Blockchain databases and bitcoin exchanges are bringing in a new logic of crowdsourced funding for civil society organisations

There’s something big afoot in the Bitcoin world. It’s important enough for the smooth and ruthless sharks of Wall Street to take notice and turn uneasy. Bitcoins have always been treated by the established monetary and financial world with healthy suspicion. Some of it was initially justified, especially when Bitcoin exchange Mount Gox wound up citing missing bitcoins that were ‘likely stolen’. The world of cryptocurrency, however, has moved at a fast clip to address many of those concerns.

A starring role has been played by the advancements in block chain technology. In simple terms, a block chain is a distributed database, but with two tweaks layered upon decentralised consensus. Decentralised consensus transfers trust to a virtual network, rather than a set of physical nodes, helping continuously and sequentially record transactions in the form of blocks. Each unique block has a digital signature and can link with other blocks creating what is termed a unique chain: hence block chain.

Conventional distributed databases require a set of permissions for each node to trust the other. In short, the permissions are used like a friend and foe identification system. The first tweak brought about by block chain technology is that data cannot be edited at any time, making it immutable. The second tweak is the manner in which each the implementation of the database can be finitely reduced to transactions and/or blocks where each single transaction/block can be digitally signed and verified and linked with each other.

This combination of instantaneous certification, unique and non-replicable digital signature for each transaction, ability to link up all such transactions as a chain and immutability makes for a digital ecosystem that’s often been described by many technophiles as ‘superpowered notary with a notebook where once the ink dries, it lasts forever’. Wall Street, or for that matter any conventional stock or money market, functions and runs on information leverage. Brokers of all shapes and kinds work the information – tips as the Mumbai daily traders colloquially call it – and try to be ahead of the arbitrage curve – call, put, buy and sell options.

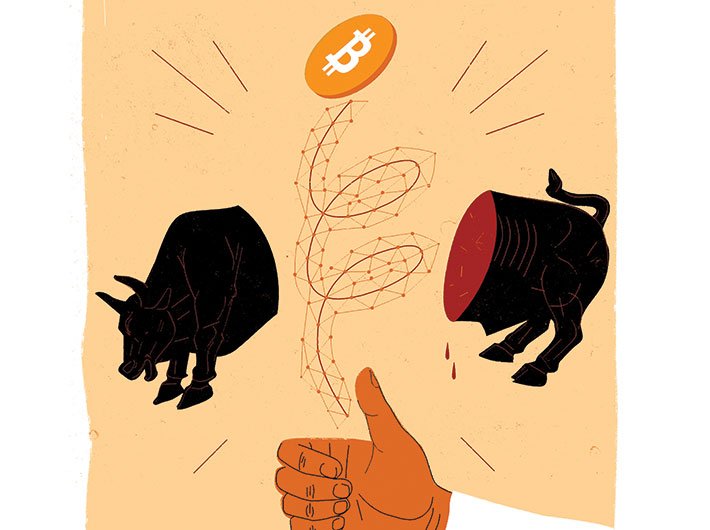

The Big Bulls – think Michael Douglas, Leonardo DiCaprio, wolves and Wall Street – use everything legitimate that big bucks could buy from complicated automated software that uses algorithms to trade in milliseconds, physicists and post doctoral fellows in mathematics to everything illegitimate from insider trading [think Rajat Gupta], ‘ghost buying’ of shares [think Harshad Mehta] and gold plating penny stocks.

The meshing of blockchain databases, bitcoins and a resultant uncomplicated system of instant and transparent transactions rip the heart out of this cozy ‘Big Bulls’ system where information asymmetry creates a private club that keeps playing the market and getting richer. This new mesh can unleash forms of democratic digital collectivisation for bringing about two fundamental changes. The first is to decisively break the monopoly of a skewed financial system run by currencies, central banks, private equity funds and large corporations. The second is to sow the seeds for emergent models of inclusion that bring together financial, social and economic aspects of life to bring in a new logic of money and its value.

It’s no wonder that the sharks of Wall Street are feeling uneasy. What the first change can do to a loaded financial system is increasingly dawning in a clear manner to all sorts of brokers and arbitrage dealers. In short, information asymmetry of the kind that exists today will not in the future. With financial and transaction level information democratised, the playing field, at least in technical terms, will be level. So, in some ways, in this future world, a common man like me should be able trade and transact shoulder-to-shoulder with the likes of Rakesh Jhunjhunwala. Of course, there is a distinct possibility of different and newer forms of insider trading, but having said that, it will require a level of sophistication that would not be easy to roll out or achieve.

If some are getting jittery, and quite rightly so, there are also several others for whom this represents a basket of opportunities that hadn’t existed even a year before. Some of the clear-cut commercial opportunities afforded by this form of borderless and paperless currency are fairly well documented. What seem to have escaped the attention of several astute observers are the possibilities that are just about peeking over the horizon. These are especially relevant for organisations and institutions that are firmly located within the broad rubric of civil society.

Today, civil society organisations in India are under several kinds of official scanners. Justified or otherwise is a different debate, but much of the scrutiny is around the funds, funding patterns, sources, audit and accounts. There are three clear doors that can be opened by the keys provided by blockchain databases, bitcoins and the metaphorical ‘everlasting ink’ respectively. Each door opens up to pathways that can transform the manner in which civil society organisations organise their internal processes related to financial, budgeting and forensic systems, and for the better.

The first pathway opened by blockchain databases can potentially put to rest all unnecessary and often malafide doubts, questions and innuendos that are being used to belittle and destroy the credibility of the civil society. The decentralised architecture of Blockchain databases can help in two ways. It takes into account the fundamental nature of civil society organisations to keep themselves flexible, democratic and diverse, and by extension allow funds to be used in a fungible manner that deep rooted and long-term social change generally requires.

Fungible use of funds, in itself, is not the issue, though it is often perversely used by official channels to corner civil society organisations. The issue is the traceability of this fungible use of funds. Blockchain databases are extremely robust and watertight in any financial asset transaction. Such transactions typically involve record-keeping, reconciliation and reporting. Since blockchain’s distributed database is verified by a network of nodes that keeps continuously growing based on previous data records, it makes it almost impossible to tamper with. And, it’s real time. In practical terms, what it gives civil society organisations is an ability to allocate, reallocate and use funds – ranging from one budget head to another to transferring money to a completely new programme – without the headache of maintaining detailed audit and forensic statements.

The second pathway opened by bitcoins is probably the most radical. Bitcoin exchanges are giving the established financial world quite a few sleepless nights because of their ability to democratise transactions. Bitcoin exchanges give civil society organisations an opportunity to come under one single roof and create an umbrella consortium, much like a stock exchange, and raise money from unconventional, yet legitimate sources. It also potentially allows the organisations to list themselves on various set of parameters, much like the stock exchange, but fundamentally different that range from social capitalisation (instead of market capitalisation), value of investment (instead of return on investment), social units (instead of stocks) and social change metrics ‘SocMet’ (instead of Sensex).

FAQs

What is Bitcoin?

Bitcoin is a consensus network that enables a new payment system and is the first complete system of digital money. It is the first decentralised peer-to-peer payment network that is powered by its users with no central authority or middlemen. From a user’s perspective, Bitcoin is pretty much like cash for the internet.

How to get Bitcoins?

One can get bitcoins either as payment for goods or services or through purchasing them at Bitcoin exchanges. One can also earn bitcoins through mining.

What is mining?

A bitcoin is generated through computers that solve complex algorithms and in return one can get certain units of bitcoins. The process performed by the computers is called mining.

Who governs it?

It is not governed by any government or international organisation. It works on a peer-to-peer fashion.

Who designed it?

The first Bitcoin specification and proof of concept was published in 2009 in a cryptography mailing list by Satoshi Nakamoto.

Source: bitcoin.org

Such an exchange can institutionalise crowdsourcing and bring into real play the intent and motivation of common people to participate and empower social change actors. Of course, the motivation of such an exchange will not be profit but long-term social change. Apart from flexibility it would give organisations the ability to exchange bitcoins for any currency (since bitcoins do not have any geographical boundaries). Additionally, it would give civil society institutions a large enough platform to genuinely involve common people in addressing deep rooted inequities of India.

In essence, such an exchange would give people like you and me not only the opportunity to fund our favourite causes without fear of favour, but also pick up social units of civil society organisations helping them shore up their corpus, while making them more accountable, transparent and global financial standards compliant. One can even imagine the possibility of such investments being connected to tax rebates and financial citizenship.

The third pathway created by the metaphorical ‘everlasting ink’ has particular significance for financial forensics. Civil society organisations typically do not have mature financial platforms and systems, like what we usually expect from the government or the corporate sector. This is not because they are not conscientious, but because they have a different operating model. It’s a model that focuses a lot of attention to programme deliverables and ground level interventions, rather than administrative and financial overheads. Typically donor organisations, as also the government too, have exacerbated this issue by using the lens of programme-to-administrative cost ratios while giving grants and funds. The possibility afforded by blockchain databases to create this ‘everlasting ink’ gives civil society organisations the ability to adhere to their unique model, while still maintaining the global standards of financial forensics at an extremely low cost.

Without a doubt, all of this is easier said than done. There are challenges. Many are located within the civil society itself that seems to be stuck in a time warp leading to an unfriendly attitude to digital technology and its possibilities. Several, however, are entrenched deeply within the government and the corporate sector and directly revolve around mindsets of distrust, impact and the usefulness of civil society action. The reality, though, is that the government is withdrawing from several social welfare domains, while the corporate sector is getting increasingly involved in macroeconomics and market-driven investments. By default, then, the civil society organisations are fast becoming the last mile connectors to the poor and marginalised communities and groups of India. It’s here that blockchain databases, bitcoin exchanges and the new digital ecosystem can chart a new path.

Swaminathan is chief strategy & programmes officer (CSPO) of Azim Premji Philanthropic Initiatives (APPI) and a also fellow of the National Internet Exchange of India (NIXI). Views expressed here are personal.

(The article appears in the March 16-31, 2016 issue)