For both nations, the path forward lies in cooperation, not confrontation, to ensure that this tug-of-war yields shared prosperity rather than mutual loss

The United States’ imposition of a 50% tariff on a wide range of Indian exports, effective August 27, has cast a long shadow over one of the world’s most dynamic trade partnerships. Framed as a response to India’s continued imports of Russian oil, this policy targets key sectors like gems and jewellery, textiles, machinery and chemicals, threatening to disrupt a bilateral trade relationship that reached a record $131.84 billion in FY 2024–25. The fallout is profound: India faces export losses in the billions, potentially shaving 0.2–0.4% off its GDP growth [Global Trade Research Initiative (GTRI), 2025]. For the U.S., the tariffs may boost short-term revenue but risk higher consumer prices and supply chain inefficiencies. Both nations risk long-term economic and strategic setbacks unless bold measures are taken.

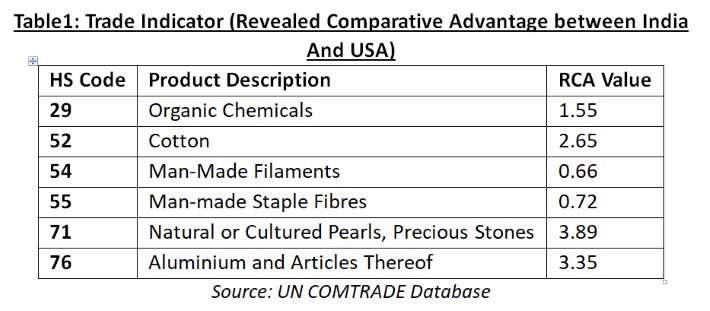

India’s export-driven sectors, particularly labour-intensive industries like textiles and gems, are at a crossroads. These sectors, which account for 18% of India’s $86.5 billion in goods exports to the U.S., support millions of jobs, especially in small and medium enterprises (SMEs) in regions like Gujarat and Tamil Nadu. The tariff hike erodes India’s price competitiveness, pushing trade toward rivals like Vietnam and Bangladesh, who face lower duties. This shift could reshape global supply chains, diminishing India’s hard-won market share. Revealed Comparative Advantage (RCA) analysis underscores India’s strength in gems and jewellery (RCA 3.89), aluminium (RCA 3.35), cotton (RCA 2.65), and organic chemicals (RCA 1.55), making these sectors particularly vulnerable to tariff-induced disruptions (see table 1). The RCA analysis highlights that the tariffs disproportionately target India’s most specialized sectors, portending substantial long-term economic costs for both nations.

Beyond economics, the tariffs strain the strategic partnership that has flourished through platforms like the U.S.–India Trade Policy Forum and the Initiative on Critical and Emerging Technologies (iCET). These mechanisms have fostered cooperation in clean energy, digital trade and defence manufacturing, aligning the two democracies in the Indo-Pacific. The tariff escalation, however, risks perceptions of economic coercion, particularly as it singles out India while sparing strategic sectors like pharmaceuticals and semiconductors. This selective approach reflects the U.S.’s dual aim of curbing its $45.6 billion trade deficit while preserving supply chains critical to its own interests. Yet, it also underscores a missed opportunity: a deeper partnership could leverage India’s growing manufacturing prowess to mutual benefit.

To navigate this crisis, India must act decisively. First, it should accelerate market diversification, targeting the EU, ASEAN, and the Middle East, where demand for its textiles and chemicals is rising. Progress in India–UK FTA talks could open new avenues for textiles, while ASEAN’s growing consumer base offers opportunities for machinery and gems. Second, domestic initiatives like Atmanirbhar Bharat and Production-Linked Incentive (PLI) schemes must be scaled up to boost manufacturing resilience, particularly in machinery and chemicals, reducing reliance on the U.S. market. Third, India should prioritize trade diplomacy, pushing for a Bilateral Trade Agreement (BTA) to negotiate tariff rollbacks to 15–20%, restoring competitiveness while deepening economic ties.

For the U.S., reconsidering this tariff regime is critical to preserving a partnership that underpins Indo-Pacific stability. Easing duties on non-strategic sectors like textiles could mitigate consumer price hikes while maintaining leverage in geopolitical discussions. Both nations should explore a “mini-deal” framework, focusing on tariff reductions in select sectors to rebuild trust without the complexity of a full FTA. Such a deal could also incentivize collaboration in emerging areas like clean energy, where India’s solar and wind component exports align with U.S. climate goals.

The India–U.S. trade relationship is too vital to be derailed by short-term frictions. These tariffs highlight the fragility of global trade in a geopolitically charged era, but they also present an opportunity to reimagine economic ties. By blending diversification, domestic reform, and strategic diplomacy, India can weather this storm and emerge stronger. For both nations, the path forward lies in cooperation, not confrontation, to ensure that this tug-of-war yields shared prosperity rather than mutual loss.

Dr. Vani Archana is a Senior Fellow at Pahle India Foundation.