At Rs. 50,000 per unit it comes cheap with the promise of providing capital to the fund-starved real estate sector

Every middle-class Indian dreams of a home coupled withlanded property to live off the rent. However, large initial investment, particularly inmetros, and low yields ensure that real estate is out of the reach of the common man. A return of 7-8 percent from commercial properties is considered highly commendable. Even to achieve this rate, one requires expert knowledge of various factors, such as the right site, tenant profile matching the site, management of expiring tenancies and timely replacement thereof. This is where ‘Real Estate Investment Trusts’ (Reits) can make a difference.

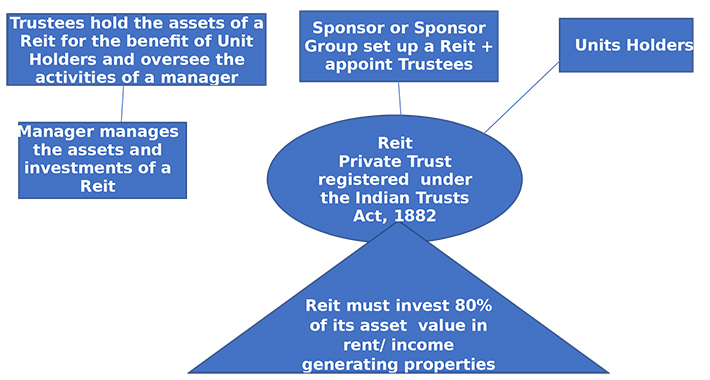

Elements of a Reit

Reits were introduced in the United States in the 1960s. Today, REITs of all types collectively own more than $3 trillion in gross assets across the U.S.It was quite a while before others followed suit:France in 2003, the United Kingdom in 2006, Germany in 2007. In 2014 the Securities Exchange Board of India notified ‘Sebi(Real Estate Investment Trusts) Regulations’(‘Reit Regulations’) and thus paved the way for Reits in India. They are often compared with mutual funds on account of organisational and structural similarities. In order to understand this instrument, consider the accompanying diagram.

As the diagram shows, any entity desirous of setting up a Reit is called a sponsor. A sponsor or a sponsor group gets a Reit registered with Sebi. The legal constitution of a Reit is that of a private trust registered under the Indian Trusts Act, 1882. Since only listed Reits can issue units to various unit holders, upon registration a Reit comes up with an issue, floats prospectus, get itself registered with a stock exchange and so on and so forth. Investment decisions, however, are taken by an expert manager. But, of course, the office of a trustee is to look after the interests of the unit holders and effectively keep an eye on the manger. This is where the similarities between a Reit and Mutual Fund ends.

What sets Reits apart as an investment tool in the hands of a common man is that (a) as much as 80 percent of the asset value of aReit is required to be invested in rent or income generating properties (remaining 20 percent is discussed later), and (b) at least 90 percent of net distributable cash flows of aReit are required to be distributed to the unit holders twice a year. Thus, the retail investor is assured of a return on investment. Other advantages as against traditional investment include (a) liquidity, (b) expert knowledge, and (c) diversified pool of high-quality assets.

Amendments

For nearly three years after its launch, no Reits were forthcoming. The Reit Regulations required more than a tweak here and there. Sebi took a note of the representations made by industry associations especially Asia Pacific Real Estate Association (APREA), merchant bankers, issuers, private equity players,law firms, and sweeping changes were made to the Reit Regulations in 2017 and thereabouts. Chief amongst them was the manner of investment in the properties as discussed below.

At the time of notification of REIT Regulations, a Reit could invest in the assets either directly or through a special purpose vehicle (SPV). Therefore, only one-levelinvestment structure was allowed. This did not reflect the reality of the real estate sector where assets are usually held through multiple layers of investment. The representations to Sebi included investment by a Reitin a two-dimensional structure: (i) a Reit shall acquire a controlling stake in the holding company (HoldCo.), and (ii) the HoldCo., in turn, shall own a controlling stake in the SPV (in which the assets are ultimately vested). Sebiaccepted the industry suggestion and suitably amended the Reits Regulations. It may be noted that though the minimum controlling stake is pegged at 51 percent for both (i) and (ii) above, by way of check and balances, Sebi has stipulated that the ultimate holding interest of a Reit in the underlying SPV should not be less than 26 percent.

Regulation 18 of Reits Regulations captioned ‘Investment Conditions and Distribution Policy’ has been liberalised to the extent possible. Investment regulations regarding 80 percent of the asset value of a Reit have already been discussed above. The remaining 20 percent can be invested by a Reit in under-construction properties, unlisted equity shares or debt of real estate companies, mortgage backed securities, Transferable Development Rights (TDRs) etc. – subject to appropriate riders.

In a sweeping and far-reaching change, a Reit can issue listed debt securities, provided that the aggregate consolidated borrowings and deferred payments of the REIT, HoldCo, and/or the SPV(s), net of cash and cash equivalents shall never exceed 49 percent of the value of the REIT assets.

We have come to such a pass that our banks are short of funds, our non-banking finance companies (NBFC) are on the brink. For developers with large inventory overhang, Reits appears to be the only answer for additional capital requirements. It is no surprise that two of our developers with the largest finished stock of commercial real estate have formed Reits. To ensure greater accessibility and funds, the minimum ticket size of a Reit unit,originally pegged at Rs. 200,000, has been brought down to Rs. 50,000, making real estate truly retail. However, the efficacy of the system hinges on the integrity of the manager under watch of the trustees.

Divya Malcolm is a partner at Kochhar& Co., Advocates and Legal Consultants. The views expressed in this article are her own and not that of the firm.