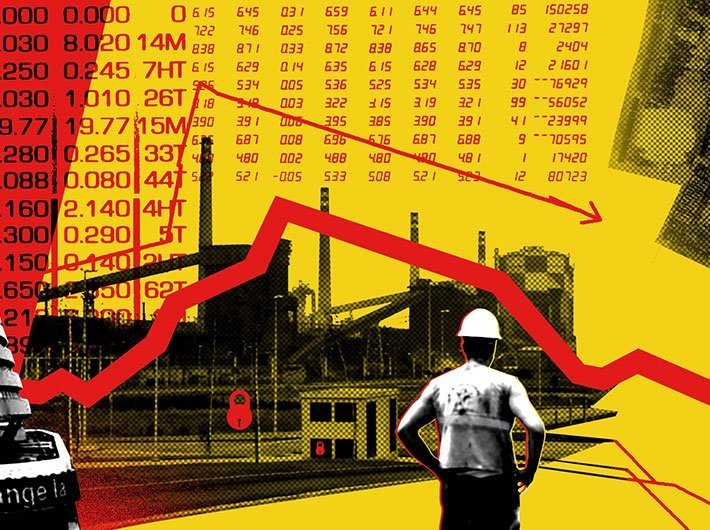

Fitch expects world GDP to grow by 1.4% in 2023, US 2023 growth forecast also lowered to 0.2%

World GDP forecasts for 2023 have been revised down again as central banks intensify their fight against inflation and the outlook for China’s property market deteriorates, says Fitch Ratings in its latest Global Economic Outlook (GEO) report.

Fitch now expects world GDP to grow by 1.4% in 2023, revised down from 1.7% in the September 2022 GEO. Fitch has lowered its forecast for US 2023 growth to 0.2%, from 0.5%, as the pace of monetary policy tightening increases, it said in a release Monday.

The Report: Global Economic Outlook – December 2022: https://www.fitchratings.com/research/sovereigns/global-economic-outlook-december-2022-05-12-2022

(For India, see page 23)

Fitch has also cut our China 2023 growth forecast to 4.1%, from 4.5%, as prospects for a recovery in housebuilding fade. China’s 2022 growth forecast remains at 2.8% as the surge in Covid-19 cases weighs on activity in the near term.

It has revised upwards eurozone 2023 growth slightly to 0.2%, from -0.1%, as the European gas crisis has eased a little, but sharper ECB rate rises will weigh on demand.

“Taming inflation is proving to be harder than expected as price pressures broaden and become more entrenched. Central bankers are having to take the gloves off. That won’t be good for growth,” said Brian Coulton, the chief economist at the ratings agency.

The risk of European natural gas shortages and rationing this winter has receded as LNG imports have surged and gas consumption has fallen. But the crisis is far from over and high wholesale gas prices continue to weigh heavily on firms’ costs and household budgets, the release said.

Inflation has exceeded forecasts – recently hitting 11% in the eurozone and UK – and core inflation is rising. Increasing services inflation is offsetting the benefits of easing supply-chain pressures.

Labour market imbalances are not improving as unemployment remains low and vacancies elevated. With tight labour market conditions, wages are chasing prices and are growing at 7% in the US, 6% in the UK and, on some measures, at above 5% in the eurozone.

The agency expects headline inflation to fall significantly in 2023 as food and energy prices stabilise. But core inflation pressures are expected to be more persistent.

The Fed, ECB, and Bank of England (BOE) have recently been raising rates in outsized moves. Fitch’s latest forecasts for the peak in Fed rates - at 5% - and ECB - at 3% - have been revised up by 100bp since September. Its latest 4.75% peak forecast for the BOE has been revised up by 150bp since the previous GEO. Fitch does not anticipate a pivot to rate cuts until 2024.

The impact of monetary tightening on the economy is already visible - particularly in housing markets - but broader effects on demand and job markets will become more apparent over time. Recessions are anticipated in the eurozone and UK starting in late 2022 and in the US in 2Q23 and 3Q23. Unemployment is likely to rise to above 5% in the US and UK in 2023.

Policy tensions - as governments seek to cushion households from shocks while central banks fight inflation - could result in missteps that increase risks to growth. Hidden leverage in parts of the non-bank financial sector - as seen in the recent UK gilts crisis - could also be a wider source of risk as real interest rates rise, the release noted.

China’s economic slowdown has eased pressure on global commodity prices, but the country is a huge net supplier of goods and pandemic-related disruptions to exports could hit global manufacturing supply chains. However, the recent easing in global supply-chain tensions could provide a bigger boost to world GDP than Fitch anticipates.