The growing NPAs are a constant worry as it is putting a huge strain on the public sector banks

The public sector banks which are teetering under the burden of non-performing assets need help from the government in the form of capital support.

Former Reserve Bank of India (RBI) governor Raghuram Rajan has said that government capital support for bad-loan ridden public sector banks is essential even if it means trimming budgetary outlays to other sectors.

“I think it’s important to recognise that banks do need capital and you need to put it aside and if it means that there are other resources allocations that should be reduced, so be it. I mean, that’s the cost of staying within the budget. This is not painless,” Rajan told the

Mint.

The growing NPAs are a constant worry as it is putting a huge strain on the public sector banks.

A Moody’s-ICRA report has pointed out that public sector banks will need anywhere between Rs 70,000 crore and Rs 95,000 crore in capital over two years.

“In our central scenario, we estimate that the 11 Moody's-rated public sector banks will require external equity capital of about Rs 70,000-Rs 95,000 crore, or about $10.6-$14.6 billion,” Alka Anbarasu, Moody's vice president and senior analyst, was quoted as saying.

“Moody's believes that capital infusions from the government remain the only viable source of external equity capital, because of the public sector banks' low capital market valuations, which will likely continue to deny them the option of raising fresh equity from the capital markets,” reported

Economic Times.

Looking at the turbulence in the banking industry, the cabinet on August 23 gave in-principle approval for public sector banks to amalgamate through an alternative mechanism (AM)

The decision would facilitate consolidation among the nationalised banks to create strong and competitive banks.

The proposals received from banks for in-principle approval to formulate schemes of amalgamation shall be placed before the AM. After in-principle approval, the banks will take steps in accordance with law and SEBI’s requirements.

In 1991, it was suggested that India should have fewer but stronger public sector banks. However, it was only in May 2016 that effective action to consolidate public sector banks began to be taken by announcing amalgamation of six banks into the State Bank of India.

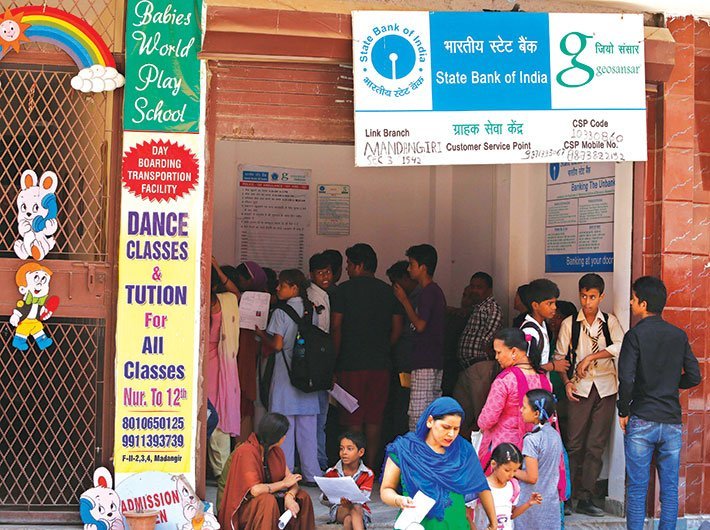

SBI is now a single bank with about 24,000 branches, over 59,000 ATMs, 6 lakh POS machines and over 50,000 business correspondents. As much as 70% of SBI’s network lies in rural and semi-urban areas.

There are now 20 PSBs other than SBI. The banking scenario has changed since 1970s-80s when banks were nationalised, with an increased banking presence from private sector banks, non-banking financial companies, regional rural banks, payment banks and small finance banks. The decision is expected to facilitate the creation of strong and competitive banks in public sector space to meet the credit needs of a growing economy, absorb shocks and have the capacity to raise resources without depending unduly on the state exchequer.

An

RBI document said that during 2015-16, scheduled commercial banks interest earnings and non-interest incomes were adversely affected. Interest income reflected the impact of the continuing slowdown in credit growth. Interest expended also witnessed deceleration. However, growth in net interest income declined as compared to the previous year. Further, operating expenses showed an improvement largely due to moderate growth in the wage bill.

Provisions and contingencies surged due to a sharp deterioration in asset quality.

Provisioning for NPAs more than doubled on account of improved recognition of non-performing assets. This led to a more than 60 percent drop in net profits for the banking sector. PSBs reported losses to the tune of Rs 180 billion with net profits declining by 148 percent over the previous year, it said.