If you equate the bad loan crisis with public sector banks, think again. Private sector lenders are also in the soup

It is a common enough notion in the market and among investors that private sector banks have superior asset management skills and consequently, a miniscule amount of toxic assets. This popular narrative has, in turn, led to a rising demand for the privatisation of public sector banks, besieged as they are by the mounting non-performing assets (NPAs) in their loan books.

The argument for privatising PSBs is often supported by a comparison of gross and net NPAs of public and private sector banks. While the comparison does bear out the massive amount of bad loans in the books of PSBs, it fails to capture the complete picture.

Contrary to the popular perception, many private banks in India such as Axis Bank, ICICI Bank and Yes Bank are also saddled with sizeable NPAs as well as other ‘stressed’ accounts which could possibly turn bad in the coming quarters. A few voices – academics, analysts and think tanks – have also been raising concerns of ‘ever-greening’ of loans and consequent refusal of private banks to recognise NPAs. However, this insight is far from well known.

Consider, for instance, the case of Axis Bank. In the December 2015 quarter, the bank declared gross NPA amounting to Rs 5,724 crore. In a matter of two quarters, this amount ballooned by 66 percent to rs 9,553 crore. For ICICI Bank, gross NPAs for the quarter ending December 2015 came to Rs 21,149 crore. This escalated by 28 percent to Rs 27,193 crore by the quarter ending June 2016.

When seen discretely, these numbers look large but they dwarf when compared to those of PSBs. Consider the case of the country’s largest banker, State Bank of India. SBI for its quarter ending December 2015 had bad loans amounting to Rs 72,791 crore. By the June quarter of 2016, this number rose by 39 percent to Rs 101,541 crore. Other PSBs like Bank of Baroda, Punjab National Bank and Bank of India also have gross NPAs around the Rs 50,000-crore mark. Seen from this perspective, the massive drubbing down of PSB stock prices in the last two years seems only natural.

However, what is not noticed when it comes to private sector banks are their controversial ‘watch lists’ of stressed assets. Innocuously named, these lists hold out great potential of damage to the banks’ already thinning profit margins. These watch lists include accounts suffering from considerable project distress or accounts stuck in red tape or those which have taken a beating because of the global downturn in commodity prices. Apart from these, the lists also include loans that have been put under the strategic debt restructuring mechanism.

In April this year, Axis Bank unveiled its watch list of accounts that could possibly become NPAs. The accounts on the watch list amounted to a massive Rs 22,628 crore. Adding to the dismal environment, loans worth Rs 2,680 crore that featured on the watch list slipped into NPA territory in the June quarter. Its total slippages came to Rs 3,698 crore. Shareholders have little to be optimistic about as the management has said that it expects 60 percent of the watch list loans, amounting to Rs 13,576 crore, to become bad in the coming eight quarters.

In the case of ICICI Bank, it put out a watch list of assets worth Rs 44,065 crore in the last quarter of FY16. In the latest June quarter, Rs 4,559 crore of these watch list loans turned bad. The profit in the June quarter also took a 24 percent hit coming in at Rs 2,232.35 crore compared to the profit in the corresponding quarter previous year. Provisions rose by 163 percent on a year-on-year basis to Rs 2,514.52 crore from Rs 955.39 crore.

As asset quality of private banks continues to deteriorate, profitability of these banks is expected to take a massive beating, puncturing the commonly held notion that these banks have been able to defend themselves against the crisis on account of their thorough due diligence before loan disbursal.

A few industry analysts are also raising their concerns over the private banks’ disclosure of stressed assets. In a June report, Religare Securities has stated that Axis Bank and ICICI Bank have more stressed assets than what they have disclosed on their watch lists. The financial services firm said that there was a massive gap between the watch lists declared by the banks and the ones arrived at by the firm. It also claimed that the watch lists declared by both the banks were “highly subjective and differ widely in terms of stressed asset inclusion”.

Religare claims that the watch list declared by ICICI Bank was missing restructured accounts and did not include exposure to stressed accounts beyond a few key sectors. When Religare included the missing components, its list of stressed assets for the bank was 35 percent higher at Rs 59,300 crore. Axis Bank, according to Religare, had not added its non-funded exposure and incorporated only 72 percent of its outstanding restructured and strategic debt restructuring (SDR) loan book. After adding the non-funded accounts and the balance of SDR exposure, it arrived at a figure of Rs 31,500 crore – 40 percent higher than what was disclosed by the bank.

These watch lists are strong signals testifying to the fact that the problem of loans – majorly disbursed to iron and steel, power, textiles and oil and gas sectors – turning bad is not just limited to the PSBs but has also managed to creep in the private sector banks.

These watch lists are strong signals testifying to the fact that the problem of loans – majorly disbursed to iron and steel, power, textiles and oil and gas sectors – turning bad is not just limited to the PSBs but has also managed to creep in the private sector banks.

In September, another financial services firm, UBS, released a report that expected the share price of Yes Bank to come down to Rs 650. The share has been trading in a three-month range of Rs 1,111-1,448. UBS claims that provisions made by the bank for non-performing loans are “unsustainably low” and expects provisioning to cause a “significant correction of the stock”. It also said that Yes Bank, Axis Bank and ICICI Bank had a relatively high share of loan approvals to corporates with credit ratings below investment grade as compared to their gross non-performing loans of FY16. The firm also added that the risk of a sharp rise in NPA in the Yes Bank loan book still persists.

On the other hand, the firm said that State Bank of India is ahead in recognition of NPA and “could possibly surprise on GNPL [gross non-performing loans] formation”.

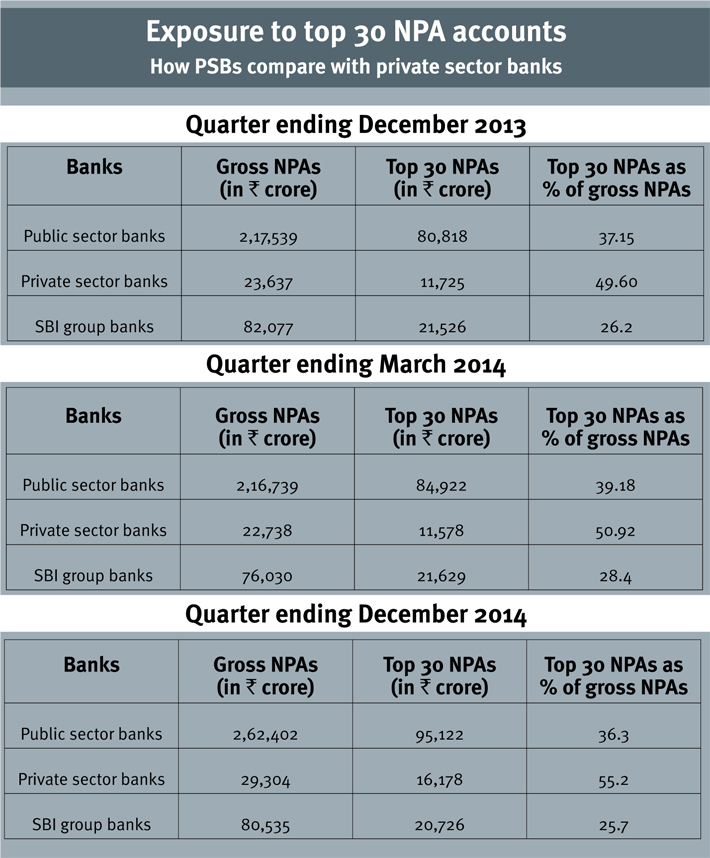

One key metric on which PSBs are relatively better off than private banks is in terms of their exposure to the top 30 NPA accounts which make up a third of all the NPAs in the country. As per the 27th report of the standing committee on finance for 2015-16, private sector banks in December 2013, March 2014 and December 2014 had a far larger exposure to the top 30 NPA accounts (see box). For some time now, the possibility of private sector banks ‘ever-greening’ their loans has been discussed in hushed tones in power circles. Krishnamurthy Subramanian, associate professor at the Indian School of Business, took the conversation public after he published his research in the Mint newspaper in May, with data showing that private sector banks were quite likely hiding their stressed assets by ever-greening of loans.

The research examined data of GNPAs and restructured assets of PSBs and private sector banks. When Subramanian put together the corporate-loan portfolio of private and public sector banks, he found that there was little difference between them – as of December 2013, 18.4 percent of the borrowers in PSBs were stressed, while for private banks the figure was 18.6 percent.

Despite the overwhelming similarity in the percentage of stressed borrowers, there was a significant difference in the quantum of reported bad loans. While PSBs exhibited a high proportion of stressed assets at 12.16 percent, the corresponding figures on the books of private sector banks were negligible at just 4.3 percent.

This massive difference in NPAs, when there is no variance in the portfolio of stressed borrowers of public and private sector banks, led Subramanian to the conclusion that private sector banks were hiding their stressed assets by possibly ever-greening their loans.

To understand the root cause of these NPAs, one needs to take a step back to the boom period which the Indian bourses and realty markets were experiencing in the last decade. A major share of stressed loans was disbursed in 2007-09 and in 2010-12 when the banks were enthused by the high GDP growth of the times. For Axis Bank alone, 17 percent of its accounts on the watch list originated in 2009 and the preceding boom years; a massive 79 percent of the stressed loans on Axis Bank’s watch list were given during 2010-12.

Now with the corporates posting disappointing results in a low demand environment, banks have started asking promoters for a personal guarantee before giving loans. In such a hostile environment of decelerating sales growth and tanking industrial production, the chances of these loans remaining healthy are slim.

Meanwhile, in the public consciousness, Vijay Mallya has become the face of crony capitalism. No doubt, crony capitalism has played its own part in the massive build-up of NPAs in the Indian economy. However, this diagnosis is a simplistic evaluation of the crisis. The other major part is the global slowdown that has affected the Indian economy.

Former RBI governor Raghuram Rajan captured the scenario perfectly when he told the parliamentary standing committee on finance in October 2014, “Many people believe that the level of NPAs reflects a level of malfeasance in the public sector system. Malfeasance exists, I will not deny that. But I will not single that out as the primary reason. If you remember, many of the projects, which are in trouble today, were started in 2007-08 after four or five years of very, very strong growth. The belief then was that the growth would continue growing and some of these were financing exports. The world was also growing very fast then. But then, we had the financial crisis. We had a slowdown in the Indian economy. All the optimistic projections about growth, etc., came down substantially after that, both in the world and domestically.”

Rajan also defended PSBs before the standing committee. He said that NPAs were more focused in PSBs, “not necessarily because the public sector banking system has made more mistakes than the private sector system”, but due to the fact that a lot of private sector banks did not invest in some of the large projects, like in infrastructure, to the same extent as the PSBs.

PSBs shoulder an unenviable yet unavoidable responsibility of footing the cost of financing India’s infrastructure projects. Private banks, by their very nature, can choose not to invest in long-term, capital intensive accounts that have to face a host of regulatory and bureaucratic hurdles before completion. PSBs, on the other hand, cannot opt out of investing in infrastructure and other sectors for less risky portfolios like retail banking.

Even the Economic Survey for 2014-15 flagged the poor presence of private sector banking during the boom years. It noted: “Indeed, one of the paradoxes of recent banking history is that the share of the private sector in overall banking aggregates barely increased at a time when the country witnessed its most rapid growth and one that was fuelled by the private sector. It was an anomalous case of private sector growth without private sector bank financing. Even allowing for the over-exuberance of the PSBs that financed this investment-led growth phase, the reticence of the private sector was striking.”

That private banks’ appetite for risk is satiated is explained by ICICI Bank’s loan portfolio composition. Since 2012, its exposure to the retail loan segment has increased from 38 percent to 46.4 percent. Against this, its exposure to domestic corporates from 2012 (28.6 percent) has remained at those levels in 2016 as well at 28.4 percent.

Given that private banks have been operating without political interference and with low exposure to large infrastructure projects, the expectation was that they would be able to defy the mounting NPAs. So far, it hasn’t been the case. Their total stressed advances for March 2016 at 4.5 percent are too high for markets to repose confidence in them.

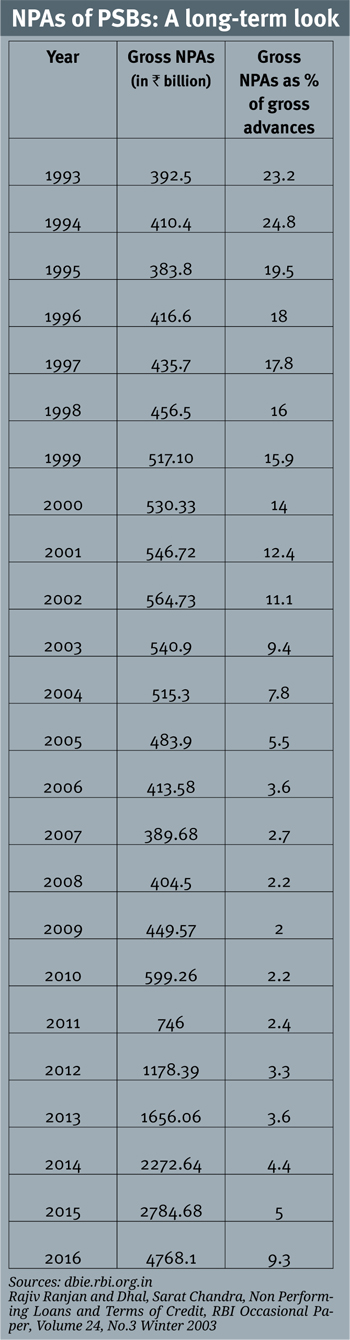

On the other hand, a long-term look at the GNPAs of PSBs reveals that they reduced drastically from 23.2 percent in 1993 to 2 percent in 2009. It was only with the downturn in the global economy that NPAs of PSBs started climbing. In 2014, it rose to 4.4 percent and to 5 percent in 2015 (see box). Unfortunately, global economic headwinds are not signalling an immediate change. The year 2016 has seen a strong spurt in GNPAs of PSBs, with the RBI estimating it at 9.8 percent of the gross advances. With the index of industrial production (IIP) numbers contracting 2.4 percent on year-on-year basis, the future does not look bright.

It is at such a time that recapitalisation of PSBs assumes greater importance than before as private sector banks have shown little enthusiasm in funding projects that entail public benefits. Refraining from doing so will be akin to punishing PSBs for funding infrastructure projects.

Perhaps the way forward is to heed what RBI deputy governor SS Mundra said at a Governance Now conclave in August: “A process has to continue to bestow greater ‘governance autonomy’ to these banks. My sense is that the government ownership of these banks has resulted in crucial stability and resilience in trying times. Immediate roadmap should, therefore, be towards complete ‘managerial autonomy’. If the government remains the largest shareholder, not necessarily majority shareholder, it still serves the intended purpose. At the same time, it releases these banks from multi-institutional oversights and overlapping controls.”

kaushal@governancenow.com