi-skilled and highly skilled manpower in large numbers. According to the new manufacturing policy, the share of manufacturing in GDP has to be increased to 25 percent by 2025 as against the present 16 percent. It also talks about creation of employment opportunities for over five lakh people on an annual basis.

More important, however, is the fact that time has come for the government to now ensure a favourable environment for manufacturers and help the country grab the much required manufacturing opportunity without any further delay. It’s better late than never.

Fit In, Stand Out, Walk: Stories from a Pushed Away Hill By Shailini Sheth Amin Notion Press, Rs 399

The recent European Union (EU) policy on artificial intelligence (AI) will be a game-changer and likely to become the de-facto standard not only for the conduct of businesses but also for the way consumers think about AI tools. Governments across the globe have been grappling with the rapid rise of AI tool

The Indian Railways is celebrating 171 glorious years of its existence. Going back in time, the first train in India (and Asia) ran between Mumbai and Thane on April 16, 1853. It was flagged off from Boribunder (where CSMT stands today). As the years passed, the Great Indian Peninsula Railway which ran the

7 Chakras of Management: Wisdom from Indic Scriptures By Ashutosh Garg Rupa Publications, 282 pages, Rs 595

In a path-breaking initiative, the Election Commission of India (ECI), for the first time in a Lok Sabha Election, has provided the facility of home voting for the elderly and Persons with Disabilities in the 2024 Lok Sabha elections. Voters above 85 years of age and Persons with Disabilities (PwDs) with 4

Reason to Be Happy: Why logical thinking is the key to a better life By Kaushik Basu Torva/Transworld, 224 pages