Over the years the government has failed to meet its disinvestment targets, but that has not deterred it from the setting its sights even higher

The government is getting ambitious. It wants to divest some PSU shareholding and raise a staggering Rs 72,500 crore during the 2017-18 fiscal. The mood is upbeat among finance ministry mandarins due to the heartening performance of the exchange traded fund (ETF), a basket of 10 bluechip central public service enterprises (CPSEs).

The disinvestment target is a significant increase from the current fiscal’s target of Rs 56,500 crore, which the government has not yet been able to meet.

The government’s disinvestment decision is aimed to bridge the fiscal deficit in 2017-18, which is around 3.2 percent (about Rs 4.35 trillion) of the GDP.

The disinvestment target appears to be a daunting task because of adverse market conditions and low valuations of PSU stocks.The government is pinning its hopes on CPSE ETF, which has been gaining traction for the past few months. The basket of CPSE ETF comprises shares of 10 Maharatna and Navratna enterprises, namely Oil and Natural Gas Corporation (ONGC), GAIL (India), Coal India, Rural Electrification Corporation, Oil India, Indian Oil Corporation, Power Finance Corporation, Container Corporation of India, Bharat Electronics and Engineers India.

The ETF is in a way similar to a mutual fund. If an investor is buying one share of the CPSE ETF, it will represent the entire basket and not the individual enterprises.

The CPSE ETF, which tracks the Nifty CPSE index, enables the government to disinvest its stake in the state-run enterprises. The ETF was launched by the government in 2014 to provide investors an opportunity to invest in a gamut of bluechip CPSEs. The Nifty 50 index is the National Stock Exchange of India’s benchmark stock market index for the Indian equity market.

The second tranche of CPSE ETF managed to raise Rs 9,600 crore last month, boosting the government’s confidence of getting more revenue out of this channel.

Experts say the markets have cheered the government’s announcement of further divesting in the PSUs in the 2017 budget.

One of the reasons behind the market euphoria is Rs 6,000 crore CPSE ETF further fund offering (FFO) that closed on January 20. “The CPSE ETF has done well so far. In the three years since it was unveiled, the CPSE ETF has shown returns that exceed the Nifty 50 returns,” a Financial Express report said.

While presenting the 2017 budget, finance minister Arun Jaitley said that CPSE ETF has received overwhelming response in the recent FFO. “The government will continue to use ETF as a vehicle for further disinvestment of shares. Accordingly, a new ETF with diversified CPSE stocks and other government holdings will be launched in next fiscal,” he added.

The past

Despite the claims made by the government, the disinvestment statistics paint a different picture.

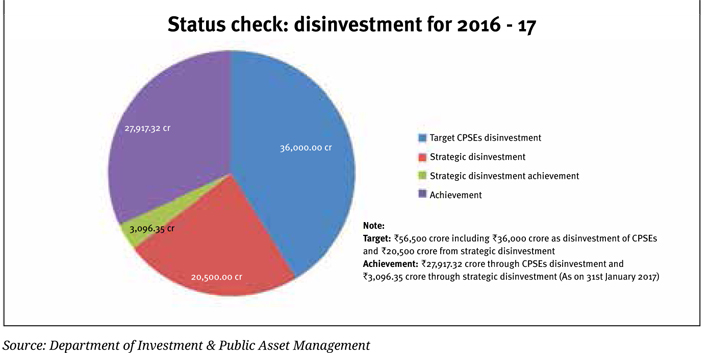

According to the finance ministry’s department of investment and public asset management (DIPAM), the government in the 2016 fiscal targeted an earning of Rs 56,500 crore, including Rs 36,000 crore as disinvestment of CPSEs and Rs 20,500 crore from strategic divestment. However, it could raise only R s27,917.32 crore via CPSEs disinvestments and Rs 3,096.35 crore of strategic disinvestment till January 31.

The official figures of the last five fiscals are troubling. In the 2011-12 fiscal, government had set a target of raising Rs 40,000 crore, but it achieved only Rs 13,894 crore, in 2012-13 the target was Rs 30,000 crore but only Rs 23,957 crore were collected, in 2013-14 the government garnered Rs 15,819 crore against a target of Rs 40,000 crore. Similarly, in the 2015 fiscal, a total of Rs 23,997 crore were raised against a target of Rs 41,000 crore (excluding strategic disinvestment of Rs 28,500 crore).

However, the finance ministry appears to be confident of meeting its target in the current fiscal. “The government would surely achieve the target of raising remaining Rs 25,487 crore before the current fiscal comes to an end as there are other options available like minority divestment,” a media report quoted DIPAM joint secretary Manish Singh as saying.

The government aims to raise Rs 72,500 crore in the 2017 fiscal via disinvestment, including Rs 46,500 crore via minority stake sale, Rs 15,000 crore through strategic stake sale and Rs 11,000 crore via listing state-run insurance companies.

Jaitley in his budget speech said the government endeavours to strengthen CPSEs through consolidation, mergers and acquisitions. Through such methods, the CPSEs can be integrated across the value chain of an industry and it will give them capacity to bear higher risks and avail economies of scale.

The hurdle

Reena Ramachandran, former chairman and managing director, Hindustan Organic Chemicals, believes that the government’s priorities to divest public sector undertakings have been shifting with market conditions and political considerations.

“There are two prime factors of divesting any CPSE. The first is the shoddy performance of a PSU and its redundancies whereas the second factor is failure in generating adequate funds from its own resources. Disinvestment is the need of the hour to revive PSUs and give a boost to employment generation,” Ramachandran says.

On the government’s failure to meet the disinvestment targets, she attributes lack of will and frequent conduct of elections as a reason behind poor generation of revenue. “The government seems to have switched itself to the election mode which plays spoilsport to carry on divestment. If the government is serious about meeting its targets every fiscal, it should show a strong will,” she adds.

She says the creation of an oil behemoth – mentioned in this budget – should have been done at least 20-30 years back to compete with global giants and register massive earnings.

On the listing of railways PSUs —Indian Railways Catering and Tourism Corporation (IRCTC), Indian Railway Finance Corporation (IRFC) and Indian Railways Construction Company Ltd (IRCON), Ramachandran believes the move would make these PSUs more accountable and it would help the government unlock the value of the CPSEs.

Former disinvestment secretary Mohammad Haleem Khan concurs and says the listing would consolidate CPSEs. “The PSUs which are performing well should be listed in the stock exchange,” he added.

The target can be easily achieved with just a one master stroke – integrate all state-run oil companies into one behemoth, says RS Sharma, former chairman-cum-managing director, ONGC.

“There should be an integration of state-run companies into one entity. The government should create a holding company with 51 percent ownership of stake,” Sharma adds.

He says despite political opposition, the government should go ahead with disinvestment to reinvigorate them and create jobs. Sharma believes that India’s economy is growing because of surge in the demand and political stability which is not the case with other emerging economies in the world. “Demand is not a constraint in India and the investors have full trust in the government too,” he added.

A Fitch Ratings report says the proposed merger of India’s state-run oil companies could reduce inefficiencies across the sector. It would also create an entity that is better placed to compete globally for resources, and less vulnerable to shifts in oil prices.

“However, a merger would witness significant execution challenges, particularly in terms of managing the integration of employees, addressing overcapacity in the merged entity, and winning the backing for the merger from private shareholders,” a Fitch statement issued in Singapore said.

The report underscored the need of giving the new oil behemoth much stronger bargaining power with suppliers, and greater financial clout to secure oil resources.

“A majority of Asian countries have just one national oil company integrated across the value chain. In contrast, there are 18 state-controlled oil companies in India, with at least six that can be considered key players – Oil India Limited, Indian Oil Corporation, Bharat Petroleum Corporation, Hindustan Petroleum Corporation and GAIL (India) and ONGC,” it stated.

Pranav Haldea, an expert on disinvestment and managing director of Prime Data, says the government has a bad record of achieving disinvestment targets over the past few years because of several roadblocks in divesting CPSEs.

“CPSEs disinvestment is not just an economy issue but political as well. It is evident from the past that privatisation and strategic sale of PSUs have always met with massive opposition from political outfits,” he added.

Haldea says that it is not an easy task for the government to go for a strategic sale of PSUs as there is an involvement of vote bank and no government wants to irk the voters. “The government will have to act efficiently if it wants to meet its target before the current fiscal ends,” he adds.

He believes that the listing of PSUs brings in transparency and accountability in the public domain.

Besides, listing also comes with several benefits like generation of more revenue receipts. “It helps them running in a better manner,” he adds.

The alternate voice

Political activist and economist Prasenjit Bose says disinvestment of profit-making CPSEs implies that the government is foregoing future streams of revenues (from dividends) against a one-time earning through sale of equities. This is the reverse of running a fiscal deficit, where the government borrows one-time from the market, against future streams of interest and repayment. In disinvestment, moreover, there is a transfer of resources from the public to the private sector, he adds.

“The Modi government has stepped up the disinvestment drive ever since it came to the power. The emphasis on mobilising revenues through disinvestment simply shows that the government’s commitment to increase the tax-GDP ratio and direct tax collections rings hollow. Strategic disinvestment is also a controversial method since allegations of undervaluation of assets have arisen whenever this route has been adopted,” says Bose.

vishwas@governancenow.com