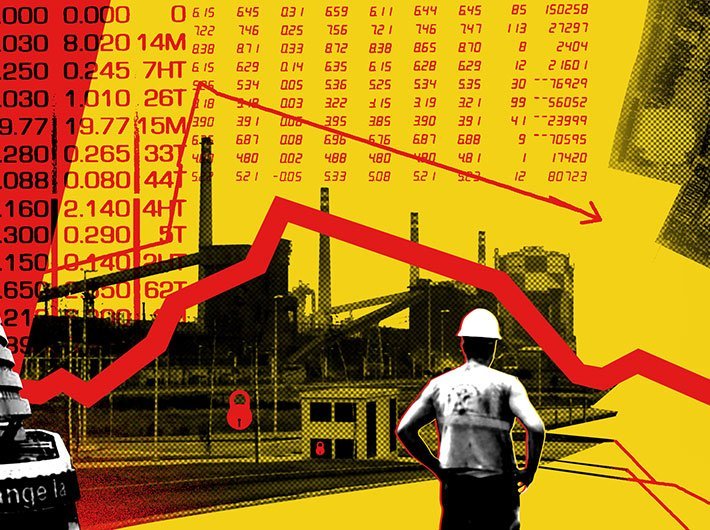

Demonetisation costs include a contraction in cash money supply and subsequent, albeit temporary, slowdown in GDP growth; benefits include increased digitalisation

Finance minister Arun Jaitley on Tuesday said that post demonetisation, once the cash supply is replenished, which is likely to be achieved by end March 2017, the economy would revert to the normal. Therefore, the real GDP growth in 2017-18 is projected to be in the range of 6.75-7.5 percent.

The Economic Survey presented in parliament points out that demonetisation will have both short-term costs and long-term benefits. Briefly, the costs include a contraction in cash money supply and subsequent, albeit temporary, slowdown in GDP growth; and benefits include increased digitalisation, greater tax compliance and a reduction in real estate prices, which could increase long-run tax revenue collections and GDP growth.

On the benefits side, early evidence suggests that digitalisation has increased since demonetisation. On the cost side, effective cash in circulation fell sharply although by much less than commonly believed – a peak of 35 percent in December, rather than 62 percent in November since many of the old high denomination notes continued to be used for transactions in the weeks after November 8.

Additionally, remonetisation will ensure that the cash squeeze is eliminated by April 2017. The cash squeeze in the meantime will have significant implications for GDP, reducing 2016-17 growth by 0.25 to 0.5 percentage points compared to the baseline of 7 percent. Recorded GDP will understate impact on informal sector because, for example, informal manufacturing is estimated using formal sector indicators (index of industrial production). These contractionary effects will dissipate by year-end when currency in circulation should once again be in line with estimated demand, which would also allow growth to converge to a trend by FY 2017-18.

| Sector |

Impact

|

| |

Effect through end-December

|

Likely longer-term effect

|

| Money/interest rates |

Cash declined sharply |

Cash will recover but settle at a lower level |

| |

Bank deposits increased sharply |

Deposits will decline, but probably settle at a slightly higher level |

| |

RBI's balance sheet largely unchanged: return of currency reduced the central bank’s cash liabilities but increased its deposit liabilities to commercial banks |

RBI's balance sheet will shrink, after the deadline for redeeming outstanding notes |

| |

Interest rates on deposits, loans, and government securities declined; implicit rate on cash increased |

Loan rates could fall further, if much of the deposit increase proves durable |

| Financial System Savings |

Increased |

Increase, to the extent that the cash-deposit ratio falls permanently |

| Corruption (underlying illicit activities) |

|

Could decline, if incentives for compliance improve |

| Unaccounted income/black money (underlying activity may or may not be illicit) |

Stock of black money fell, as some holders came into the tax net |

Formalization should reduce the flow of unaccounted income |

| Private Wealth |

Private sector wealth declined, since some high denomination notes were not returned and real estate prices fell |

Wealth could fall further, if real estate prices continue to decline |

| Public Sector Wealth |

No effect. |

Government/RBI's wealth will increase when unreturned cash is extinguished, reducing liabilities |

| Formalization/ digitilisation |

Digital transactions amongst new users (RuPay/ AEPS) increased sharply; existing users’ transactions increased in line with historical trend |

Some return to cash as supply normalises, but the now-launched digital revolution will continue |

| Real estate |

Prices declined, as wealth fell while cash shortages impeded transactions |

Prices could fall further as investing undeclared income in real estate becomes more difficult; but tax component could rise, especially if GST imposed on real estate |

| Broader economy |

Job losses, decline in farm incomes, social disruption, especially in cash-intensive sectors |

Should gradually stabilize as the economy is remonetized |

| GDP |

Growth slowed, as demonetisation reduced demand (cash, private wealth), supply (reduced liquidity and working capital, and disrupted supply chains), and increased uncertainty |

Could be beneficial in the long run if formalization increases and corruption falls |

| |

Cash-intensive sectors (agriculture, real estate, jewellery) were affected more. Recorded GDP will understate impact on informal sector because informal manufacturing is estimated using formal sector indicators (Index of Industrial Production). But over time as the economy becomes more formalized the underestimation will decline. Recorded GDP will also be overstated because banking sector value added is based (inter alia) on deposits which have surged temporarily |

Informal output could decline but recorded GDP would increase as the economy becomes more formalized |

| Tax collection |

Income taxes rose because of increased disclosure Payments to local bodies and discoms increased because demonetised notes remained legal tender for tax payments/clearances of arrears |

Indirect and corporate taxes could decline, to the extent growth slows Over long run, taxes should increase as formalization expands and compliance improves |

| Uncertainty/ Credibility |

Uncertainty increased, as firms and households were unsure of the economic impact and implications for future policy Investment decisions and durable goods purchases postponed |

Credibility will be strengthened if demonetisation is accompanied by complementary measures. Early and full remonetisation essential. Tax arbitrariness and harassment could attenuate credibility |

The Economic Survey states that the weighted average price of real estate in eight major cities which was already on a declining trend, fell further after November 8, 2016 with the announcement of demonetisation. It goes on to add that an equilibrium reduction in real estate prices is desirable as it will lead to affordable housing for the middle class and facilitate labour mobility across India currently impeded by high and unaffordable rents.

The Survey suggests a few measures to maximise long-term benefits and minimise short-term costs. One, fast remonetisation and especially, free convertibility of cash to deposits including through early elimination of withdrawal limits. This would reduce the GDP growth deceleration and cash hoarding. Two, continued impetus to digitalisation while ensuring that this transition is gradual, inclusive, based on incentives rather than controls and appropriately balancing the costs and benefits of cash versus digitalisation. Three, following up demonetisation by bringing land and real estate into the GST. Four, reducing tax rates and stamp duties. And finally, an improved tax system could promote greater income declaration and dispel fears of over-zealous tax administration.