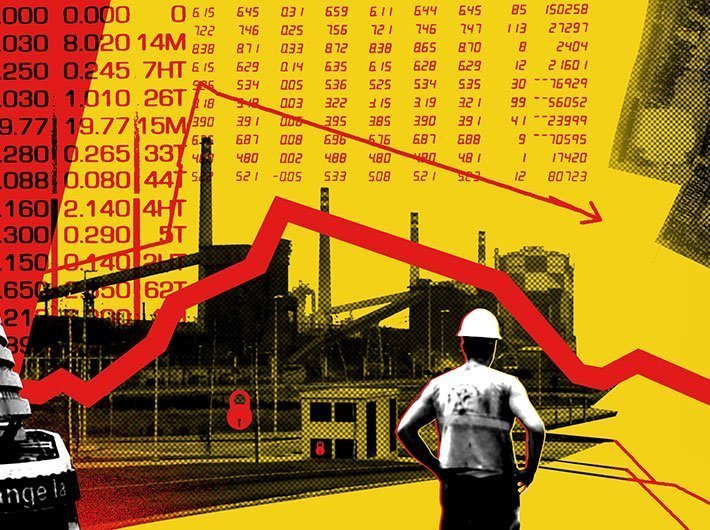

Economic activity expected to contract by 5% in current fiscal: speedy fiscal improvement later unlikely

The rating agency Fitch Ratings on Thursday revised the Outlook on India’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘Negative’ from ‘Stable’ while affirming the rating at ‘BBB-‘.

The revision of the Outlook, a press release said, reflects the following key rating drivers:

* The coronavirus pandemic has significantly weakened India's growth outlook for this year and exposed the challenges associated with a high public-debt burden. Fitch expects economic activity to contract by 5% in the fiscal year ending March 2021 (FY21) from the strict lockdown measures imposed since 25 March 2020, before rebounding by 9.5% in FY22. The rebound will mainly be driven by a low-base effect. Our forecasts are subject to considerable risks due to the continued acceleration in the number of new COVID-19 cases as the lockdown is eased gradually. It remains to be seen whether India can return to sustained growth rates of 6% to 7% as we previously estimated, depending on the lasting impact of the pandemic, particularly in the financial sector.

* The humanitarian and health needs have been pressing, but the government has shown expenditure restraint so far, due to the already high public-debt burden going into the crisis, with additional relief spending representing only about 1% of GDP by Fitch estimates. Most elements of an announced package totalling 10% of GDP are non-fiscal in nature. Some further fiscal spending of up to 1 percentage point of GDP may still be announced in the next few months, which was indicated by a recent announcement of additional borrowing for FY21 of 2% of GDP, although we do not expect a steep rise in spending.

* Fiscal metrics have deteriorated significantly, notwithstanding the government's expenditure restraint, due to the impact of the severe growth slowdown on revenue, the fiscal deficit and public-sector debt ratios. Fitch expects general government debt to jump to 84.5% of GDP in FY21 from an estimated 71.0% of GDP in FY20. This is significantly higher than the median of 42.2% of GDP for the 'BBB' category in 2019, to which FY20 corresponds, and 52.6% for 2020. The medium-term fiscal outlook is of particular importance from a rating perspective, but is subject to great uncertainty and will depend on the level of GDP growth and the government's policy intentions.

* India's record of fiscal consolidation has been mixed since the 2008 global financial crisis, with the general government debt remaining broadly stable at close to 70% of GDP for over a decade. Double-digit nominal GDP growth has not led to a decline in the government debt ratio in recent years, an important reason being the crystallisation of contingent liabilities and significant off-budget financing. Weak implementation of fiscal rules stipulated in the Fiscal Responsibility and Budget Management Act contributes to the Fitch view that a speedy fiscal improvement after the pandemic recedes is unlikely.

* India's medium-term GDP growth outlook may be negatively affected by renewed asset-quality challenges in banks and liquidity issues in non-banking financial companies (NBFC). The financial sector was already facing weak business and consumer confidence before the crisis and authorities had to deal with some high-profile cases over lapses in governance. Nonetheless, the banking sector's non-performing loan (NPL) ratio likely improved to 9.0% in FY20 from 11.6% two year earlier, according to our estimate, due to government capital injections.

* A renewed rise in NPLs and the need for further financial government support now seem inevitable despite regulatory measures announced by the Reserve Bank of India (RBI). These measures include an extension of the 90-day moratorium on recognition of impaired loans to 180 days and several relaxations in bank lending limits such as allowing banks to fund interest on working-capital loans. These moves will put a heavy onus particularly on public-sector banks to bail out the affected sectors and extend impaired-loan recognition, heightening solvency risks if not met by adequate and timely capital support.

On the other hand, India's 'BBB-' IDRs also reflect the following key rating drivers:

* The relatively closed nature of India's capital markets, with limited foreign portfolio inflows, supports the authorities' ability to finance wider fiscal deficits domestically. Only around 4% of government securities are held by non-residents and the external liabilities account for just 6% of central government debt. The RBI has also built up its foreign-exchange reserve buffers in recent months to $502 billion by June 5, covering around nine months of current account payments, higher than the 'BBB' median of five months. The government intends to open up more to foreign capital in the next few years as a source of deficit financing, but foreign investors' tolerance for government debt at current levels, with a significantly larger portion of external debt, remains to be tested.

* The RBI cut its policy rates by 115bp since March this year to support the economy and provided liquidity through long-term repo operations, including targeted ones to stimulate bank lending to NBFCs. Fitch expects the RBI to cut its policy rate by at least another 25bp this fiscal year, as a recent spike in food prices is receding and near-term price moves are likely to be disinflationary in the current environment. A credible inflation-targeting framework in place since 2016 makes debt reduction through high inflation less likely over the medium term. India experienced double-digit inflation in the few years immediately following the deterioration in fiscal metrics during the global financial crisis.

* The government has announced structural reforms as part of its response to the pandemic to strengthen GDP growth over the medium term, which, if successful, could improve India's fiscal position. Reforms to improve the efficiency of agricultural supply chains could help reduce food prices and swings in inflation, with food prices accounting for almost half of the CPI basket. The intention to privatise state-owned enterprises (SOE) could also be transformative, depending on the details, the willingness of the government to sell stakes of over 50%, and the demand for these assets in the current environment. The combined debt of around 200 SOEs owned by the central government amounts to 6.7% of GDP, but such information is unavailable for the around 800 SOEs owned by state governments.

* Geopolitical risk related to longstanding border issues with India's neighbours was highlighted again by recently intensified tensions with China. Relations with Pakistan are, moreover, negatively affected by the repeal of the special status for Kashmir and recent changes to the status of illegal immigrants based on their religion. A stronger focus by the ruling BJP on its Hindu-nationalist agenda since its re-election in May 2019 risks becoming a distraction for economic reform implementation and could further raise social tensions, the release said.

* The Indian economy is less developed on a number of structural metrics than many of its peers. India's ranking for Ease of Doing Business has drastically improved in recent years; at the 68th percentile it is now comparable, albeit still below, the 'BBB' median of the 71st percentile. India's relatively low basic human development is indicated by its ranking on the United Nations Human Development Index (32nd percentile versus the BBB median of 67th percentile), while average per capita GDP also remains low, at $2,100, compared with the 'BBB' range median of $12,172.

* ESG - Governance: India has an ESG Relevance Score of 5 for both Political Stability and Rights, and the Rule of Law, Institutional and Regulatory Quality and Control of Corruption, as is the case for all sovereigns. Theses scores reflect the high weight that the World Bank Governance Indicators have in our proprietary Sovereign Rating Model. India has a medium World Bank Governance Indicator ranking at the 49th percentile (below the BBB median of 58th percentile), reflecting a recent record of peaceful political transitions, moderate institutional capacity and established rule of law, but a high level of corruption.

For more, read:

https://www.fitchratings.com/site/re/10111579