How do you see demonetisation as a way of curbing black economy?

Demonetisation is not the way to tackle black economy. The reason is that the black money is in circulation; it is not held at home. The RBI has issued currency notes worth Rs17 lakh crore, and of that 85 percent is in Rs 1,000 and Rs 500 notes. Also, out of this, bulk would be with businesses for their working capital. My estimate is that at least Rs 8-9 lakh crore would be working capital of businesses. Only Rs 5-6 lakh crore would be with households. And out of that too, Rs3-4 lakh crore would be white money. So the black money which is demonetised would not be more than Rs 2-3 lakh crore. This is not a large sum of money. And most of this money would also be recycled. One businessman told me that he paid wages to his employees in advance in order to whiten his black money. People are buying gold and property. Therefore, a lot of this money will actually get recycled.

Over the last 40 years, about Rs 200-300 lakh crore has been generated as black income. Out of that, track component [black money stashed in houses] would be just 1-2 percent. So if you are able to demobilise this income, that would hardly create any difference. Out of the black wealth, black money is in very small percentage. So when you say I am demonetising the black money, then it is not demonetising the black wealth – which would be Rs200-300 lakh crore and it has already been consumed. And those who have this, they are not affected at all.

Do you think this move will not serve the purpose?

Black income is generated through a variety of means – in drugs, in under- or over-invoicing in trade and business. There are as many ways of generating black income as the number of sectors in the economy. So even if you are able to demobilise some amount of black money this year, it would be generated again next year. And now you are printing the Rs 2,000 currency note. It would be easier to misuse it. What is the logic of saying that we are demonetising Rs 1,000 and Rs 500 currency notes in order to destroy black money, but then printing Rs 2,000 currency note? This whole thing is very counterproductive. And it is affecting the white economy very adversely.

How is it affecting the white economy?

A large part of our economy consists of small business and workers who have no bank accounts, or stores that do not use credit or debit card readers. [Now, because of demonetisation] wages are not being paid. Industry and trade are suffering. All people are postponing their discretionary purchases. It is not a thoughtful move at all.

In any case, the industry was growing hardly at 1 percent rate. And suddenly the demand has collapsed. Mobile phone service providers are complaining that a large number of their prepaid cards are not selling as people do not have smaller currency notes. Therefore, the number of calls has dropped. Even the large-scale industry is suffering because of the lack of demand.

What would be the result of demonetisation?

General people are being affected adversely. And as demand falls, production falls, which would ultimately result in fall of employment. This will affect people at large. And the slowdown in demand will last for one-two years. Money supply will not be restored for another seven-eight months. The [amount of] currency you printed over 15 years, you cannot print in a few weeks. Because of this difficulty in circulation, the demand will slow down for the coming eight-ten months. And, therefore, recession is very likely. It will affect everyone. It is affecting agriculture, industry and services. This is a very wrong move of the government. It is not demobilising the black economy but hurting the common man and hurting the white economy.

What could be the better alternatives?

There are a lot of things the government could have done. For instance, tracking the hawala houses; they could have acted against the banking secrecy [that is, banking secrecy limitations on disclosure of NPA accounts and names of defaulters]. The Lokpal bill has been passed but the Lokpal is yet to be set up to make people accountable. The whistleblowers bill must be more actively pursued. There are a lot of steps that the government could have taken and above all it is a political matter. The government needs to show the political will that it will not allow those who have black income go scot-free. The government typically does not do that, because it says this will affect the business climate. But this is worse than that.

So the government should build an extensive database of people who are generating black income, bring honesty into the tax department and finish the hafta system. If they increase their administrative capabilities that would bring some change. The banking sector itself has a lot of corruption.

So you do not see this as a remedy to tackle black economy.

They cannot do this kind of thing which is not a solution to tackle black economy problem. It will just hurt the white economy and small traders and workers. They could have taken some other steps. If this could have solved the black economy problem, it does not matter even if we have to suffer some pain. If it is not solving the problem and causing a lot of problems to people who are innocent or workers who are not generating black income, then why do it? The percentage of black income which is immobilised is very small.

This problem has not come up today itself. So, it is not that you have to solve it overnight.

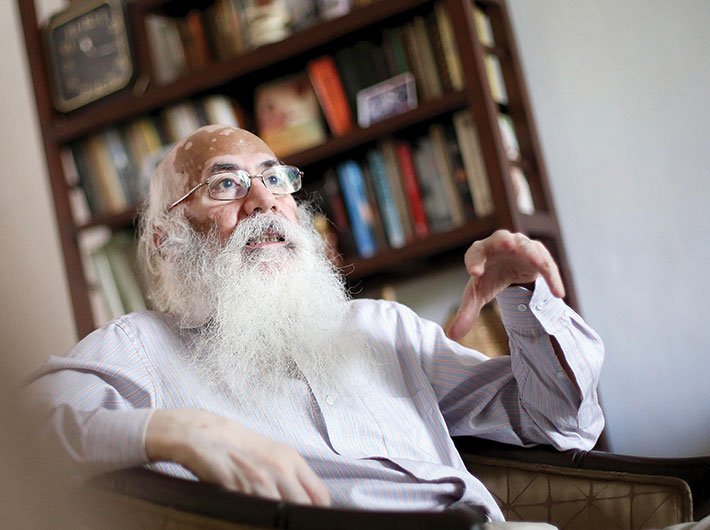

(The interview appears in the December 1-15, 2016 issue)