A walk down the history of modern banking scandals can be summarised in two words: greed and speculation

Modern banking in India is just about 250 years old. In the interim, we have witnessed dozens of crises, scams and scandals of varying degrees. In many cases, dozens, even more, banks failed. The reasons for the runs on the banks, or their subsequent ‘saviour’ decisions, were many. But ironically, and possibly not coincidentally, two themes have been recurring for at least 150 years – from the most important event in 1865 (the stocks crash in Bombay) to the Nirav Modi one in 2018.

The first was that the failures were intertwined with ‘externalities’, that is, events that were beyond the control of the protagonists and alleged fraudsters. There was inevitably Adam Smith’s “invisible hand” that guided the institutions, and personalities behind them, to unmitigated, overriding disasters. The responsibility lay with the market forces, especially those that were unleashed from across the borders, or whose epicentres lay thousands of miles away in North America and Europe, or closer home in East Asia and Japan.

Invariably, though not inevitably, the events in Indian banking were interlinked with the stock market. This was true in 1865, it was clear, though unrecognized and unclearly documented during the times and travails of Harshad Mehta, and it is evident in the ongoing ‘bad loan’ crisis. In the aftermath of the Rs 11,000 crore (or Rs 22,000 crore) Nirav Modi fraud on Punjab National Bank (PNB), the stock market regulator, SEBI, decided to probe the “suspected nexus between the diamond traders and stock market brokers”.

However, after everything is done, and most is written, there is only one factor that’s common to all the financial scams – Greed, with a big ‘G’. And it’s related to Speculation, with a big ‘S’. As that authority on financial speculation, John Kenneth Galbraith, wrote, “Recurrent speculative insanity and the associated financial deprivation and larger devastation are… inherent in the system.” He could have easily added, “And also in the human hearts, minds and souls”.

Galbraith concluded, “In small ways the history of the great speculative boom and its aftermath does not change. Much, much more remains the same.” So, let’s traverse the history of modern banking scandals from the beginning. Not in a sequential manner, but in ways that explain what happens, why and how. In fact, let’s reverse the notion of the beginning and end of each of these events, and begin with the final straw, the catalyst and turning point that truly forces a scam to become public.

The breaking point

Normally, such points are hidden. After months, maybe years, of introspection, they are unearthed, and then they seem absolutely natural and logical. It is also the case that sometimes, different researchers and experts pinpoint different breaking points that co-exist and nurture each other in an unending exponentially and cataclysmic manner. It doesn’t really matter, as long as someone somewhere believes in only one of them.

In the 1860s, the turning point was marked by the end of the American Civil War. It had a disastrous impact on King Cotton, which had become the utmost item of speculation in India because of British industry’s desire to procure the raw material from here given the closed trade with the US. DE Wacha, in his book, A Financial Chapter in the History of Bombay City (1910), detailed the events comprehensively and holistically.

“As soon as the fall of General Lee’s army was known in March 1865 (in the US), the monetary crash came with a terrific effect…. Simultaneously, the famine price at which Indian cotton was selling… heavily declined…. That fall tolled at once the death-knell of speculation and wrought Bombay’s ruin…. In the share market its effect was like that of the most destructive bomb-shell…. Merchant after merchant and trader after trader failed…,” he wrote.

In terms of specifics, “The Bank of Bombay (one of the largest) lost all its capital save a few lakhs which returned to the ruined shareholders about a hundred Rupees for every five hundred Rupees but which were once quoted at nearly 3,000 Rupees. Of the numerous banks, many gave only a fraction of fractions as the return of capital, while the mushroom financials, save half a dozen, paid nothing. Some of them had to make a heavy call on the contributories.”

The breaking points inevitably stayed external, far away from the protagonists. Who could have predicted the end of the American Civil War? True, but one could easily see the unbridled, greedy speculation that had to end, that was only looking for an excuse of a prick. The end of the war was more like a sledgehammer banging against the ever-inflating bubble. The situation remained the same during the banking crises in the 1910s and 1920s/30s.

Of course, in the 1910s, the catalyst cause of another banking crisis was due to the First World War. But it was accompanied by a sense of airy euphoria that began over a decade ago, when the Indian Swadesh Movement led to Swadeshi banks to fund Swadeshi enterprises. As a recent article said, “By 1913, there were 451 banking companies. No prizes for guessing what happened next.” In 1913-14, 54 banks shut down.

Clearly, the destruction of the Indian banks in the 1930s was fuelled by the Global Great Depression, which had its roots in the excesses in the US, and which plagued the economies of most nations for several decades. According to a short piece on banking crises, the reason was what’s called an international “contagion”. According to it, “Real commodity prices collapsed by about 51% during 1928-31” and “real interest rates reached almost 13% in the US”. The impact was felt worldwide, including in India.

Experts blame the stock markets, and the trading villains, for what happened. In recent times, researchers blamed the central bankers in crucial economies such as the US, England and Germany. Whether it was the banks that lend the monies to speculate on stocks, or errant and greedy brokers, who took loans to invest in stocks, Indian banks, bankers, and traders refused to take the blame. It was a financial conspiracy hatched by others, and in far-away zones.

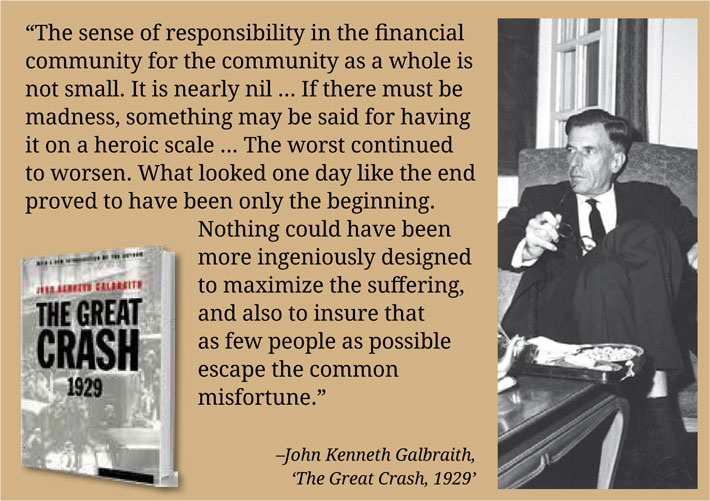

However, this may be an apt time to look at some of the quotes in Galbraith’s seminal book, ‘The Great Crash, 1929’, on the US market fall in 1929 and its aftermath. “The sense of responsibility in the financial community for the community as a whole is not small. It is nearly nil,” he says. And then adds, “If there must be madness, something may be said for having it on a heroic scale.” He concludes, “The worst continued to worsen. What looked one day like the end proved to have been only the beginning. Nothing could have been more ingeniously designed to maximize the suffering, and also to insure that as few people as possible escape the common misfortune.”

In many ways, although it is not immediately understood, the roots of the Nirav Modi scam lay outside the Indian shores. He, and his employees and companies used a form of a bank guarantee from PNB to raise buyers’ credit from the foreign branches of the other banks, without any collateral. Only when an official in PNB checked, and demanded 100% cash margin against the guarantee did the fraudulent scheme come crashing down.

Taking stock of stocks

It is commonly believed, even today after over 25 years, that the Harshad Mehta scandal was purely related to the stock market. The Big Bull, another one in a series of such bulls in financial china shops over the past 250 years, frenzied the capital markets, and brought about his and overall exchanges’ downfall with his personal mania. In fact, it was his immediate payment of Rs 500-600 crore to the State Bank of India in April 1992 that brought him down with a relentless and unseen gusto.

As everyone speculated about his source of money to control the stock market, and the prices of stocks that were his picks, the ‘Pied Piper’, who wanted to sell ‘paper dreams’ was caught napping. It came to light that he took advantage of the loopholes in the banking sector, and delays in reconciling banks’ credit accounts, to borrow huge chunks of cash, invest in stocks, make killings, return the money, and borrow afresh to start the process over and again.

Later, during the 1990s and early 2000s, the CR Bhansali and Ketan Parekh scams were found to have links with the commercial banking sector, as also the cooperative banks. Both borrowed to fuel the prices of their ‘favoured’ stocks. Both were undone when, like in a Ponzi scheme, the rotation of the money cycle, stops for a stupid reason – an externality that isn’t in their control. Even the ongoing non-performing asset (NPA) and ‘bad loan’ crisis can be linked to the stock market, although they were initially hatched in the corporate boardrooms, and bankers’ offices.

In banking parlance, there are three golden rules, and they are invariably followed by the men in pinstriped suits. The first is that a loan is given against a solid, more expensive collateral – you will get 80-90% of the price of your property as a loan. The second is mark-to-market – the collateral is adjusted as the market price of the asset changes. If the price goes up, you can increase the size of the loan; if it goes down, you add to the collateral.

Finally, the bank can always take over the asset of the borrower, be it a car, house, or company. This can be done directly, like is the case with us mortal people. Or it can be done indirectly; in the case of an evolved businessperson, the bank can convert its loan into shares, and take over the company. The end result is the same; the bank retrieves its money in assets, which are sold off. However, the chain breaks off during the negotiations.

Most promoters have used their shareholdings in their companies as collateral to get the loans. As the price of the stock moves, the value of the collateral changes, which forces the promoters to pledge more or less shares. When the loans are not paid up, usually, of course, due to the external environment, like a huge fall in prices of the manufactured products, the banks take over the shares, or convert loans into shares. But the banks don’t know how to manage, even sell, the companies. So, they negotiate.

The promoters-bankers sit across the table and prepare huge rehabilitation packages, debt restructuring in lieu of future promises made by both sides. This may include more loans, more collateral, sale of redundant assets like the expensive planes and yachts owned by the owner, and conversion of loans into shares. Over a short period, the bankers fulfil some of their promises, and the promoters renege on some. It’s back to square one – the time is ripe enough for another default on the loan payments.

By this time, the share prices of the erring, or wilfully defaulting, owners take a beating, which puts pressure on the collateral, as well as the wealth of the additional shares owned by the lending agencies. It is a financial warp, which goes on extending like a spider’s web of scams and scandals.

Greed is King

Ultimately, it is greed that causes the crises. Greed among the owners, borrowers, traders and speculators. And coupled with this is the lack of integrity and application among the lenders and regulators, who are finally caught napping. They had been led to believe, either internally or by external agents, that the loans will be safe, and will be repaid. Anyway, they have the collateral in place, whose value suddenly diminishes in no time, when the concerned corporate announces unbelievable losses, or writes down the value of its assets. The story is the same, and so is the ending.

This was beautifully captured, vis-à-vis the speculator, by Galbraith. “The fortunate speculator who had funds to answer the first margin call presently got another and equally urgent one, and if he met that there would still be another. In the end, all the money he had was extracted from him and lost. The man with the smart money, who was safely out of the (stock) market when the first crash came, naturally went back in to pick up bargains. The bargains then suffered a ruinous fall. Even the man who waited for volume of trading to return to normal and saw Wall Street become as placid as a produce market, and who then brought common stocks would see their value drop to a third or fourth of the purchase price in the next 24 months.”

Unfortunately, the same mindset and rules apply to the bankers and regulators. They too behave in different ways, always with a

certain hope and confidence in their individual intelligence. They fail, like their banks. Even the ones that are too big to fail, have no future. This was evident from the merciless Global Financial crisis of 2008.

Srinivas is a veteran business journalist.

(The column appears in the March 15, 2018 issue)